Will Coca-Cola Stay Fizzy After Its 52-Week High?

Shares of Coca-Cola (NYSE: KO) hit a 52-week high yesterday. Let's take a look at how the company got there to find out whether clear skies remain on the horizon.

How it got here

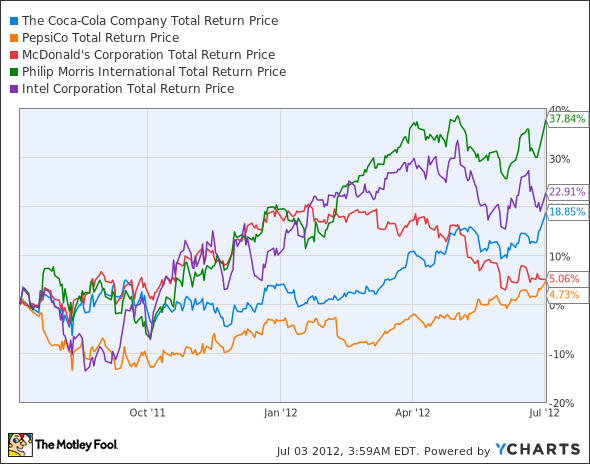

There's something to be said for owning a company so dominant that it could be run by a ham sandwich. That's not a knock on Coca-Cola, which has been a refuge for value-seeking investors throughout the past year. Its 52-week high reflects the appeal of internationally successful brands in strange times as much as it does the company's continued success. In that regard, Coca-Cola has as much in common with fast-food titan McDonald's (NYSE: MCD) and tobacco giant Philip Morris International (NYSE: PM) , as it does with diversified food-and-drink rival PepsiCo (NYSE: PEP) :

KO Total Return Price data by YCharts

As you can see, top brands in many sectors, including Intel, the world's largest chipmaker, have been beneficiaries of the market's preference for established leaders with rather unassailable positions. McDonald's 2012 slide, relative to other leaders, has a great deal to do with its previously high valuation -- a year ago, the company had the highest P/E ratio of the bunch, a distinction now held by Coca-Cola:

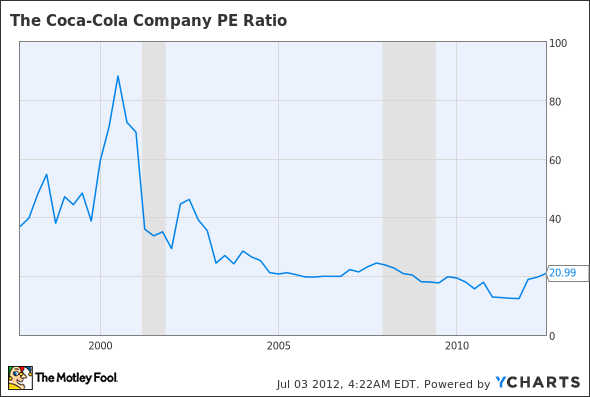

KO P/E Ratio data by YCharts

What you need to know

Is Coca-Cola's high P/E a warning sign or a temporary blip? Let's take a closer look by examining some key metrics for these market leaders:

Company | P/E Ratio | 3-Year Annualized Earnings Growth | Price to Free Cash Flow | Net Margin (TTM) |

|---|---|---|---|---|

Coca-Cola | 21.0 | 8.5% | 27.0 | 18.5% |

PepsiCo | 17.5 | 2.6% | 23.8 | 9.6% |

McDonald's | 16.5 | 7.5% | 20.2 | 20.3% |

Philip Morris | 17.6 | 11.7% | 16.7 | 27.8% |

Intel | 11.3 | 42.0% | 15.1 | 23.2% |

Source: Morningstar.

Coca-Cola also leads this list on a price to free cash flow basis, which can be a more accurate representation of real value. It's not likely to fall apart any time soon, but Foolish analyst Joe Magyer has pointed out that Coca-Cola has not been a consistently great investment over the past 15 years, suffering the same earnings multiple compression that befell many companies after the dotcom bust:

KO P/E Ratio data by YCharts

On this longer timeline, Coca-Cola looks cheap, but there's also something to be said for the irrational exuberance that pushed its valuation to such heights in the first place. With the exception of Intel's post-recession (both of them) valuation highs, none of its market-leading peers have fallen quite so far.

These five companies have all been tremendously successful with international expansion -- Philip Morris to such a degree that its former parent spun it off to focus on those markets. Coca-Cola is a truly international company, with less than a third of its earnings in North America. Much of its continued growth will now depend on new products and increased consumption overseas, with an emphasis on the latter. Investors looking for long-term growth will have to bank on continued strength in both areas to justify investing in the company now.

Coca-Cola's most recent earnings report offered a sign of that strength, as international sales improved 9%. The company's next report is scheduled for July 17, and another strong showing in the midst of a grinding global economic slowdown would likely cement its position as a top defensive pick for the rest of the year, regardless of current valuation.

What's next?

Where does Coca-Cola go from here? That will depend on its second quarter. As long as the company maintains its consistent growth, Foolish investors everywhere will keep calling it one of the market's best stocksfor the long haul. The Motley Fool's CAPS community has given Coca-Cola a five-star rating, with 95% of our CAPS players expecting the stock to continue its 52-week trend.

Interested in tracking this stock as it continues on its path? Add Coca-Cola to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens. Want to find out more about Coca-Cola's long-term value? For that information and to discover the names of two other dividend stalwarts you should buy to beat any market, claim your copy of The Motley Fool's latest free report: "The Three Dow Stocks Dividend Investors Need."