Relax: It's the Stock Market

You're tired. It's hot. You deserve a vacation. As you head off into the unknown land of horrible Internet connections and fruity drinks with umbrellas, why not put your money where your mind is and invest in relaxation? Not only do these five consumer goods companies help millions of people kick back and enjoy the good life, they also might fatten up your portfolio.

Hit the road

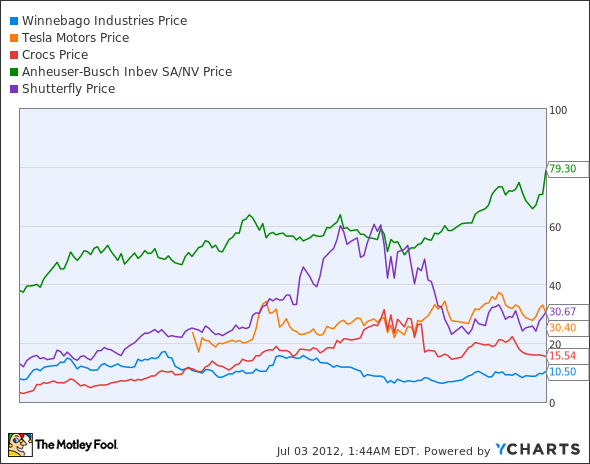

In the mood for a road trip? Winnebago (NYS: WGO) has been vacationers' home away from home for more than 50 years. In May, Winnebago hosted an extremely cost-effective "Dealer Days" event, boosting sales in the quarter by 15% and pumping net profit for the quarter up an astounding 230%. With $80 million cash and Chairman Randy Potts citing "reinvestment, diversification, stock buybacks, and cash dividends" as possibilities, Winnebago is gearing up for an exciting journey.

For those of you who can only truly relax for the 3.9 seconds it takes you to go from zero to 60 mph, why not take Tesla Motors (NAS: TSLA) for a spin? Tesla's stock has had its ups and downs over the past year, but rave reviews for Tesla's first mass-produced Model S are scattering skeptics left and right.

Strategic partnerships with Toyota and Daimler are also helping push Tesla out of start-up mode and into sustainable production. It's true that Tesla has never reported positive net income, but it has managed to increase annual revenue by nearly 1,500% over the past four years. In that same time, Tesla has been pouring money into R&D, an essential expense for an electric automotive company. With forward-thinking CEO Elon Musk at the wheel, this high-growth company could shoot off faster than a champagne cork at a beach party.

Put your feet up

While some might argue that Crocs (NAS: CROX) are a fashion faux pas, its stock and sales still seem to be headed up. Crocs was hit hard by the 2008 recession and suffered from mounting inventory, but has consistently improved net income for the past four years without incurring any long-term debt.

Management effectiveness is a strong point for this company, defying industry averages with a 17% return on assets, a 23% return on invested capital, and a 25% return on equity for fiscal year 2011. With steadily increasing unit sales, growth potential in Asia, and a growing "comfort" focus that relies less on popularity whims, Crocs might be a fit for more than just your foot.

Beer me

Having reached your destination and traded your loafers for Crocs, it's time to pop open a brewsky. Anheuser-Busch InBev (NYS: BUD) boasts Budweiser, Stella Artois, Corona, and 73 other domestic brands in its corporate cooler. Its newest acquisition of Grupo Modelo bumps InBev's expected sales up to $50 billion and its global presence to 24 countries. With a 16.7% profit margin and an affordable 19.4 P/E ratio (compared to an industry average of 17.9). I'll drink to that.

How much are a thousand words worth?

Vacations don't last forever, but photos do. From the comfort of your home, Shutterfly (NAS: SFLY) helps you and 6 million others preserve life's most memorable moments by organizing, printing, and shipping your photos directly to your doorstep. An on-demand production model keeps Shutterfly debtless, while sales and unit growth continue to steadily increase. With five years of increased sales, a healthy R&D budget, and a new partnership with Hallmark, you might just benefit from some financial exposure to Shutterfly.

Of all the companies listed here, I think Winnebago has the most to offer. It's a time-tested company with level-headed management and a few bright ideas that will transform the way it runs its business. A vertically integrated company (complete with a one-quarter-mile assembly line named "Big Bertha"), Winnebago understands its business model from start to finish and finally has the capital to fine-tune efficiencies. With RV sales up more than 50% in the past two years, Winnebago seems well-poised to rekindle the mobile home mania of yester-year.

The next big adventure

Back at home and back at work, your mind can't help but wander to the only thing that's better than vacation: permanent vacation! For a limited time only, The Motley Fool is offering a special free report outlining exactly what you need to do to make sure your golden years live up to their name. It's as free as this article, so get yours today!

At the time thisarticle was published Fool contributor Justin Loiseau owns none of these stocks, but he wouldn't mind taking aTesla Roadsterfor a spin on his next vacation. You can follow him on Twitter@TMFJLoand on Motley Fool CAPS@TMFJLo.The Motley Fool owns shares of Tesla Motors and Winnebago Industries.Motley Fool newsletter serviceshave recommended buying shares of Tesla Motors. The Motley Fool has adisclosure policy.We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.