What We Really Need to Be Asking About JPMorgan

JPMorgan Chase's (NYS: JPM) "London Whale" is still on the tip of everyone's tongue. That's as it should be since the debacle has already cost the bank close to $6 billion.

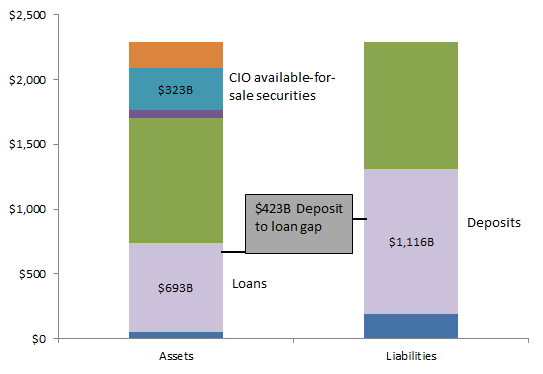

But, if we step back for a moment, the question we should be asking is: Why does JPMorgan's chief investment office -- the source of the rapidly metastasizing trade -- have an investment portfolio of $323 billion in the first place? Or, in other words, why is JPMorgan trading its deposit base rather than making loans?

The chart below was adapted from a JPMorgan handout (link opens PDF file) that it provided with its second-quarter earnings.

Source: JPMorgan Chase.

The first thing to notice is the CIO portfolio at the top of the asset pile. JPMorgan's CIO is typically described as the bank's arm that's responsible for investing the bank's "excess deposits." Excess deposits are exactly what they sound like: depositors' money that hasn't been reinvested in loans. So when the banking business is slow -- at least, the banking business as defined by loaning out depositors' funds -- JPMorgan turns to the CIO office to protect that money and earn some conservative returns on it until the bank finds a place to loan it out. Or so the story goes.

Move further down the graphic and we see the loans on the asset side and the deposits on the liability side. Deposits are much larger than loans and JPMorgan highlighted that in the chart by helpfully calculating the gap between deposits and loans. It's as if the bank is telling us, "See, we can't help it. We have all of this money we can't loan out so we need this huge CIO portfolio to invest that cash."

A $423 billion story

The $423 billion loan deposit gap comes to 38% of the bank's total deposits. That's a massive difference between loans and deposits.

But what does it mean? One logical conclusion is that there simply isn't borrowing demand right now. As consumers and businesses buckle down due to economic uncertainties, the last thing they want to do is take on a whole bunch of new debt.

That's an easy story to check up on, though. If JPMorgan is unable to find adequate loan demand, then it stands to reason that other banks are facing the same sagging demand. But that doesn't seem to be the case.

Bank | Total Deposits | Net Loans | Loan-to-Deposit Gap as a Percentage of Deposits |

|---|---|---|---|

JPMorgan | $1,116 billion | $693 billion | 38% |

Bank of America (NYS: BAC) | $1,041 billion | $870 billion | 16% |

Wells Fargo | $930 billion | $748 billion | 20% |

Citigroup (NYS: C) | $906 billion | $619 billion | 32% |

US Bancorp (NYS: USB) | $234 billion | $207 billion | 12% |

M&T Bank | $61 billion | $60 billion | 2% |

Huntington Bancshares (NAS: HBAN) | $45 billion | $40 billion | 11% |

Source: Company filings. Note: All bank data is as of the first quarter 2012, except JPMorgan, which is as of second quarter 2012.

Citigroup's gap between loans and deposits is as close to JPMorgan as it gets, but other major banks around the country don't seem to be having nearly the same struggle as JPMorgan when it comes to lending out depositors' money.

If I were cynical, I might say that JPMorgan would rather not find new loans. I might suggest that JPMorgan would rather kick those "excess deposits" out to its CIO and invest the money instead. After all, the CIO arm reported combined 2009 and 2010 profit of $7.9 billion. That's against total JPMorgan net income of $29 billion in those years. During those same two years retail financial services delivered a paltry $1.4 billion in profit, while the asset management division -- which had $1.8 trillion in assets under supervision at the end of 2010 -- managed just $3.1 billion in profit.

It certainly seems like there would've been good reason to want to get more "excess deposits" in the hands of the CIO.

Not quite back to banking

In the wake of the financial meltdown, JPMorgan and its outspoken CEO, Jamie Dimon, have been vociferous critics of the new regulations that some lawmakers and industry experts would like to see put in place. In particular, they've had plenty to say about regulators' attempt to curtail big-bank proprietary trading activities.

There are large financial companies that we're comfortable letting trade as much as they want. They're called hedge funds. The deposit insurance and too-big-to-fail backing -- yes, you better believe it's still there -- that we provide to big banks should not be there to allow bankers to chase trading profits in an effort to justify huge salaries.

If regulators are smart, they'll make the most of the fortuitous timing of the London Whale incident. Make deposit-taking banks leave the proprietary trading to hedge funds. Let them get back to the business of banking.

JPMorgan notwithstanding, some top investors have been zeroing in on the banking sector. To find out who's been sniffing around and what banks you should be watching, check out The Motley Fool's free special report "The Stocks Only the Smartest Investors Are Buying."

The article What We Really Need to Be Asking About JPMorgan originally appeared on Fool.com.

The Motley Fool owns shares of JPMorgan Chase, Citigroup, Bank of America, and Huntington Bancshares. Motley Fool newsletter services have recommended buying shares of Wells Fargo. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.Fool contributor Matt Koppenheffer owns shares of Bank of America, but does not have a financial interest in any of the other companies mentioned. You can check out what Matt is keeping an eye on by visiting his CAPS portfolio, or you can follow Matt on Twitter @KoppTheFool or Facebook. The Fool's disclosure policy prefers dividends over a sharp stick in the eye.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.