An Essential Sector for Every Investor to Own

Characterized by plain Jane necessity products, the sometimes-considered-boring consumer-goods sector begs notice. And rightly so. Consumer spending represents more than two-thirds of U.S. GDP. Investors would be wise to pay attention to this sector, since it bears winners in both good economic times and bad.

The yin and yang of consumer-goods stocks

The two types of consumer-goods stocks are staples and discretionary. Think of them as sisters of the same family who don't share much except common genealogy: the more even-tempered and methodical staples and the more volatile wild child discretionary. Using the MSCI World Sector Weightings as a benchmark, approximately 22% of your total stock portfolio should be allocated to consumer goods. Broken down further, this means 12% of your overall stock portfolio in staples and 10% in discretionary.

We use staples daily and consume them quickly without a second thought. Staples tend to be recession-resistant and more stable over time, relative to other sectors, because people still need cereal and laundry detergent in both good economic times and bad. We buy discretionary products, such as cars and jewelry, less frequently. We're more likely to buy these when we feel richer, typically during robust economic times.

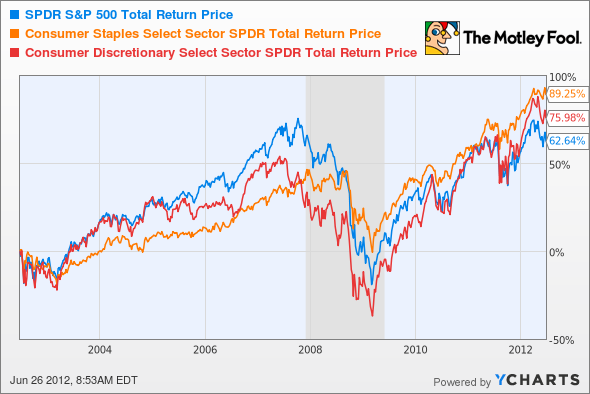

Over long spans of time, staples companies are consistent high performers.

SPY Total Return Price data by YCharts

And even though no sector was safe during the most recent recession, staples held up far better than discretionary and the overall stock market.

SPY Total Return Price data by YCharts

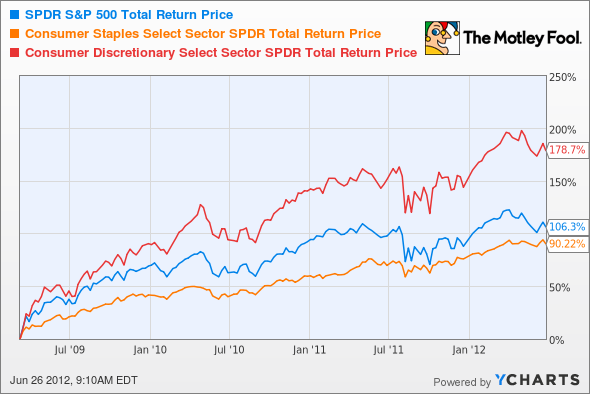

But sales growth for staples companies is tougher to achieve compared with discretionary. Staples' thin margins leave little wiggle room if, say, input costs increase. Discretionary stocks enjoy more upside during a vigorous economy; both sales and profits can quickly ramp up for these companies.

SPY Total Return Price data by YCharts

Playing on the offensive with discretionary stocks may be an appropriate bet if you foresee an extended stock-market rally. But timing the stock market is a losing proposition even if you moonlight at the Psychic Network. Instead, shoot for both defensive staples and offensive discretionary stocks in your portfolio.

Let's take a look at some ideas for both.

Consumer staples

Altria Group (NYS: MO) is the United States' largest tobacco company, with brands including Marlboro and Virginia Slims. Marlboro enjoys a 42% domestic cigarette market share among the approximately 20% of the U.S. adult population that smokes. Altria also has a 28% ownership in SABMiller.

You may think of Altria as a boring, stodgy, and slow-moving stock performer, but it's posted a total return of more than 50% during the past five years. Altria pays a sizable 4.8% dividend yield, has paid a dividend since 1928, and has increased it for the past 42 years consecutively.

Of course, many staples companies carry less litigation risk, namely 126-year-old Coca-Cola (NYS: KO) . Its stable business, iconic brand, solid balance sheet, and 2.7% dividend yield are huge plusses. The world's largest beverage company boasts sales of 26.7 billion cases worldwide, including 15 billion-dollar brands. Coca-Cola also boosted its good-deeds reputation recently by announcing its multimillion-dollar commitment to advancing clean-water access in Africa.

Consumer discretionary

Costco Wholesale (NAS: COST) skirts the line as a retailer in selling both staples and discretionary items. The company also enjoys amazing growth and continued profitability through its membership business model. The company stock posted a 55% total return during the past five years. It boasts low levels of long-term debt and is expected to grow sales 13% annually over the next five years. Sitting down recently with Costco co-founder Jim Sinegal, Motley Fool CEO Tom Gardner gained a bird's-eye view of the company culture and saw how Sinegal believes Costco profits through promotion of its employees.

One stock I'd steer clear of now is door-to-door retailer Avon Products (NYS: AVP) . Even though the company has substantial emerging-market growth potential, its number of independent representatives is declining in every market except Latin America, South Africa, and Turkey. Granted, Latin America is its core market, but with such a big presence there already, it may be hard for the sector to pick up the slack of lost representatives elsewhere. Its profit margins have declined 25% in past two years, and its 5.9% dividend appears unsustainable. The company also faces lawsuits claiming it wasn't acting in shareholders' best interests in its rejection of Coty's takeover bid.

Lighten your load

If you'd like to gain exposure to this space but find it difficult choosing individual companies, then consider exchange-traded funds. ETFs provide broad market exposure that mimic the performance of an index -- like the S&P 500 -- or provide specific exposure to certain sectors.

Consider SPDR Select Sector Fund -- Consumer Staples ETF (NYS: XLP) for the defensive portion of your consumer-goods portfolio and SPDR Select Sector Fund -- Consumer Discretionary ETF for the offensive portion.

Foolish bottom line

If you bet wrong in the stock market, it could cost you. Developing a strategy for adding both consumer staples and discretionary companies to your portfolio will cover all your bases.

If you're looking for more consumer-goods stock ideas, we have one you strongly need to consider. Our analysts have dubbed it both "The Motley Fool's Top Stock for 2012" and "The Costco of Latin America." Not only does this company embody Costco's profitable membership business model, but it also boasts huge emerging-market exposure and tons of growth potential. This stock report won't be available forever, so get your free copy today.

At the time thisarticle was published Fool contributorNicole Seghettiowns shares of Costco. She's been known to scarf down free samples. Follow Nicole on Twitter, @NicoleSeghetti. The Motley Fool owns shares of Costco Wholesale and Coca-Cola.Motley Fool newsletter serviceshave recommended buying shares of Coca-Cola and Costco Wholesale. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.