Why Paychex Could Head Even Higher

Shares of Paychex (NAS: PAYX) hit a 52-week high on Wednesday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

Recessions? High unemployment rate? Yeah, Paychex doesn't really care about that -- it'll grow regardless.

Paychex has shrugged off chronic economic weakness and sluggish growth prospects and through acquisitions continues to build upon its leading payroll services, human resources, and retirement benefits business.

In Paychex's most recent quarter, the company recorded a 4% increase in payroll service revenue, its largest revenue-generating segment, and a 12% rise in human resources revenue. At the heart of these gains are two recent purchases: SurePayroll and ePlan. SurePayroll, an online software-as-a-service payroll company, was purchased for $115 million in late 2010 and claimed 30,000 primarily small businesses as clients. However, SurePayroll's client list also includes Citigroup (NYS: C) and SunTrust Bank (NYS: STI) . ePlan, purchased last year, added an additional 4,000 401(k) plans across 50 states and granted Paychex an even broader 401(k)-solution audience.

But when are there not risks involved? Organic growth has been practically non-existent due to slow business hiring, and payroll services revenue has only trickled higher because of acquisitions. Record-low interest rates also could affect net income, as Paychex's float yields dry up and retirement clients pull out funds with few clear avenues of growth. Finally, everyone loves a high-yielding dividend stock -- that's what attracted me to Paychex in the first place -- but at a payout ratio of 84%, concerns about dividend sustainability and future growth come into question.

How it stacks up

Let's see how Paychex compares to its peers.

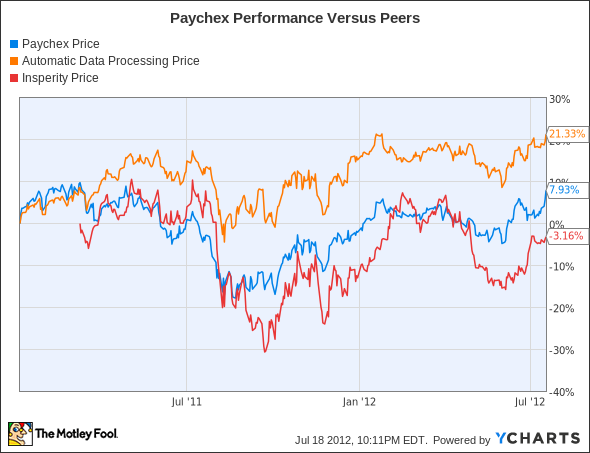

Being intricately tied to unemployment rates, economic health, and interest rates, it's not a surprise given with the up-and-down data we've received over the past year that Paychex and its rivals, Automatic Data Processing (NYS: ADP) and Insperity (NYS: NSP) , haven't moved much.

Company | Price/Book | Price/Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

Paychex | 7.7 | 17.0 | 20.1 | 3.8% |

Automatic Data Processing | 4.4 | 15.1 | 17.7 | 2.7% |

Insperity | 2.9 | 15.0 | 13.5 | 2.2% |

Source: Morningstar.

One big reason ADP has been outperforming its peers recently lies with the meat and potatoes of its most recent quarterly report: 6% organic revenue growth! ADP reported better global client retention and was actually able to increase new client additions by 3.3% in its payroll service segment. In addition, while its dividend may be a full 110 basis points lower than Paychex, its payout ratio of 54% signifies a much more sustainable payout.

Insperity is also seeing a nice rebound off its recessionary lows. In its latest quarter it reported record EBITDA, a 58% increase in net income, and an 11% increase in revenue as worksite employees being paid rose by 8.5%.

Paychex's growth has been considerably more modest and fueled by acquisitions, although it offers a more diversified portfolio of payroll and human resource solutions and a considerably better yield.

What's next

Now for the $64,000 question: What's next for Paychex? The answer depends on those main factors discussed earlier: employment figures, macroeconomic growth, and interest rates. If growth figures remain modest, Paychex will likely head higher.

Our very own CAPS community gives the company a four-star rating (out of five), with an overwhelming 95.5% of members expecting it to outperform. Count me among the optimists, as my CAPScall of outperform is currently positive by six points.

A bet on Paychex is a bet on continued employment and human resource growth. Paychex has aligned itself to be diverse among the solutions it offers, and it boasts a premium dividend among payroll service companies. I'm not discounting the macroeconomic issues that persist, but I do think Paychex's acquisitions make it strong enough to be an outperformer in nearly any investing environment.

Payroll service companies aren't the only exciting growth stories in the financial sector. Our analysts at The Motley Fool have been taking notes on what stocks the smartest investors, including Warren Buffett, have been buying, and are willing to share those findings with you in our latest special free report. Click here to claim your very own copy.

The article Why Paychex Could Head Even Higher originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Citigroup. Motley Fool newsletter services have recommended buying shares of Paychex and Automatic Data Processing, as well as writing a covered straddle position in Paychex. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.