Buy, Sell, or Hold Sirius XM Radio?

When it comes to investing, knowing when to buy, sell, or hold a stock can mean the difference between making money and losing it in the market. However, making the best decisions for your investments can be challenging. Fortunately, investors can minimize risk by weighing both the pros and cons of a given stock before deciding how to act. Today, we'll take a closer look at Sirius XM Radio (NAS: SIRI) and evaluate whether investors should buy, sell, or hold this media stock.

Buy

The satellite radio company is proving to the world that it can command pricing power. Sirius raised its rates earlier this year in a move that caused many analysts to worry that the price hike would cause subscribers to jump ship. In fact, the opposite occurred. In its last quarter, Sirius reported better-than-expected subscriber growth to the tune of 622,042 net subscribers.

Successfully raising the monthly fees it charges users is no small triumph. Take Netflix (NAS: NFLX) , for example. The video streaming service provider was crushed after attempting to increase prices by about 60% in some cases. Thousands of Netflix customers were outraged as a result of the price hike, which ultimately led to 800,000 cancellations and the stock losing as much as 77% of its value in the weeks following the announced price bump.

Luckily for Sirius, the move provided further evidence of the company's loyal fan base of paying customers.

Sirius is benefiting from a recent rebound in auto sales as well, which I suspect will continue into 2013. In fact, most new and pre-owned vehicles in the U.S. come equipped with Sirius XM. Better still, if you're lucky enough to own a new Aston Martin, you'll also receive a complimentary lifetime subscription to the satellite radio service.

As my fellow Fool Rick Munarriz points out, the company now has a whopping 22.9 million active accounts in North America. For comparison, rival satellite service provider DIRECTV (NAS: DTV) claims fewer than 20 million subscribers in the region.

Investors will get a more thorough read on the company's financial health when Sirius XM posts its latest quarterly results next month. I'd be surprised if we didn't see a significant boost in revenue given the 12% price increase on monthly subscription fees.

Sell

Increased competition in the space is something potential investors should consider. New forms of media are constantly popping up in the broadcast radio industry, which means a stock's position in the market can fluctuate rapidly. New streaming services from contenders such as Pandora (NYS: P) and Spotify could pose a future risk to Sirius XM, as these companies provide alternative broadcast options at a fraction of the cost to listeners.

These Internet radio firms use a freebie model to attract customers to their service. At last count, Pandora had more than 51 million active users. The company also recently kicked off its expansion initiative overseas, with trial services now running in Australia and New Zealand.

The push overseas should help Pandora grab new listeners, although that doesn't matter as much as it would for Sirius since those users don't pay for the service. Pandora's reliance on ad spending could weaken its position in the industry given the slow economy. Still, to remain competitive Sirius needs to maintain its focus on offering quality content.

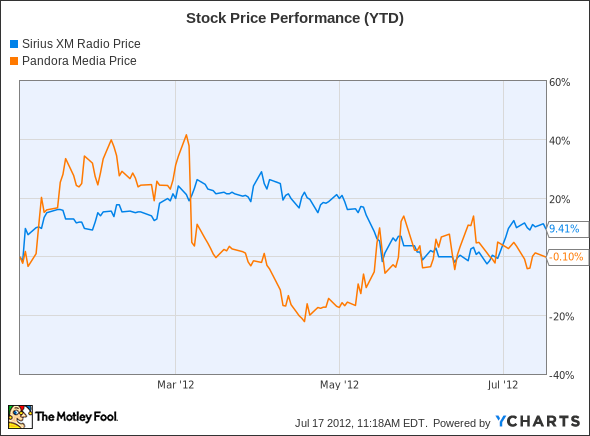

Let's see how Pandora's stock measures up to Sirius XM in terms of price performance.

SIRI data by YCharts

Hold

Another major concern for investors is how the battle between Sirius XM and its largest shareholder, Liberty Media (NAS: LMCA) , will be won or lost. Liberty currently has a 46% stake in Sirius. But if Liberty Media CEO John Malone has his way, it will likely end in a spinoff of the satellite radio business.

The war between the two companies was waged earlier this year when Liberty Media made an appeal to the FCC to take control of the satellite-radio provider. Fool Michael Lewis suggests that perhaps a better way for investors to get exposure to Sirius XM is by buying shares of Liberty Media.

On the other hand, more conservative shoppers may want to hold off on shares of Sirius XM until the company reports quarterly earnings on Aug. 7.

Final thoughts

Six months ago, I wasn't confident in Sirius XM's ability to realize revenue and drive growth. Today, I hold a different opinion. Having carefully weighed the risks and rewards in this name, I now find myself in Rick's camp with the bulls. Sirius XM continues to grow its subscriber base, despite tough competition and regardless of a steep price hike. That's why I'm giving the stock a three-year outperform rating on my profile in Motley Fool CAPS.

Knowing which stocks to buy isn't always easy. Fortunately, The Motley Fool's top analysts have uncovered three stocks that you should own today. Click here for instant access to this free report titled "3 Stocks That Will Help You Retire Rich."

The article Buy, Sell, or Hold Sirius XM Radio? originally appeared on Fool.com.

Fool contributor Tamara Rutter owns shares of Netflix and Liberty Media. Follow her on Twitter, where she uses the handle @TamaraRutter, for more Foolish insights and investing advice. The Motley Fool owns shares of Netflix. Motley Fool newsletter services have recommended buying shares of Netflix. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.