Why Spectrum Pharmaceuticals Could Head Even Higher

Shares of Spectrum Pharmaceuticals (NAS: SPPI) opened at a 52-week high this morning. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

Spectrum's approach of "when in doubt, buy it out" seems to be working for the hematology and oncology focused biotech with a keen eye on growth by acquisition.

In Spectrum's latest quarter, the company reported record profits on the heels of tight operating expense controls, and fantastic prospects for its two FDA-approved drugs and a recent acquisition.

Spectrum's lead drug, Fusilev, a combination therapy used in the palliative care of patients with advanced colorectal cancer, was the primary reason revenue soared 37% last quarter. Fusilev continues to gain market share and looks poised to provide double-digit revenue growth for the immediate future.

On the other hand, Zevalin, a treatment for follicular lymphoma, has seen sales stagnate in recent quarters. However, a ruling by the FDA late last year removing the requirement that doctors use a bioscan prior to using Zevalin clears the way for an easier path to prescribing the treatment.

Finally, Spectrum's offer to purchaseAllos Therapeutics (NAS: ALTH) for $1.82 per share (plus an additional $0.11 if Allos' lead drug, Folotyn, is approved in the European Union) is a "very smart strategic move" as my Foolish colleague Brian Orelli perfectly opined. He goes on to note that Folotyn and Zevalin are prescribed by the same doctors, but they don't compete with each other. The cost synergies and instant bottom-line boost from Allos will be welcomed by shareholders.

But, not everything is going to be a cakewalk for Spectrum. Just prior to announcing this buyout, it also announced two unfavorable phase 3 trial results for its bladder cancer drug apaziquone, which it developed with marketing partner Allergan (NYS: AGN) . It may not be a total wash, but the data is not likely to indicate an approval-worthy drug.

How it stacks up

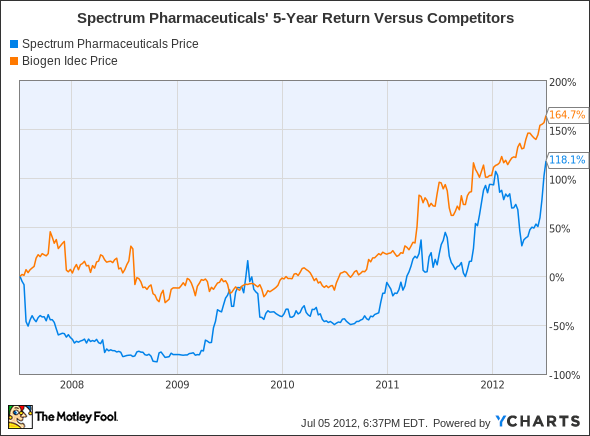

Let's see how Spectrum comapres to peer Biogen Idec (NAS: BIIB) .

With such a small target audience, Spectrum has fended off generic competitors and only has one primary competitor to its pipeline: Biogen Idec. Spectrum, continuing the theme of acquiring potential blockbusters, actually purchased Zevalin's U.S. rights from Biogen Idec through a joint-venture Biogen Idec had with Cell Therapeutics (NAS: CTIC) . Moving Zevalin was no big deal for Biogen Idec whose blockbuster Rituxan controls the lion's share of the non-Hodgkin's lymphoma market and is a primary reason why Zevalin sales have failed to take off.

Spectrum does have other tricks up its sleeve outside of Fusilev, Zevalin, and Folotyn. Including the apaziquone trial, Spectrum currently lists 11 drug hopefuls on its website, stretched across 15 clinical phase trials. Even if only a few of these trials are successful, that's a healthy and developing pipeline.

What's next

Now for the $64,000 question: What's next for Spectrum Pharmaceuticals? The answer is going to depend on whether it can reinvigorate Zevalin sales, if it can rapidly and cost-effectively integrate Allos' Fotolyn into its product portfolio, and if it can gain approval for some of the remaining 15 therapies in its clinical phase portfolio.

Our very own CAPS community gives the company a four-star rating (out of five), with a whopping 97.1% of members expecting it to outperform. I've yet to personally make a CAPScall on Spectrum in either direction until now, but I am ready to enter a CAPS limit order of outperform on the company at $14.

"Why not buy now?" you may be wondering. With only one analyst following the company, earnings results tend to be all over the place. That means Spectrum could just as easily miss EPS expectations by 50% as it could beat by 100%. I do see a lot of potential behind Fusilev sales and the Allos buyout, but remain concerned by Zevalin's stagnant growth. Spectrum could easily be a sub-10 P/E stock based on forward earnings projections, and $14 looks like the perfect area where the reward begins to greatly outweigh the risks of further pipeline failures and Zevalin's sales slump.

That said, Spectrum Pharmaceuticals clearly has a pipeline that's changing lives. If you'd like the inside scoop on a stock our Motley Fool Rule Breakers team feels could offer the next revolutionary product, then click here for your free access to our latest report.

Craving more input on Spectrum Pharmaceuticals? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.