This Is 1 Incredible CEO

The Motley Fool's readers have spoken, and I have heeded your cries. After months of pointing out CEO gaffes and faux pas, I've decided to make it a weekly tradition to also point out corporate leaders who are putting shareholder interests and those of the public first and are generally deserving of kudos from investors. For reference, here is last week's selection.

This week, we'll get off our recent kick of highlighting health-care CEOs and return to the technology sector, where I'll show you why Intel's (NAS: INTC) CEO, Paul Otellini, is really the pick of the litter.

Kudos to you, Mr. Otellini

Behind every great company there's usually a great CEO. Intel has had quite a few notable leaders, but I'm happy to add Otellini to that list.

Intel is an absolute technological giant, with its little chips powering massive markets like personal computers and cloud servers. Despite warnings yesterday from semiconductor equipment manufacturer Applied Materials (NAS: AMAT) that results would come in below expectations, and preliminary results from Advanced Micro Devices (NYS: AMD) that were considerably weaker than expected because of poor demand in Asia and Europe, Intel is well positioned for growth.

Intel's outperformance begins with its vertically integrated assembly line. Unlike fabless chipmakers Taiwan Semiconductor (NYS: TSM) and United Microelectronics (NYS: UMC) which are contracted out to make chips on behalf of other design shops, Intel's production facilities are integrated under one roof from start to finish. That's a time- and cost-saving procedure, and it's a reason so many businesses choose Intel.

That leads me to my next point: Intel's move into the smartphone market. Possessing the lion's share of the PC market isn't enough for Intel. As smartphone and tablet average selling prices drop with the addition of more product into the marketplace, these high-demand products fall into a range of affordability for more consumers. That increase in demand could be a major growth driver for Intel in the coming years, provided its new Atom chips can gain traction against ARM Holdings and its army of licensees.

Finally, Intel's push toward cloud computing with the introduction of its new Xeon E5-2600 chips earlier this year should cement its name as a primary hardware play on the cloud revolution. With big-name networking companies already designing their new servers around these chips, Intel continues to be a driving force in technological development.

A step above his peers

But there's more to Intel and Otellini's leadership than just performance (but don't get me wrong -- we like a company that can execute). Three more factors make Otellini an incredible CEO.

First, Intel's focus on the environment is practically unparalleled in the tech sector. Intel is the largest purchaser of renewable green-energy credits in the world and is spearheading ways to increase the energy efficiency of its facilities. All told, Intel REC's equate to the removal of 185,000 cars from the road annually, and the power it saves in its manufacturing facilities is enough to power 50,000 homes.

Second, Intel is focused on hiring college graduates. Unlike some of the recently highlighted CEOs, not all of these hires are occurring in the United States (Intel has a large presence in Israel and has been hiring there). However, Intel has been diligent in its efforts to create jobs for college graduates worldwide despite a stagnant global growth environment.

Finally, Otellini has made it clear that Intel's next CEO would be hired from within the company. That's great news, because promoting leadership from within tends to keep skilled workers from jumping ship and gives them a sense that job advancement is possible. Otellini himself joined Intel in 1974 and speaks to the ethos behind a revolutionary and long-tenured workforce.

Two thumbs up

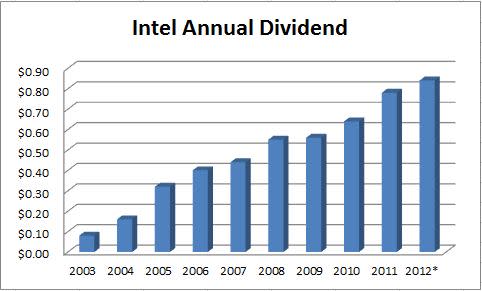

OK, I lied! There's still one more factor I've yet to discuss that puts Otellini head-and-shoulders above his peers. The final piece to the puzzle is Intel's dividend growth during his tenure.

It's great that Intel is hiring young, skilled, workers and that it's doing right by the environment, but it's also worth noting that shareholders are appreciated just as much as Intel's employees.

Since taking the helm in 2005, Intel's quarterly dividend has jumped 163% from just $0.08 to $0.21. Its dividend growth has been absolutely meteoric -- 34% annually over the past eight years.

Source: Dividata.

*Assumes quarterly payout of $0.21 for the remainder of 2012.

Intel's current yield of 3.2% places it squarely on income-investors' radars and is an extremely robust yield for such a high-growth company. Plus, Intel's payout ratio (how much it pays out in dividends as a percentage of net income) is just 34%, leaving plenty of room for further distribution increases. This is the reason it was one of my first submissions as a great dividend company you can buy right now.

Paul Otellini has done a marvelous job orchestrating Intel for years. In my opinion, he's creating a happy environment for his workers, spearheading technological innovations, and continues to put shareholders high on his list of priorities. That's definitely worth two thumbs up in my book.

Do you have a CEO you'd like to nominate for this prestigious weekly honor? Shoot me an email and a one- or two-sentence description of why your choice deserves next week's nomination, and you just might see your nominee in the spotlight.

Here at the Fool, we love management teams that have strong track records of rewarding their shareholders, which is why I invite you to download a copy of our latest special report, "Secure Your Future With 9 Rock-Solid Dividend Stocks." This report contains a wide array of companies and sectors that are likely to keep your best interests in mind, just like Intel, whether the market is up or down. Best of all, it's completely free for a limited time, so don't miss out!

At the time thisarticle was published Fool contributorSean Williamshas no material interest in any companies mentioned in this article. He loves giving credit when credit is due. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley Fool owns shares of Intel.Motley Fool newsletter serviceshave recommended buying shares of Intel. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policythat's a chip off the old block.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.