Is Atmel Ready to Run From Its 52-Week Low?

Shares of Atmel (NAS: ATML) hit another 52-week low yesterday. Let's take a look at how the company got there to find out whether cloudy skies remain on the horizon.

How it got here

Investors seem to have abandoned ship in the wake of disappointing Android tablet launches. The company's been sliding for over a year, after early ebullience over the company's role in non-Apple mobile devices gave way to the grim realities of Apple dominance. On the plus side, Atmel's at least remained in positive territory for the past half-decade, something fellow non-Apple, mobile-chip players Cypress Semiconductor (NYS: CY) and NVIDIA (NAS: NVDA) wish they could claim:

ATML Total Return Price data by YCharts

Those meager (at the moment) gains could evaporate if a possible supply partnership with Amazon.com for the next Kindle Fire doesn't result in big sales. This is also a worry for NVIDIA, which may supply the processing power. All of this is just speculation at the moment, and there's no guarantee that another Kindle Fire will be anyone's salvation, even Amazon's.

What you need to know

Atmel has a lower valuation than many peers, but that favorable comparison breaks down a bit when you look at its competitors' price to free cash flow ratios:

Company | P/E Ratio | Price to Free Cash Flow | Net Margin (TTM) |

|---|---|---|---|

Atmel | 11.0 | 19.6 | 15.4% |

Cypress Semiconductor | 24.1 | 9.8 | 9.8% |

NVIDIA | 15.4 | 13.4 | 12.8% |

Texas Instruments (NYS: TXN) | 17.1 | 12.5 | 13.6% |

Source: Morningstar.

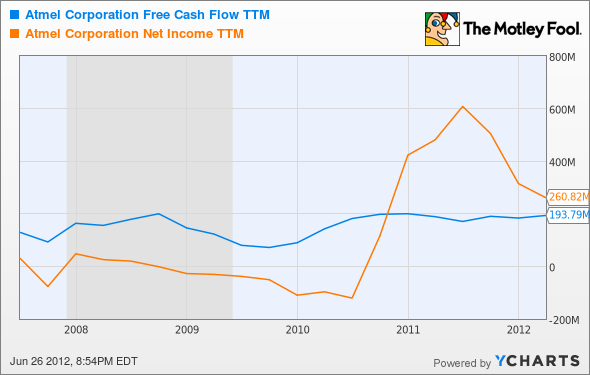

Despite a higher net profit margin, Atmel's generating less free cash flow, relative to its market cap, than other semiconductor companies. Its free cash flow, like its profitability, has wavered quite a bit over time -- but the former has been more consistent than the latter:

ATML Free Cash Flow TTM data by YCharts

A big role in a major piece of mobile hardware, like the next Kindle Fire, could turn both of those metrics up again, offering Atmel a bigger short-term boost than it might for Texas Instruments, which is about 10 times larger. New Windows 8 tablets and smartphones might also be a worthwhile pursuit for any of these chipmakers. Gartner expects Windows tablets to grab 12% of the overall tablet market by 2016 -- which still leaves Apple with the lion's share.

Gartner also expects Android tabs to boost their share to 37% of that future pie, which will be nearly four times as large as today's market of 118.9 million shipped tablets. Today's low might be an attractive price for Atmel, assuming it can establish a stronger foothold before the market really takes off.

What's next?

Where does Atmel go from here? That will depend on its role in the mobile market, as dominant touchscreen player or also-ran. The Motley Fool's CAPS community thinks Atmel has a bright future ahead, offering the company a four-star rating, with only 8% of active players expecting the stock to continue its 52-week trend lower.

At this depth, I'd be hard-pressed to disagree, as simply maintaining position while the mobile market grows ought to bring years of increased earnings. I've also recently noted the company's development of flexible touch sensors, which could be a big trend in computing in the years to come. I'll be making an outperform CAPSCall today to back that prediction.

While Atmel appears to offer some upside to investors at its rock-bottom valuation, we think another component play holds much greater promise for investors. To find out which stock we're talking about, check out The Motley Fool's free report, "The Next Trillion-Dollar Revolution." It has everything you need to know about one company making all the right moves in all the right computing trends. Click here now for your free information.

The article Is Atmel Ready to Run From Its 52-Week Low? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Amazon.com and Apple. Motley Fool newsletter services have recommended buying shares of Amazon.com, NVIDIA, Apple, and Cypress Semiconductor. Motley Fool newsletter services have also recommended creating a bull call spread position in Apple and writing puts on NVIDIA. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.