Analyst Debate: Can Green Mountain Coffee Roasters Be a Top Stock Again?

The Motley Fool has been making successful stock picks for many years, but we Fools don't always agree on what a great stock looks like. That's what makes us "Motley," and it's one of our core values. We can disagree respectfully, and we often do. Investors do better when they share their knowledge.

In that spirit, we three Fools have banded together to find the market's best stocks, which we'll rate on The Motley Fool's CAPS system as outperformers or underperformers. We'll be accountable for every pick based on the sum of our knowledge and the balance of our decisions. Today we'll be discussing specialty coffee and coffeemaker provider Green Mountain Coffee Roasters (NAS: GMCR) .

Green Mountain Coffee Roasters by the numbers

Green Mountain, maker of the Keurig single-brew coffee system and K-Cups, has had a dismal trailing-12-month period with its share price down 81%. Here's a quick snapshot of some figures that will better acquaint you with the company.

Statistic | Result (most recent available) |

|---|---|

Revenue (TTM) | $3.47 billion |

Net Income | $329.2 million |

Price/Book | 1.3 |

Price/Cash Flow | 11.6 |

Forward P/E | 5.1 |

Operating Margin (TTM) | 15% |

Cash/Debt (MRQ) | $146 million / $450 million |

Sales Breakdown (MRQ) | Single Serve Packs (74%) |

Competitors | Starbucks (NAS: SBUX) |

Sources: Morningstar, Yahoo! Finance, Green Mountain quarterly report. TTM = trailing 12 months. MRQ = most recent quarter.

Sean's take

What a wild and unwelcome ride for shareholders of Green Mountain. Once Wall Street's darling, Green Mountain has been ground into little bits after drawing the ire of notorious short-selling savant David Einhorn and reporting unfavorable growth prospects in the second quarter.

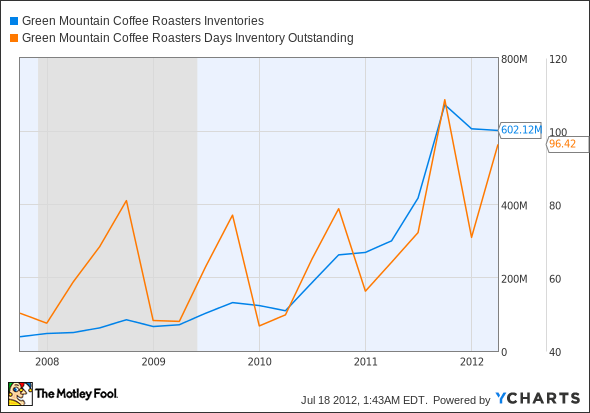

Green Mountain's recent failures can essentially be broken down into three issues. First, Green Mountain doesn't adequately understand its customer base. The company has increased inventory levels in six of the past seven quarters and seems to be just assuming it will sell more without really understanding the forces driving demand.

Second, competition looms large. Starbucks has considerably deeper pockets than Green Mountain and is slated to introduce its own single-serve coffeemaker, known as the Verismo, later this year.

Finally, two of the key patents on Green Mountains K-Cups are set to expire in September, which will allow competitors to legally utilize its design. Kroger, for example, announced its intentions last month to market private-label K-Cups when those patents expire.

In spite of these worries, Green Mountain offers investors an intriguing value at these beaten-down levels. Green Mountain has K-Cup distribution partnerships with both Starbucks and Dunkin' Brands, and has an easily identifiable brand name in grocery stores. The Green Mountain growth engine also remains vibrant. It's hard to ignore a 47% increase in K-Cup sales in the most recent quarter with a 12% boost in selling prices.

As long as Green Mountain can retain pricing power, maintain its partnerships, and get a better grip on its inventory controls, I'd say it deserves a speculative buy rating at five times forward earnings -- although I'd keep it on a short leash.

Alex's take

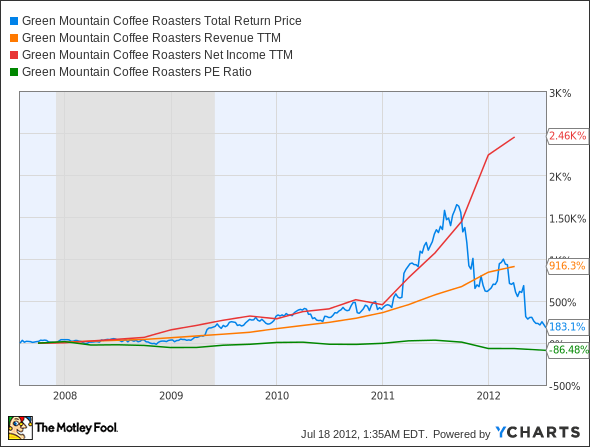

Green Mountain has been absolutely devastated lately by short-selling bearishness, but both top and bottom lines keep growing. Thanks to the big plunge, Green Mountain's overall top- and bottom-line growth have so far outpaced the growth of its stock price that its P/E is nearly 90% lower than it was at the end of 2007:

GMCR Total Return Price data by YCharts

Negative cash flow is an issue, but that's been largely the result of multiple major acquisitions, which combined to take a $1.37 billion chunk of change out of Green Mountain's cash flow over the past two annual reporting periods. Barring any major acquisitions, it's reasonable to expect cash flow to accelerate into positive territory, and it already has over the past two quarters, with $166 million in free cash flow last quarter to just $93 million in net income.

