Let's Keep Things in Perspective, Folks!

It wasn't long after Apple (NAS: AAPL) announced disappointing quarterly results that the headlines started pouring in.

"Apple shares plunge on disappointing earnings"

-- Los Angeles Times

"Apple shares plummet in after-hours trading"

-- Boston Herald

Before the market opened today, shares of Apple were trading for about $572 -- or about 4.6% lower than where they were when the market closed on Tuesday.

We haven't seen shares trading that low since ... well, June 28. Less than one month ago.

Investors, get your head straight

The big takeaway from the headlines and the constant sensationalism is this: We are far too often captives of our own short-term view of things. If you're a gambler (er, I mean trader), then it makes sense that a 5% swing could rattle your cage.

But for investors, the minimum timeline for your thesis to play out is three years.

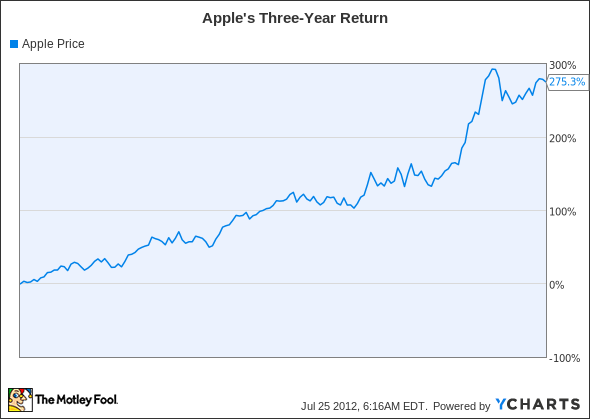

So how have investors in Apple done over the past three years? Let's take a look.

Keep two things in mind here. First, over the same time period, the S&P 500 returned 44%, so Apple is beating the broader market by a superwide margin.

And second, during these past three years, Apple has seen its shares "plunge" by more than 4.5% on four different occasions , yet the company soldiered on. Imagine how many investors got scared out of the stock by short-term-ism in the interim and missed out on these huge, wealth-producing gains.

If you want to know what a real "plummet" looks like, ask a shareholder of MAKO Surgical (NAS: MAKO) . Since March 23, the stock is off 70%, and it has endured two true plunges of 36% and 43% on disappointing earnings.

Yet I continue to hold shares of MAKO despite the drop. When I bought in, it was because I believed that the company's Rio Surgical system allowed for the type of alignment knee and hip replacement procedures patients desired. The company hasn't been able to close deals as fast as hoped, but I'm willing to wait and see whether this is a hiccup, or a sign of a larger problem.

Knowing when to part ways

One of the most important things you can do as an investor is to write down, point by point, exactly why you're buying into a company, and what would have to happen for you to sell it. Of course, this is just a guide, but you'd probably realize how useful it is when a bad earnings report has you ready to jump over the edge.

I had a very small position in Green Mountain Coffee Roasters (NAS: GMCR) after it became clear that its Keurig machines were finding a spot on all of my friends' kitchen counters. The stock realized some tremendous gains between 2009 and the middle of 2011 -- rising 1,140%!

But when the company came out with earnings in April, I parted ways my shares. The difference between Green Mountain and MAKO is that one of the reasons I bought Green Mountain -- that its coffee makers and K-Cups would be ubiquitous 10 years from now -- no longer seemed likely to play out. Expiring patents and competition from the likes of Starbucks (NAS: SBUX) led me to believe my thesis wouldn't play out.

You might roll your eyes and say, "Yeah, but you could've locked in some huge gains if you'd sold earlier -- and the stock was so overpriced." And you would be right. But if I jumped every time a stock became overpriced, or it produced earnings that disappointed Wall Street, I also wouldn't be sitting on some of my biggest winners.

Which brings us back to Apple. This is a company that's now trading for just under 12 times free cash flow but is expected to grow earnings by 21% over the next 12 months. The company may not be for your portfolio, but two things seem clear: Apple isn't broken, and its price is decidedly cheap.

If you'd like to get the full scoop on both the bear and bull cases for owning Apple, you can pick up the Fool's brand-new premium report on Apple, completed by our top technology analyst.

The article Let's Keep Things in Perspective, Folks! originally appeared on Fool.com.

Fool contributorBrian Stoffelowns shares of Apple, MAKO Surgical, and Starbucks. You can follow him on Twitter, where he goes byTMFStoffel. The Motley Fool owns shares of Starbucks, MAKO Surgical, Apple, and Green Mountain Coffee Roasters.Motley Fool newsletter serviceshave recommended buying shares of Apple, Green Mountain Coffee Roasters, MAKO Surgical, and Starbucks, creating a lurking gator position in Green Mountain Coffee Roasters, writing covered calls on Starbucks, and creating a bull call spread position in Apple. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.