Can These Fertilizer Stocks Grow Higher?

Shares of nitrogen-fertilizer makers CF Industries (NYS: CF) and Rentech Nitrogen Partners (NYS: RNF) both hit a 52-week high today. Let's take a look at how they got here to find out whether there are still clear skies ahead.

How it got here

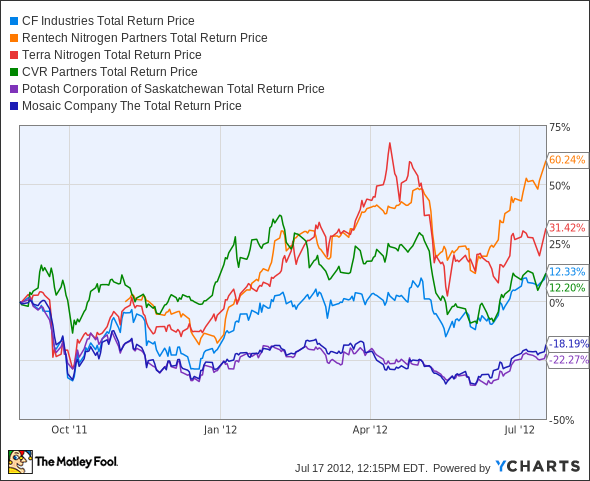

This isn't CF's first trip to the dance. It's been making new highs since the spring after reversing a spate of rather weak fertilizer industry earnings that kicked off the year. Rentech's been on a similar ride. Despite their similar springtime surges, CF isn't in the same class as Rentech, which has been one of the market's best performers since it went public late last year:

CF Total Return Price data by YCharts

You can see the divergence in fertilizer stocks, with nitrogen-focused producers making gains while potash and phosphate companies like PotashCorp (NYS: POT) struggle. Let's take a quick look at why that's happening.

What you need to know

Rentech's price-to-earnings ratio is a bit high compared to its peers, but when you drill down to a more important metric -- price to free cash flow -- the company looks like a much more reasonable investment. That metric also does a great job explaining why PotashCorp has floundered:

Company | P/E Ratio | Price to Free Cash Flow | Net Margin (TTM) | Dividend Yield |

|---|---|---|---|---|

CF Industries | 8.4 | 7.6 | 25.2% | 0.8% |

Rentech Nitrogen Partners | 48.0 | 18.2 | 13.9% | 14.1% |

PotashCorp | 13.6 | 45.0 | 34.4% | 1.3% |

Terra Nitrogen (NYS: TNH) | 7.8 | 8.2 | 63.9% | 7.4% |

CVR Partners (NYS: UAN) | 12.3 | 14.8 | 45.1% | 8.5% |

Source: Morningstar.

CF's growth looks a lot more sustainable than Rentech's, given its lower valuations on both counts. But look at that dividend! Yes, seriously, look at it. It could be a big problem going forward, because it's so high that the payout ratio may not be sustainable:

Company | Dividend Yield | Payout Ratio | Free Cash Flow Payout Ratio |

|---|---|---|---|

CF Industries | 0.8% | 15% | 14% |

Rentech Nitrogen Partners | 14.1% | 492% | 186% |

PotashCorp | 1.3% | 8% | 28% |

Terra Nitrogen | 7.4% | 111% | 113% |

CVR Partners | 8.5% | 268% | 320% |

Source: Morningstar.

Terra and CVR Partners, as master limited partnerships, are obligated to pay out nearly all their earnings in dividends -- but you might make the case that they're going a bit overboard. Rentech's also an MLP, and its payouts are nearly double its present levels of free cash flow. The company's issued debt recently to cover its obligations, so investors may be headed for a dividend cut in the future.

CF shareholders, on the other hand, should be clamoring for a dividend increase. With only 14% of the company's free cash flowing back to shareholders, there's easily room for a payout at least double the current yield.

What's next?

Where do these fertilizer stocks go from here? That'll depend on farm factors. Corn plantings, which rely on nitrogen fertilizer, have neared record highs, but widespread droughts in the United States threaten to dent earnings across the agricultural board. That may turn out to be a net positive for fertilizer companies, as excess corn supplies worried one analyst enough to spark an industrywide spate of downgrades. With demand remaining constrained, farmers will push harder to juice yields on whatever good acreage they have left.

The Motley Fool's CAPS community has given both stocks a four-star rating, expressing strong optimism on the future of these fertilizer companies. If you agree, why not add this basket of nitrogen fertilizer companies to your Watchlist? You'll get all the news we Fools can find, delivered to your inbox as it happens.

If you're looking for great dividend stocks with sustainable payouts, take a look at our free report on the nine rock-solid dividend paying stocks that can secure your future. The report's only available for a limited time, so claim your free copy now to start building the foundation of long-term portfolio success.

The article Can These Fertilizer Stocks Grow Higher? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of CF Industries Holdings. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.