Is Fossil Ready to Do an About-Face?

Shares of Fossil (NAS: FOSL) hit a 52-week low on Wednesday. Let's take a look at how it got there and see if cloudy skies are still in the forecast.

How it got here

Who says you can't travel through time? Fossil did in May when it completely reversed course and has since seen its share price retrace to November 2010 levels.

The maker of watches and other retail accessories blamed weakness in European spending and changes in its merchandising and assortment strategies for its weak outlook. Overall, Fossil lowered its full-year forecast to a range of $5.30 to $5.40, which was moderately below Wall Street's expectation of $5.56. The results, which are undoubtedly weak but not catastrophic by any means, caused Fossil's share price to implode. Since that report, Fossil has lost more than half its value.

Also working against Fossil is that dismal retail sales report from last week. U.S. retail same-store sales hit a three-year low as consumers in middle-income brackets restrained their spending. Macy's (NYS: M) , one of many large department stores Fossil sells its products out of, was one such retailer that missed the mark.

Despite persistent worries in Europe and a cloudy retail sales picture, there are still positives to take away from Fossil. For one, the demand for brand-name merchandise remains largely unaffected. Fossil currently has a deal in place to supply designer brand Michael Kors (NYS: KORS) with watches that it then rebrands and sells under the Michael Kors brand. In its latest quarter, Michael Kors reported a whopping 36.1% increase in same-store sales.

Swiss-industry watch sale strength is also working in Fossil's favor. Although Fossil's bread and butter price point is around $50-$150, data from the Swiss watchmaking industry shows consumers' appetite for timepieces remains strong.

How it stacks up

Let's see how Fossil stacks up next to its peers.

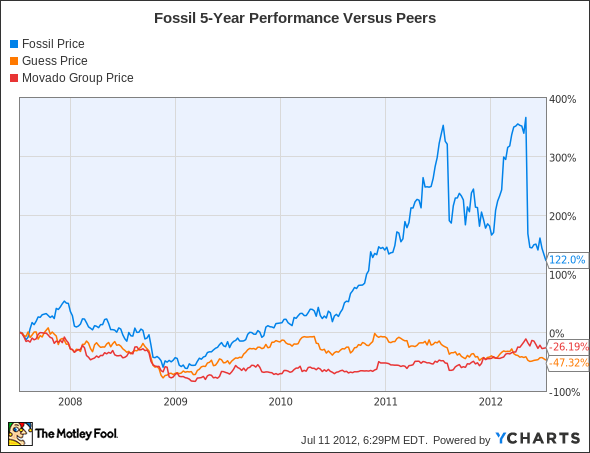

Despite its troubles, don't feel too sorry for Fossil shareholders, who have rejoiced in its outperformance over peers Guess? (NYS: GES) and Movado Group (NYS: MOV) over the past five years.

Company | Price / Book | Price / Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Fossil | 3.5 | 17.4 | 9.7 | 16.2% |

Guess? | 1.9 | 6.5 | 7.8 | 17.8% |

Movado Group | 1.6 | 10.6 | 12.4 | (2.6%) |

Source: Morningstar, author's calculations, CAGR = compound annual growth rate.

It's not often I'll say this during a comparison, but all three watch and accessory providers offer a compelling case to buyers.

Movado Group had a huge revenue contraction from the recession but has since found its niche in the $300-$1,000 price range. The company has boosted its earnings guidance, raised its dividend, and even declared a special dividend to shareholders earlier this year.

Guess? has me absolutely shaking my head in disbelief. While it isn't a pure play watchmaker, It's the fastest growing low-to-mid-tier price point watch manufacturer and also boasts the cheapest valuation with a 3% yield. I frankly couldn't pound the table fast enough on Guess? if you gave me a robotic arm.

Finally, there's Fossil, which has pronounced issues in Europe but is trading below 10 times forward earnings -- historically low by its standards.

What's next

Now for the $64,000 question: What's next for Fossil? That question depends on if it can continue to reduce its exposure in Europe while expanding its international reach, and if it utilizes its strong cash flow to reward shareholders (Fossil isn't currently paying a dividend, while Guess? and Movado both do).

Our very own CAPS community gives the company a four-star rating (out of five), with 90.4% of members expecting it to outperform. As you can tell from my sectorwide optimism, I count myself among the optimists. However, my CAPScall of outperform is down 34 points at the moment.

That CAPScall isn't something I'll be closing anytime soon as I stand by my original thesis, made in May, that the company's free fall was a brutal overreaction to a 5% reduction in EPS. Fossil's sales to Asia are increasing, and it's been able to adapt its product line through numerous recessions over the past few decades. At less than 10 times forward earnings, Fossil could be ready to do an about-face and head higher.

Even if Fossil isn't the right investment for you, you might be interested in reading about three companies our analysts at Stock Advisor feel will outperform in the emerging markets. Get your copy of this latest free special report by clicking here.

Craving more input on Fossil? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

The article Is Fossil Ready to Do an About-Face? originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. He owns far too many watches. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Fossil, Guess?, and Movado Group. Motley Fool newsletter services have recommended buying shares of Fossil and Guess?, as well as writing covered calls on Guess? and shorting shares of Fossil in a separate newsletter service. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.