Excess inventory, as Sean mentioned, is also a problem, but there are signs that this inventory bloat is finally starting to deflate:

GMCR Inventories data by YCharts

But let's look at this a different way. Green Mountain, despite its promotional tie-ups with Starbucks and Dunkin', isn't so much a competitor to Starbucks as it is a competitor to other grocery-store coffees. Starbucks and Dunkin' have grocery presences, but there's also J.M. Smucker's (NYS: SJM) Folgers and Kraft's Maxwell House, among others.

Nothing stops consumers from opting for cheaper store-brand coffee, but Folgers and Maxwell House soldier on, as do Starbucks and Green Mountain on store shelves. So here I'd like to take a look at a few other well-known consumer brands, all of which you could feasibly replace with cheaper knock-off options, and see how their current valuations stack up to historical averages.

Company | Current P/E | 5-Year Historical Average P/E | Difference From Average to Present |

|---|---|---|---|

Green Mountain | 8.4 | 44.7 | (81.2%) |

Starbucks | 30.4 | 33.1 | (8.2%) |

Peet's | 44.6 | 34.9 | 27.8% |

J.M. Smucker | 18.5 | 16.2 | 14.2% |

Hain Celestial | 36.9 | 27.7 | 33.2% |

Diamond Foods (NAS: DMND) | 8.3 | 26.7 | (68.9%) |

McCormick | 21.2 | 17.6 | 20.5% |

Source: Wolfram Alpha.

The only consumer-foods company anywhere near Green Mountain in terms of its spread between historical average and current multiple is Diamond Foods, and Green Mountain's spread is worse! You mean to tell me that a company whose worst issues so far have been inventory problems should be trading further from its averages than one that's had actual legal trouble, and may even have committed fraud?

With the exception of Starbucks (which has an average skewed far worse than the others by a recessionary spike) and Diamond, all these consumer brands are trading higher than their historical averages. Green Mountain might not be at that level again for a long time, but it's certainly not out of the question to expect it to regain a double-digit P/E in the near future now that the hype balloon's been thoroughly deflated.

I agree with Sean that Green Mountain deserves at least a speculative buy with a short leash. I expect us to watch this call very closely going forward, but I also expect it to yield some gains in the near future.

Travis' take

The past year has been rough on growth stocks that have shown even the slighted weakness, and Green Mountain is the poster child of these stocks. Whether it's expiring patents, competition, or an overabundance of inventory, every possible red flag is being treated like the company's downfall. But is Green Mountain really so bad that it deserves an 8.6 trailing P/E ratio despite the fact that revenue was up 37% in the most recent quarter?

To get some perspective, I'll ask this question first: When was the last time a company disappeared into thin air because its patents expired?

Patents expire all the time and it's a problem for those who own them, but it doesn't usually spell the end of sales altogether. Pharmaceutical patents expire and companies don't go under, lots of manufacturing firms deal with this, and Green Mountain will have to do the same. When its patents expire, 10% of Green Mountain's licensing revenue will likely evaporate into thin air, but 90% of the business will still be there.

I will also point out that this may actually be good for Green Mountain. If Starbucks, Dunkin', Folgers, etc. add K-Cups on the grocery aisle, there could be a positive effect for Green Mountain's brands as more customers buy coffee machines that take K-Cups. Unless you assume that Green Mountain will be kicked off store shelves altogether, something I highly doubt, the growth of K-Cup usage as a whole could potentially be a good thing.

Finally, I've suggested before that the stock is so cheap that Starbucks should consider buying Green Mountain outright. Starbucks has been relatively unsuccessful in reaching the home coffee market and Green Mountain's K-Cup muscle could help the company expand its distribution.

Green Mountain has a lot of question marks hanging over it, but with all of these known problems Wall Street analysts still expect profit to be $2.37 per share this year and $3.05 next year. That kind of profit and growth doesn't seem like a dying company to me and I agree that the stock can outperform extremely low expectations. With that said, I'll have my parachute on, ready to jump if something bad happens.

The call

It appears that while Green Mountain has sizable obstacles in its path that it'll need to address and overcome, we've come to the consensus that if it walks and talks like a duck... then it's got to be a duck!

Green Mountain has exhibited strong growth throughout its history and it could be getting an unfair rap here at the hands of pessimists and short-sellers. We'll be entering a CAPScall of outperform on Green Mountain in our TMFYoungGuns CAPS portfolio, but we'll also be keeping a tight leash around Green Mountain if even the slightest hint of underperformance surfaces.

(In other news, we've collectively decided to end our underperform call on Clean Energy Fuels after racking up nearly 30 points in outperformance since our pick was initiated in mid-April.)

Even if Green Mountain isn't the right stock for you, perhaps the three stocks our analysts at Motley Fool Stock Advisor have chosen as companies ready to dominate the emerging markets might be. Find out the identity of these three powerhouses by clicking here to get your free copy of this latest report.

The article Analyst Debate: Can Green Mountain Coffee Roasters Be a Top Stock Again? originally appeared on Fool.com.

Fool contributors Sean Williams, Alex Planes, and Travis Hoium have no positions in any companies mentioned. You can follow Sean on Twitter at @TMFUltraLong, Alex at @TMFBiggles, and Travis at @FlushDrawFool.The Motley Fool owns shares of Green Mountain Coffee Roasters, Starbucks, and Hain Celestial. Motley Fool newsletter services have recommended buying shares of Green Mountain Coffee Roasters, Starbucks, McCormick, Hain Celestial, and Clean Energy Fuels, as well as creating a lurking gator position in Green Mountain Coffee Roasters, writing covered calls on Starbucks, and writing naked calls on Dunkin' Brands Group.Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.