Why ZAGG Beat Back the Bears in 2012

The first half of 2012 is in the rearview mirror, and investors are gearing up for what looks to be an action-packed ending. There are bound to be some big winners -- and more than a few duds -- no matter what happens in the United States and abroad.

Will your favorite stock have its victory lap as we hit the homestretch, or will it get lapped? First-half performances can hold some clues, so let's look to the recent past to find out whether ZAGG (NAS: ZAGG) deserves a place in your portfolio going forward.

First-half recap

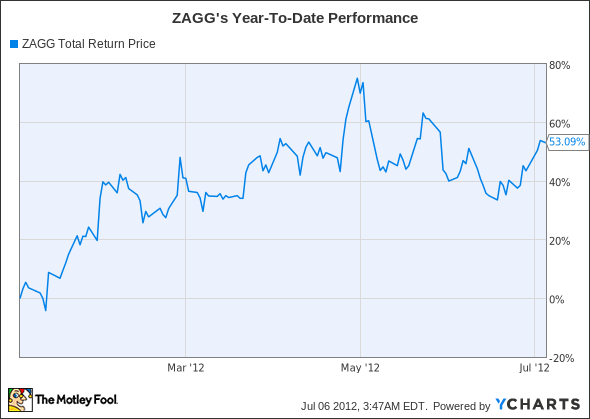

ZAGG has been one of 2012's best stocks, as you can see here:

ZAGG Total Return Price data by YCharts

Here are a few financial snapshots of its recent performance:

Market Cap | $342.7 million |

Trailing 12-Month Revenue | $208 million |

TTM Net Income | $20 million |

TTM Free Cash Flow | $26 million |

Most Recent Quarter Revenue | $55 million |

MRQ Net Income | $5 million |

MRQ Free Cash Flow | $15 million |

MRQ Revenue / Net Income YOY Change | 103.7% / 66.7% |

P/E and Forward P/E | 17.3 / 9.3 |

Price to Free Cash Flow | 13.2 |

Motley Fool CAPS Rating (out of 5 stars) |

Source: Morningstar.

What the numbers don't tell you

ZAGG has made a habit of beating analysts silly this year, with both its February and May earnings reports knocking it out of the park. The tiny company has had great success enticing mobile buyers to its protective and functional covers, riding Apple's (NAS: AAPL) wave of dominance to greater sales over the past few quarters. However, much of ZAGG's growth occurred in the first three months of the year, as its stock has barely moved since a post-earning peak at the end of February.

However, that flatness has been studded by a few major pops and drops, possibly as a result of huge short interest in the company's stock. When longtime Fool Rick Munarriz pointed out the Street's love-hate relationship with ZAGG in January, 8.3 million shares of its 29.6 million outstanding shares were sold short. That number's barely changed, as 8.3 million are still sold short today, out of a slightly larger float of 30.3 million shares.

What's ZAGG done to change investors' minds? Since the start of the year, the company's gained two major distribution channels, increasing its product footprint in AT&T (NYS: T) Mobile stores and persuading Wal-Mart (NYS: WMT) to stock its signature invisibleSHIELD protective coverings. ZAGG's also taken a major equity stake in start-up HzO's nanotech-based waterproofing technology, which might be a huge driver of future revenue should that technology gain Apple's (or any other mobile manufacturer's) blessing.

One potential threat might be coming from an unexpected direction. Microsoft's (NAS: MSFT) Surface tablet comes with a very slick-looking protective cover that doubles as a full-size keyboard, which might persuade other tablet manufacturers to start producing their own versions. That would undercut ZAGG's growing tablet-keyboard-slash-case product line, particularly if Apple goes that route. That threat remains distant, but it's something to consider.

ZAGG may be the right stock to protect the outside of the mobile revolution, but do you know which company's best-positioned on the inside? The Motley Fool does, and we've got an exclusive free report on that company's prospects. It's got so much potential we've named it the key stock of "The Next Trillion Dollar Revolution." Don't miss out -- claim your copy of this important report now.

At the time thisarticle was published Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Microsoft and Apple. Motley Fool newsletter services have recommended buying shares of Apple and Microsoft. Motley Fool newsletter services have recommended creating a bull call spread position in Microsoft. Motley Fool newsletter services have recommended creating a diagonal call position in Wal-Mart Stores. Motley Fool newsletter services have recommended creating a bull call spread position in Apple. Motley Fool newsletter services have recommended writing naked calls on ZAGG. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.