Is MAKO Surgical the Next Hansen Medical?

Pop quiz: which of the following price charts would you rather ride?

Clearly, this is a rhetorical question, but with MAKO Surgical's (NAS: MAKO) gloomy earnings release last night, investors (including myself) can't help fearing that the road ahead for the surgical specialist may one day resemble the blue one above. Here's whose performance you're actually looking at.

Intuitive Surgical (NAS: ISRG) represents the role model for aspiring medical-device companies. It came out with its truly disruptive da Vinci robotic device, implemented a sustainable business model with recurring revenue sources, saw widespread adoption, and delivered everywhere investors could hope for.

Hansen Medical (NAS: HNSN) , on the other hand, represents a cautionary tale of what can go wrong if adoption fails to materialize in a meaningful way. Sales of its Sensei systems and disposable catheters languished, and adoption today remains tepid at best. The company sold just two Sensei systems last quarter; compare that with the eight that were sold in the same quarter four years ago.

Call it in the air

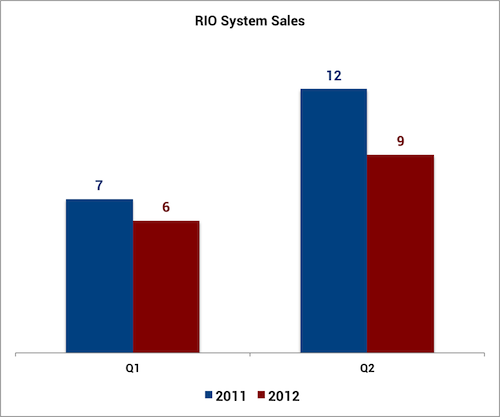

It's far too premature to definitely say that MAKO is going down the same road, but last night's figures don't inspire a lot of confidence in system sales, and they at least stoke some fears that just such a grim reality panning out. We're now looking at two consecutive quarters of year-over-year decreases in RIO sales.

Source: Earnings press releases.

The next several quarters will be critical to show whether this is a small bump in the road to riches, or whether MAKO's technology is failing to gain the traction it needs to justify its valuation.

On the conference call, CEO Dr. Maurice Ferre explained very clearly that the company was seeing its sales cycle extend and that deals are now taking longer to close because hospitals want more surgeons on board to help bolster the return on investment, or ROI, and that these deals aren't lost but rather delayed.

Ferre said hospitals are focusing more on their ROIs than in the past, as they become slightly more "risk-averse on their purchasing." An encouraging sign is robust participation in MAKO's BioSkills training labs, which is typically a meaningful leading indicator as it requires a significant time commitment from the surgeon to participate. These are doctors who are sacrificing time on their weekends just to come in and learn about the procedures, and MAKO is booked through November for these labs.

That bodes well for surgeon engagement, which will help the ROI analysis for hospitals, and it should help these deals close eventually, albeit with a prolonged sales cycle.

Numbers speak for themselves

Still, MAKO was forced to cut its full-year guidance on both system sales and procedures. We're talking about a difference of 20 systems, from the high end of the original guidance at 62 systems to the low end of current guidance at 42. Each system sells for around $750,000 (before Total Hip Arthroplasty applications), so that's a potential difference of about $15 million.

2012 Guidance | January | May | July |

|---|---|---|---|

RIO systems | 56 to 62 | 52 to 58 | 42 to 48 |

MAKOplasty procedures | 11,000 to 13,000 | 11,000 to 13,000 | 11,000 to 12,000 |

Source: Earnings press releases.

For reference, MAKO sold 48 RIO systems last year, so it will need to hit or exceed the high end of guidance to beat 2011 RIO sales. Ferre doesn't think these deals are lost but are rather being pushed off into 2013 because of the aforementioned sales-cycle factors. If that's the case, than this is just a speed bump and the long-term story remains intact.

The pressure is now on to execute over the next year and prove that these deals truly are still in the pipeline and close them where it counts: the top line.

The good news

Last quarter, MAKO set up a financing facility through Deerfield Management, to give the company cash flexibility if it needs it, up to $50 million. Deerfield received warrants up front and would receive additional warrants if MAKO draws funds in the $10 million increments specified in the arrangement.

These would be mildly dilutive, but fortunately, CFO Fritz LaPorte feels confident that MAKO doesn't need to raise additional capital at this point and that the company's cash burn rate is in line with expectations.

Source: Earnings press releases.

Average monthly utilization among installed systems remains healthy at 7.2. This is helped by the new Total Hip Arthroplasty, or THA, procedures that began recently and are off to a strong start. THA procedures have more than doubled over the past three quarters since they launched in the fourth quarter, with 280 performed this quarter.

Cautiously optimistic, or optimistically cautious?

I don't think MAKO Surgical will become the next Hansen Medical, but the fear is there. This is the second consecutive disappointing quarter in RIO system sales, but this was always a five- to 10-year story to begin with.

There are bound to be some hurdles as MAKO grows into a larger company, and hopefully RIO sales growth will reaccelerate in 2013 as the company accommodates for longer sales cycles. As cautiously optimistic as investors were after last quarter, there's still reason to be optimistic, but more reasons to be cautious.

MAKO investors like myself may be feeling gun-shy today after the stock's gut-wrenching 40% plunge, so some safer picks may be in order. These nine rock-solid dividend stocks should help mitigate some of the wilder swings. Grab a copy of this free report to learn more.

At the time thisarticle was published Fool contributorEvan Niuowns shares of MAKO Surgical, but he holds no other position in any company mentioned. Check out hisholdings and a short bio. The Motley Fool owns shares of MAKO Surgical and Intuitive Surgical.Motley Fool newsletter serviceshave recommended buying shares of Intuitive Surgical and MAKO Surgical. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.