The 10 Best Small-Cap CEOs

To see the 10 worst small-cap CEOs, click here.

Gauging the quality of a CEO is an inexact science. Do you look at revenue growth? Increases in earnings? Decreases in expenses? Return to shareholders? Or do you use a combination of these plus a litany of other relevant variables that you think up?

The task is made even harder when CEOs are compared across other companies and industries. Who's to say, for example, whether Steve Jobs of Apple was a better leader and visionary than Jeff Bezos of Amazon.com? Both founded and led companies that provide great products and services to their customers as well as market-smashing returns for shareholders.

Fortunately, a new service provided by Chiefist.com does the work for us. "Many of the annual exec rankings focus almost exclusively on share price improvement or some other concept of total return to shareholders," says the company's website. "While we like making a buck from our stocks as much as the next person, the notion of measuring executive performance based solely on the company's stock price pop over a 365-day period strikes us as simplistic and incomplete."

To normalize for variations across industries, in turn, the team at Chiefist developed their proprietary Business Value Enhancement Metric, or BVEM, which employs a variety of metrics to rank CEOs of publicly traded companies. Among other things, it incorporates margin expansion, earnings-per-share growth, and trends in both return on equity and book value per share.

What follows is Chiefist's current list of the 10 best small-cap CEOs since the middle of 2010 (as in golf, a lower score is better):

Rank | CEO | Company | Score |

|---|---|---|---|

1 | Steve Klosk | Cambrex (NYS: CBM) | 16.25 |

2 | Jack Golsen | LSB Industries (NYS: LXU) | 16.45 |

3 | Eric Wintemute | American Vanguard (NYS: AVD) | 21.60 |

4 | Sidney DeBoer | Lithia Motors (NYS: LAD) | 23.80 |

5 | Jay Freeland | FARO Technologies (NAS: FARO) | 25.75 |

6 | Dale Barnhart | Lydall | 28.15 |

7 | David Seltzer | Hi Tech Pharmacal | 32.40 |

8 | Steven Nielsen | Dycom Industries | 32.75 |

9 | Gary Owens | OYO Geospace | 34.70 |

10 | M. Turner | Pinnacle Financial Partners | 35.05 |

Source: Chiefist.com, "Best Small Cap CEOs."

As you can see, the list contains CEOs from a variety of companies and industries. To mention a few:

Cambrex, a life sciences company, provides products and services related to human therapeutics. Over the last two years, shares in Cambrex are up an impressive 150%.

LSB Industries and American Vanguard are both chemical companies. Last month, fellow Fool Rex Moore selected American Vanguard as one of June's "Foolish 8 Stocks." And while LSB experienced a set-back in May due to an explosion at one of its facilities, Rex continues to maintain that it's still a buy.

Auto dealer Lithia Motors, an Oregon-based automotive franchisee and retailer of new and used vehicles, recently impressed by reporting second quarter earnings per share of $0.76 compared to last year's $0.54. New vehicle same-store sales for the company increased 34% year-over-year, while used vehicle sales improved 20%.

FARO Technologies develops and markets computer-aided measurement and imaging devices for use by commercial and industrial customers. Earlier in the year, it was chosen by Fool contributor Rebecca Lipman, of Kapitall, as one of 2012's top tech stocks to watch.

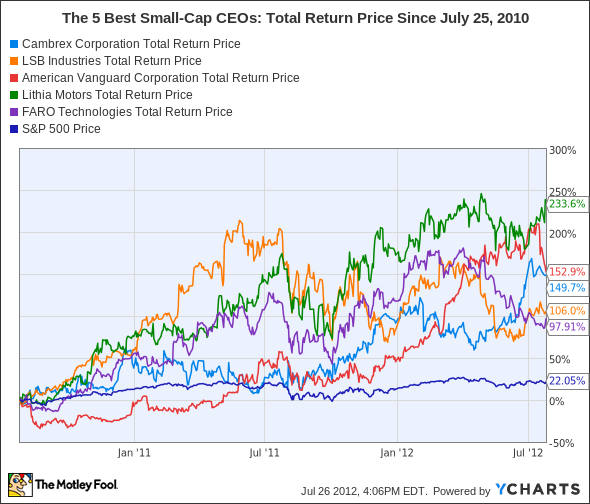

Despite their differences, however, the one thing these companies have in common is superior share price performance over the last two years. As you can see below, all of them have beaten the broader market by leaps and bounds, with Lithia taking the lead returning 233% since the middle of 2010.

CBM Total Return Price data by YCharts

Foolish bottom line

Whether you use metrics like this to gauge a CEO's value or not, it's always important to trust the people leading the companies you're invested in. And it's for this reason, that I invite you to view one of our newest free reports about three stocks that will help you retire rich. Of the stocks recommended, two of them are arguably led by the best CEOs alive today. To view this free report, click here now.

Meanwhile, if Steve Jobs' legacy is important to you, read our premium report on Apple. You'll get the best from our top tech analyst on Apple's future prospects and challenges, along with free updates for an entire year.

The article The 10 Best Small-Cap CEOs originally appeared on Fool.com.

Fool contributor John Maxfield does not own shares of any of the companies listed above. The Motley Fool owns shares of Amazon, Apple, and LSB Industries.Motley Fool newsletter serviceshave recommended buying shares of Amazon and Apple, as well as creating a bull call spread position on Apple. The Motley Fool has adisclosure policy.We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.