What's Behind Westport Innovations' Wild Year?

The first half of 2012 is in the rearview mirror, and investors are gearing up for what looks to be an action-packed ending. There are bound to be some big winners -- and more than a few duds -- no matter what happens in the United States and abroad.

Will your favorite stock have its victory lap as we hit the home stretch, or will it get lapped? First-half performances can hold some clues, so let's look to the recent past to find out whether Westport Innovations (NAS: WPRT) deserves a place in your portfolio going forward.

First-half recap

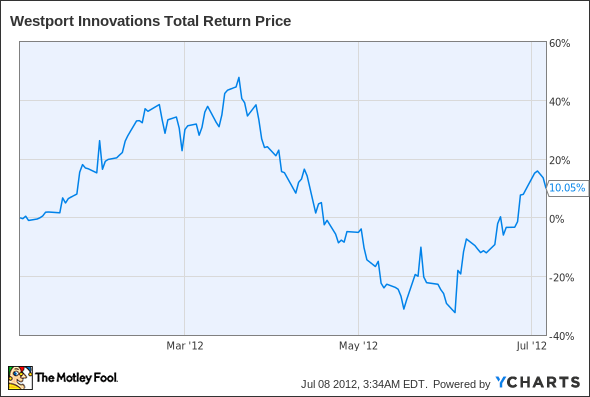

Westport has been on a roller coaster this year, cresting at more than a 40% gain before plunging precipitously. The stock's still positive for the year, but it hasn't recaptured its former highs:

WPRT Total Return Price data by YCharts.

Here are a few key metrics regarding its recent performance:

Market Cap | $2 billion |

TTM Revenue | $204 million |

TTM Net Loss | ($51 million) |

TTM Free Cash Flow | ($59 million) |

MRQ Revenue | $89 million |

MRQ Net Loss | ($23 million) |

MRQ Free Cash Flow | ($17 million) |

MRQ Revenue/Net Income Year-Over-Year Change | 122.5%/(64.3%) |

Motley Fool CAPS Rating (out of 5) | ***** |

Source: Morningstar. TTM = trailing-12-month. MRQ = most recent quarterly.

What the numbers don't tell you

Clean Energy Fuels (NAS: CLNE) mirrored much of Westport's early share-price growth this year, as both stocks were buoyed by hopes of the NAT GAS Act passing. When that didn't materialize, the sell-off was on in earnest. But along the way, Westport offered some telling (and tantalizing) pieces of information on its present growth and future potential.

Westport and Cummins' (NYS: CMI) well-known partnership received Navistar (NYS: NAV) and Clean Energy's blessing in February. Navistar, after announcing its Clean Energy partnership to put more nat-gas trucks on the road, revealed that it would be using Cummins-Westport engines in its production lines. Westport's 2011 earnings report also had some interesting tidbits, including the revelation that CEO David Demers would be targeting Heckmann's (NYS: HEK) fleet of fracking-services trucks for conversion.

The Cummins-Westport-Navistar honeymoon didn't last very long, though. Shortly after the NAT GAS Act went down in flames, Cummins announced its intent to build its own nat-gas engine without Westport's help. Downward pressure continued in May, when a weak first-quarter report sent shares to their 2012 lows.

Good news arrived later in May as Westport engineered a relationship with Volvo. The engine maker soon made another big move, revealing another partnership with Caterpillar in early June.

Going forward, shareholders should watch for other major partnerships and supply arrangements. Big shifts in the price of natural gas should also be of particular interest, as a big driver of Westport's appeal is the relatively lower expense of nat-gas fuel compared to gasoline and diesel. Fellow Fool Travis Hoium points out that we've got too much natural gas already, and offers a chart noting the steady decline in nat-gas drilling rigs over the last few years.

Westport also happens to be a very popular stock for the shorts, so its upcoming earnings report could see a huge movement in either direction.

Will the upcoming elections push Westport in the right direction? It's possible. The Motley Fool's been digging into the election's impact on your portfolio, and we've put together a free list: "Stocks That Could Skyrocket After the 2012 Presidential Election." Cummins is one company that could see huge benefits. To find out the rest, click here for your free copy of this important report now.

At the time thisarticle was published Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Heckmann and Westport Innovations. Motley Fool newsletter services have recommended buying shares of Cummins, Westport Innovations, and Clean Energy Fuels. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.