Will Sprint's Earnings Be Like a Lone Voice in the Wilderness?

Sprint Nextel (NYS: S) , the communications products and services provider, is set to report earnings before the market opens next Thursday, July 26. Analysts estimate this quarter's earnings at a $0.40 loss per share on revenue of $8.73 billion. Sprint has struggled mightily against larger Dow Jones Industrial Average rivals AT&T (NYS: T) and Verizon Communications (NYS: VZ) , and its financial condition is not pretty. Revenue has been steady, but income statement metrics below the gross margin have been negative for many quarters going back to 2010.

Sprint's stock price, currently at $3.66, has risen a spellbinding 56.41% from $2.34 since the start of 2012. I won't digress into why the stock price is this low. Rather, despite the coming negative report I'd like to focus on trends that might help us understand if we can expect good news in the future. Who knows? Sprint may just surprise to the upside, and then it will be off to the races. The Motley Fool's Earnings Quality Score database has ranked Sprint as a solid "A" for all of 2012.

Let's review income statement metrics first:

Sprint | March 31, 2012 | March 31, 2011 | March 31, 2010 |

|---|---|---|---|

Revenue (millions) | $8,734 | $8,313 | $8,085 |

% Change (YOY) | 5.1% | 2.8% | |

Cost of goods sold | 58% | 53% | 52% |

SG&A | 28% | 29% | 30% |

Taxes | (4%) | (9%) | (9%) |

Gross margin | 42% | 47% | 48% |

Operating margin | 1% | 3% | (2%) |

Net profit margin | (10%) | (5%) | (11%) |

Operating cash flow margin (LTM) | 11% | 14% | 15% |

Source: S&P Capital IQ.

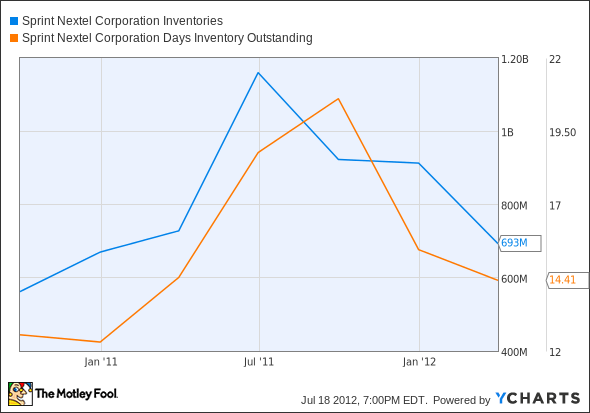

Revenue is growing -- slowly but in the right direction. But Sprint's cost structure at 86% of revenue -- the sum of cost of goods sold (COGS) and selling, general and administrative -- is higher than either AT&T's or Verizon's, both at 67%. The biggest difference between Sprint's cost structure and its main competitors' is the COGS, which makes up most of the 19% difference. One way to account for the higher cost is to compare the inventory component of the COGS. Sprint's inventory makes up 13.63% of the COGS versus Verizon and AT&T having inventories that are 9.39% and 9.20% of their COGS, respectively. Some of this difference can also be explained as a function of scale -- Sprint's sales comprise 28% of AT&T's sales, and 31% of Verizon's sales. Lastly, Sprint's larger rivals each carry approximately $1.1 billion in inventory versus Sprint's $700 million, which means that Sprint's inventory as a percentage of revenue is much higher. Inventory is a drag on margins and cash flow, but Sprint's inventory story has improved over the last year.

S Inventories data by YCharts

The second chart displays Sprint's outstanding shares and long-term debt growth over the last two years. Note that Sprint has positive operating cash flow margins in the low double digits, from the table above, but the debt is like a 22-billion-pound weight around this sprinter's ankles. Because the shares are cheap, the only other way to raise cash is to sell more shares. Fortunately, there are buyers when the price is cheap.

S Shares Outstanding data by YCharts

Another way to determine a company's health is to look at cash flow, and this is one of Sprint's few positives. Sprint's interest expense -- another drag on earnings and cash flow -- was over $1 billion last 12 months, but this was $300 million less than the prior year.

Sprint | March 31, 2012 | March 31, 2011 | March 31, 2010 |

|---|---|---|---|

Revenue (millions) | $8,734 | $8,313 | $8,085 |

Operating cash flow (millions) | $978 | $919 | $1,122 |

Operating cash flow margin | 11.20% | 11.06% | 13.88% |

Interest expense (millions) | $298 | $247 | $372 |

Source: S&P Capital IQ.

AT&T | March 31, 2012 | March 31, 2011 | March 31, 2010 |

|---|---|---|---|

Revenue (millions) | $31,822 | $31,247 | $30,530 |

Operating cash flow (millions) | $7,796 | $7,732 | $7,238 |

Operating cash flow margin | 24.50% | 24.75% | 23.71% |

Interest expense (millions) | $859 | $846 | $765 |

Source: S&P Capital IQ.

Verizon | June 30, 2012 | June 30, 2011 | June 30, 2010 |

|---|---|---|---|

Revenue (millions) | $28,552 | $27,536 | $26,773 |

Operating cash flow (millions) | $9,314 | $7,757 | $9,723 |

Operating cash flow margin | 32.62% | 28.17% | 36.32% |

Interest expense (millions) | $679 | $717 | $679 |

Source: S&P Capital IQ.

The comparison sheds light on Sprint's operating cash flows year over year versus AT&T's and Verizon's much higher cash flow margins. While all three companies are significantly leveraged with debt, it's easy to see that Sprint's interest expense as a percentage of operating cash is much higher than its competitors'.

Lastly, all three companies pay federal corporate income taxes and taxes to the states in which they do business. Because Sprint has negative income, it has some deferred tax assets on its balance sheet to use in later periods. AT&T has a higher tax rate than either Sprint or Verizon, but can use some of its deferred tax assets to pay current taxes due.

2011 | Sprint | AT&T | Verizon |

|---|---|---|---|

Effective tax rate | NM | 37.7% | 2.7% |

Deferred tax assets (millions) | $130 | $1,470 | $0 |

Source: S&P Capital IQ.

Foolish bottom line

Sprint is an example of a company that has been able to survive against larger rivals and through many periods of reported negative income and earnings per share primarily due to its ability to maintain its customer base, but also because it has positive cash flows and ample working capital. If there is a silver lining somewhere in the company's long string of negative reports, it is perhaps that investors are not expecting too much in terms of stock performance from this "little engine that tried" so that management can focus on improving the business.

While the high percentage of debt is worrisome, Sprint is now among Apple iPhone retailers and offers comparable calling and data plans to its competitors. Savvy investors are starting to listen. In fact, over the last six months, net insider buying has been 250,000 shares. This may be an opportune time to pick up some shares. Foolish readers should base investment decisions on earnings quality.

The article Will Sprint's Earnings Be Like a Lone Voice in the Wilderness? originally appeared on Fool.com.

Fool contributorJohn Del Vecchiois co-advisor to Motley Fool Alpha and co-manager of the Active Bear ETF (NYS: HDGE) . You may follow him on Twitter @johnfdelvecchio. He does not own any shares in the companies mentioned in this article. The Motley Fool owns shares of Apple.Motley Fool newsletter serviceshave recommended buying shares of Apple.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Apple. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.