Can Infosys Recover From Europe's Woes?

Infosys (NAS: INFY) , a business consulting, technology, engineering, and outsourcing services provider, became the subject of financial headlines last week. It met its quarterly revenue estimate for its first fiscal 2013 quarter, ending June 30, but just missed earnings per share at $0.73 versus analysts' average estimates of $0.75. But Infosys guided lower for full-year 2013 earnings and revenue, and the stock dropped 11.67% on Thursday to $38.53. The price has recovered somewhat to $39.30.

Management's discussion of quarterly results, while optimistic about new clients, reported poor business conditions in Europe and increased pressure by clients for renewed price renegotiations and/or discounts. Infosys reported $1.752 billion revenue for the quarter but took a $15 million one-time charge for a large program cancelation, and rupee-dollar currency fluctuations forced another $15 million charge.

CEO S.D. Shibulal noted three factors influencing the reduced guidance -- currency fluctuations, pricing, and business reasons. He noted that because of price reductions, he saw the need to achieve 8% to 9% volume gains with revenue growth of 5%, but the company only achieved 2.7% volume gains for the quarter.

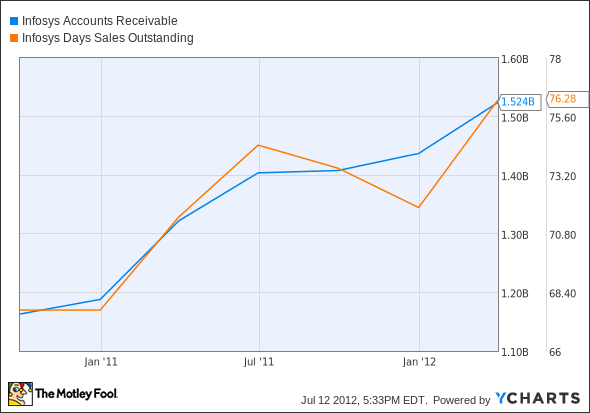

CFO V. Balakrishnan pointed out margin declines but noted that days sales outstanding and accounts receivable were "under control." He said:

[R]eceivables have slightly gone up this quarter, but we don't see a trend there. ... For the year, we have revised our guidance to 5% minimum growth for the full year. Our EPS growth for the full year is predicted to grow at 1%. ... And we are also assuming that we'll be adding some 35,000 employees gross for the full year. We added around 9,236 in the first quarter.

Let's review some financial metrics to decipher management's discussion and possibly shed some light on Infosys' future.

INFY Accounts Receivable data by YCharts

6/30/12 | 3/31/12 | 12/31/11 | 9/30/11 | 6/30/11 | 3/31/11 | 12/31/10 | 9/30/10 | |

|---|---|---|---|---|---|---|---|---|

Accounts Receivable | $1,752 | $1,771 | $1,806 | $1,746 | $1,671 | $1,602 | $1,585 | $1,496 |

Days Sales Outstanding | 83 | 79 | 73 | 74 | 77 | 75 | 68 | 71 |

A/R as % Revenue | 91% | 86% | 80% | 81% | 84% | 83% | 75% | 78% |

Source: S&P Capital IQ.

The table reinforces what the chart illustrates graphically. There is a disturbing trend of rising receivables and days needed to collect receivables. Also, receivables are growing as a percentage of revenue. This is typical when a company wants to provide clients with looser payment terms in order to "keep them happy." However, this hurts cash flow. Operating cash flow has averaged more than $400 million on a quarterly basis, but it could be much higher if the receivables situation improved. The company's cash conversion cycle has increased from 70 days to 83 days over the last two years, and is now at its highest level. Surprisingly, Infosys' days payable outstanding is only one day and total payables equal $7 million.

6/30/12 | 3/31/12 | 12/31/11 | 9/30/11 | 6/30/11 | 3/31/11 | 12/31/10 | 9/30/10 | |

|---|---|---|---|---|---|---|---|---|

Revenue | $1,752 | $1,771 | $1,806 | $1,746 | $1,671 | $1,602 | $1,585 | $1,496 |

% Change YOY | 5% | 11% | 14% | 17% | 23% | 24% | 29% | N/A |

Source: S&P Capital IQ.

The revenue table provides evidence that Infosys' revenue trend is slowing and also a possible reason why management reduced guidance to the 5% range of revenue growth. Management may expect future quarterly revenue growth to continue deteriorating, which would bring the full year's guidance close to the estimated 5% range.

Earnings-per-share growth is now expected to grow at only 1% for the full year, according to Infosys' CFO. This is markedly down from 9% year-over-year growth for the most recent quarter, and from 18% growth two years ago. The P/E ratio with the price drop is still at 12.86 and the forward P/E is 11.71. Infosys pays a dividend of $0.79 (1.8%). The newly announced growth rate combined with the dividend yield is much less than the P/E, which indicates the stock is now overpriced. Since June 29, the stock price has declined 12.78% from $45.06 to the current $39.30, so the stock price could rise 2.8% to $46.32 if we use another valuation method. However, based on the trend data I would look for growth investments on more stable ground.

Friday, July 13, also proved to be an unlucky day for Lexmark (NYS: LXK) , as shares tumbled after the printer maker warned of lower-than-expected second-quarter profit. Hewlett-Packard (NYS: HPQ) and Xerox (NYS: XRX) also fell "in sympathy" with the rival printer maker.

"The revised second quarter outlook reflects a weaker than expected demand environment, particularly in Europe, and a larger than expected impact from unfavorable changes in currency exchange rates," Lexmark said in a written statement.

Lexmark was down $3.93, or 16.37% to $20.33 in Friday's trading. The company pays a 4.8% dividend ($1.20) and has a trailing P/E of only 5.19. Revenue, operating income, net income, and earnings per shares have all declined year over year since 2010. Operating cash flow margin averages 10%, so the dividend could survive awhile longer.

Foolish takeaway

Europe's debt crisis will continue to affect U.S. companies that do business in Europe for some time to come. Pay attention to the sector in which these companies operate in, and ask whether the products and/or services sold are necessary, or can clients make do for a while with what they have? As always, Foolish readers should base investment decisions on earnings quality.

The death of the PC

The days of paying for costly software upgrades are numbered. The PC will soon be obsolete. And BusinessWeek reports 70% of Americans are already using the technology that will replace it. Merrill Lynch calls it "a $160 billion tsunami." Computing giants including IBM, Yahoo!, and Amazon are racing to be the first to cash in on this PC-killing revolution. Yet a small group of little-known companies have a huge head start. Get the full details on these companies, and the technology that is destroying the PC, in a free video from The Motley Fool.

The article Can Infosys Recover From Europe's Woes? originally appeared on Fool.com.

Fool contributor John Del Vecchio is co-advisor to Motley Fool Alpha and co-manager of the Active Bear ETF. You may follow him on Twitter @johnfdelvecchio. He does not own any shares in the companies mentioned in this article. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.