Better Buy Now: Carnival or Royal Caribbean?

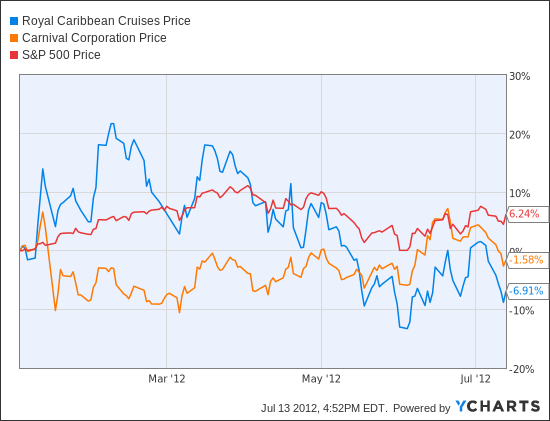

The travel industry as a whole is currently thriving as consumers regain some discretionary income and start booking vacations they'd been putting off over the last few years. 2012 hasn't been quite so rosy for cruise lines, though. Industry leader Carnival (NYS: CCL) and runner-up Royal Caribbean (NYS: RCL) are both trailing the market.

This could mean now is a great time for investors to buy, but let's look a little closer. Here's a quick glance at how the two companies stack up against each other:

Company | Market Cap | Operating Margin | Debt-to-Equity Ratio | Price-to-Earnings Ratio | Dividend Yield |

|---|---|---|---|---|---|

Carnival | $25.2 billion | 12.75% | 0.30 | 17.7 | 3.0% |

Royal Caribbean | $5.2 billion | 11.92% | 0.36 | 9.2 | 1.7% |

Source: Yahoo! Finance.

Investors shouldn't put too much stock in price-to-earnings (P/E) ratios, because they don't really tell you much about a company's future earning potential. However, in the table above, Carnival's higher ratio is worth some investigation.

Carnival controls nearly half of the cruise industry. Royal Caribbean has about a quarter. It's unusual to see such a disparity in valuations among two top companies in an industry, especially given that Royal Caribbean has a ton of room for growth and emerging trends on its side, with a very reasonable P/E ratio.

As more and more baby boomers enter retirement, they're looking for ways to travel and relax. Cruises advertise themselves as both the journey and the destination, with many pricing tiers, including the popular "all-inclusive."

These two points help cruises seem like a stress-free way to travel that's ideal for retirees. And I'd argue that Royal Caribbean's portfolio of upscale brands will likely be more appealing than the family-centered focus of Carnival's most popular brands.

Throw in Royal Caribbean's focus on emerging markets, and that gives it two major opportunities for growth. Meanwhile, Carnival is still dealing with lawsuits and a tainted brand image from its Costa Concordia accident earlier this year.

Both companies have similar debt-to-equity ratios and operating margins. In my book, that makes the company with more opportunity for growth, Royal Caribbean, the smarter pick for investors here.

That said, the cruise industry still isn't a sure thing. If you're looking for a company with a much higher chance of upside, check out our top stock for 2012.

The article Better Buy Now: Carnival or Royal Caribbean? originally appeared on Fool.com.

Fool contributor Amanda Buchanan holds no position in any company mentioned. Click here to see her holdings and a short bio. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.