Reduce Risk, Not Return

The two largest financial risks we face as Americans are home ownership and employee retirement plans. So, to avoid the potential pitfalls of these investments, it only makes sense to avoid them entirely.

Basically, you should become homeless and stop saving.

If this doesn't work out so well, a concept called Modern Portfolio Theory can help you figure out how to avoid the life of the penniless vagrant. But why do we need help to begin with?

All or nothing

More than 50% of people with the option to invest in their employer's stock do so. If their company hits a wall, these employees could both lose their jobs and watch their safety nets evaporate in the blink of an eye.

Remember the Enron fiasco? Not only did the company go down in flames because of massive fraud and an accounting scandal, but more than 20,000 employees lost their jobs and saw their company stock drop to 0. This sort of thing could happen to almost anyone.

The median American family in 2010 had a net worth of only $77,300, down significantly from over $126,000 in 2007, according to Federal Reserve figures. The burst of the housing bubble was responsible for more than 75% of that decline. Ouch.

So what is an individual investor to do in light of these two devastating financial perils?

What say ye, Harry?

Modern Portfolio Theory (MPT) was introduced back in 1952 by a man named Harry Markowitz. Since then, it has changed the investment world as we know it, and in 1990 -- 38 years after introducing the theory for his graduate thesis -- Markowitz won the Nobel Prize in Economics for his contribution. Good things come to those who make earth-shattering economic models and wait, I guess.

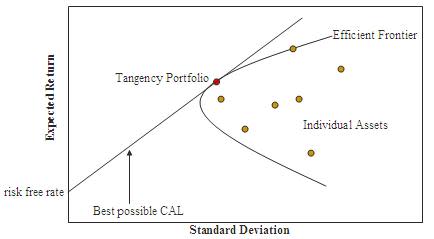

What Markowitz called the "Efficient Frontier" is where you'll get the highest returns for any given risk level. The graph below illustrates the theory:

Source: Public domain, via Wikipedia.

Or, more simply:

The further to the right we go, the riskier our portfolios are. The further up, the higher the expected return. So naturally, if we wander more to the right, we'll want to make sure we're moving higher as well. The Efficient Frontier illustrates the highest possible points for each level of risk.

The curved line and the shaded area within it represent all the possible ways you can construct a portfolio. The straight line serves to show the point on the Efficient Frontier with the optimal risk/return trade-off. You can construct a portfolio that expects higher returns, but from this point on, you'll have to take disproportionately more risk to do so.

Mo' money, mo' Modern Portfolio Theory

Ol' Harry's breakthrough was that he realized the correlation between different holdings was vitally important. Diversification is only useful if it provides insurance when one part of your portfolio plummets. If you've diversified into other areas, and they all nosedive too, it's not a very useful strategy. So, diversifying your risks is more important than diversifying your assets.

David Swensen, the Chief Investment Officer at Yale University, is one of the premier advocates for MPT, and he has added his own stipulations to the model to make it more convenient for individual investors:

Allocate funds to six core asset classes, with a heavier weight on equities.

Rebalance to align with the original weightings on a regular, defined basis.

Buy indexes and ETFs with a low fee structure over specific securities.

There are a number of ETFs you can use to implement MPT in your own portfolio. For international exposure, you'll want to take a look at the Guggenheim BRIC ETF (NYS: EEB) . Not only is this an excellent emerging markets play with extreme growth potential, but it offers upwards of a 4% dividend. Remember, you'll want to examine your portfolio before considering this ETF. If you're already loaded up with emerging markets stocks or indices, this ETF may not be the most "efficient" place to put your money.

iShares Barclays TIPS Bond (NYS: TIP) is a good example of a low-cost (0.2% annually), accessible way for the average investor to gain exposure to extremely low risk securities. Thankfully, these are inflation-protected investments, so the yield is currently around 3.5% -- not too shabby considering the 10-year Treasury yield is about 1.5%. On top of that, bonds have a low correlation with equities, so this fund could be a prudent safety net.

Vanguard Energy ETF (NYS: VDE) is an excellent way to gain exposure to the energy sector, and it offers a 1.6% dividend of its own. It tracks the MSCI U.S. Investable Market Energy Index, which is composed almost entirely of Oil & Gas companies. Vanguard owns its reputation as a low-cost institution, with a 0.2% expense ratio. I'm very bullish on this fund, which is why I made a thumbs-up CAPS call on it over a month ago.

Modern Portfolio Theory may not solve all of our problems, but it does provide some answers. Spreading your investments around to different asset classes that won't all move together is a smart way to reduce your exposure and limit your risk.

Funds can be a great way to get exposure to different asset classes you need in order to retire. But you also need to know about the shocking truth about your retirement. Don't miss this chance to grab your free copy of this can't-miss report today!

The article Reduce Risk, Not Return originally appeared on Fool.com.

Fool contributorJohn Divineowns none of the securities mentioned in the story above, but he totally drew that awesome chart. You can follow him on Twitter@divinebizkidand on Motley Fool CAPS@TMFDivine.The Motley Fool owns shares of Vanguard Energy ETF. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.