Coming Soon: Yum! Brands Earnings

Yum! Brands (NYS: YUM) is expected to report Q2 earnings on July 18. Here's what Wall Street wants to see:

The 10-second takeaway

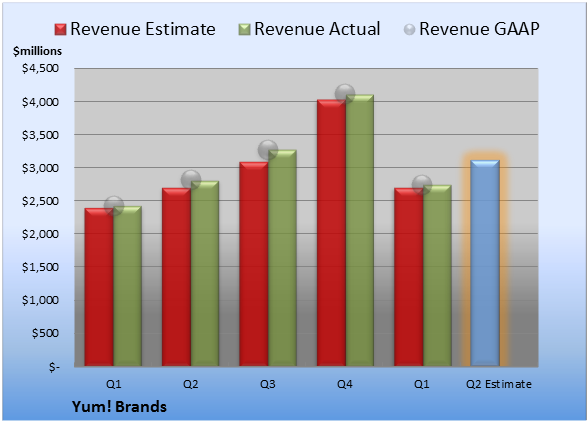

Comparing the upcoming quarter to the prior-year quarter, average analyst estimates predict Yum! Brands' revenues will expand 10.6% and EPS will improve 6.1%.

The average estimate for revenue is $3.11 billion. On the bottom line, the average EPS estimate is $0.70.

Revenue details

Last quarter, Yum! Brands booked revenue of $2.74 billion. GAAP reported sales were 13% higher than the prior-year quarter's $2.43 billion.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

EPS details

Last quarter, non-GAAP EPS came in at $0.76. GAAP EPS of $0.96 for Q1 were 78% higher than the prior-year quarter's $0.54 per share.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Recent performance

For the preceding quarter, gross margin was 29.6%, 60 basis points better than the prior-year quarter. Operating margin was 19.7%, 120 basis points better than the prior-year quarter. Net margin was 16.7%, 580 basis points better than the prior-year quarter.

Looking ahead

The full year's average estimate for revenue is $13.78 billion. The average EPS estimate is $3.31.

Investor sentiment

The stock has a four-star rating (out of five) at Motley Fool CAPS, with 3,111 members out of 3,240 rating the stock outperform, and 130 members rating it underperform. Among 784 CAPS All-Star picks (recommendations by the highest-ranked CAPS members), 764 give Yum! Brands a green thumbs-up, and 20 give it a red thumbs-down.

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on Yum! Brands is outperform, with an average price target of $71.85.

Add Yum! Brands to My Watchlist.

The article Coming Soon: Yum! Brands Earnings originally appeared on Fool.com.

Seth Jaysonhad no position in any company mentioned here at the time of publication. You can view his stock holdings here. He is co-advisor ofMotley Fool Hidden Gems, which provides new small-cap ideas every month, backed by a real-money portfolio. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.