Why 3M Could Head Even Higher

Shares of 3M (NYS: MMM) hit a 52-week high yesterday. Let's take a look at how it got there and see whether clear skies are still in the forecast.

How it got here

3M and many conglomerates are benefiting from slow, but steady, growth.

In 3M's second-quarter earnings results, released two weeks ago, all six of the company's segments reported operating margins north of 20%. Year-over-year profits increased 3.8% while sales dipped 1.9% mostly due to unfavorable currency effects. 3M's health care segment provided the biggest boost with gains of 5.4% while display and graphics sales weakened by 6.6% because of continued weakness in the electronics industry, as if Sony (NYS: SNE) reported eight straight annual losses in its television division wasn't enough confirmation of that weakness.

What's truly odd about 3M's growth pattern was the geographical "backwardness" by which it grew. Whereas many businesses are seeing strong growth in Asia, 3M saw sales decline slightly in the region. It witnessed its most robust growth in Latin America and Canada, totaling 11.4%.

As usual, 3M's success doesn't automatically make it a buy as signs point to global challenges ahead. Avery Dennison (NYS: AVY) recently reported weaker sales and earnings figures as it grapples with the fact that one-third of its business is tied to Europe. Also, the Patient Protection and Affordable Care Act could take a bite out of 3M's and Johnson & Johnson's (NYS: JNJ) bottom line as the medical device excise tax of 2.3% is set to take effect in 2013. Rising input costs also present a challenge to 3M and paint-maker Sherwin-Williams (NYS: SHW) .

How it stacks up

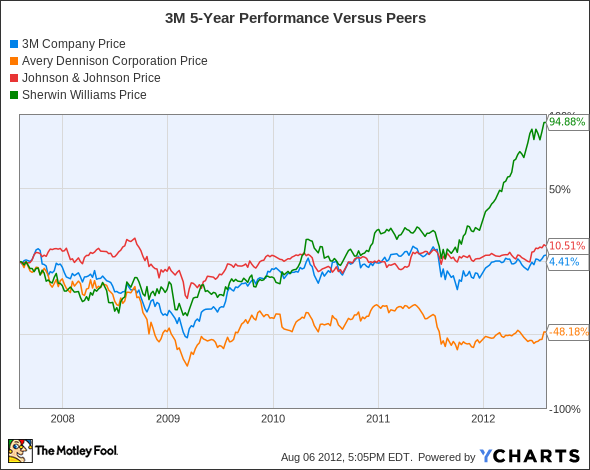

Let's see how 3M stacks up next to its peers.

MMM data by YCharts

Aside from Sherwin-Williams, growth among these stocks has been choppy or non-existent at best.

Company | Price/Book | Price/Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

3M | 3.9 | 12.2 | 12.5 | 2.5% |

Avery Dennison | 1.9 | 6.0 | 12.3 | 3.3% |

Johnson & Johnson | 3.1 | 12.3 | 12.4 | 3.4% |

Sherwin-Williams | 9.9 | 17.0 | 19.3 | 1.1% |

Source: Morningstar.

One thing prevalent among 3M, J&J, and Avery Dennison is consistent cash flow and healthy yields. The same can't be said for Sherwin-Williams, which is trading at an astronomical valuation relative to its narrow product portfolio in comparison to the other three companies here.

3M and Johnson & Johnson really differentiate themselves on the grounds that both are elite dividend aristocrats that have raised their annual dividends in 54 and 50 consecutive years, respectively.

Unfortunately, the size of 3M and J&J is both a blessing and a curse. Their diverse product lines often shield them from extreme global weakness. However, their sheer size makes organic growth rates of 2%-4% the norm.

What's next

Now for the $64,000 question: What's next for 3M? That question is going to depend on overall global economic growth, and whether the company can kick-start sales in the Asia-Pacific region and in its graphics segment.

Our very own CAPS community gives the company a highly coveted five-star rating, with an overwhelming 96.8% of members expecting it to outperform. Count me among the majority here as well as my CAPScall of outperform is up six points since inception.

3M is no longer a growth story, but another of a handful of safety plays across a broad variety of sectors. Its geographic diversity and pristine dividend history make it a company to strongly consider for individual retirement accounts thanks to its steady cash flow.

Dividends are a fantastic way of supplementing your personal income. Our analysts believe this so much that they've singled out the three Dow Jones Industrial stocks that you need to own for their dividends out of the 30 companies that comprise the index. 3M is one; find out the identity of the other two, for free, by clicking here to download your copy of this latest special report.

The article Why 3M Could Head Even Higher originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Johnson & Johnson and has sold shares short of Sony. Motley Fool newsletter services have recommended buying shares of 3M, Johnson & Johnson, and Sherwin-Williams, as well as creating a diagonal call position in both 3M and Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.