Chesapeake: From Bad to Worse to Potentially Criminal

If you thought the wheels were coming off at Chesapeake Energy (NYS: CHK) before, you had better take this news sitting down. A special investigation by Reuters has uncovered dozens of emails that point to illegal collusion between Chesapeake and Encana (NYS: ECA) to hold down the prices of land of shale-rich plays in Michigan in 2010.

Something fishy here

Imagine this: In May of 2010, the Michigan Department of Natural Resources held land auctions that drew particular interest from natural gas companies hoping to frack the state's Collingwood shale. The auction of 118,000 acres brought in a whopping $178 million for the state. A full 83% of bids had competitive offers, and Chesapeake and Encana combined to contribute 93% of the sales to the state.

Just five months later, Michigan held a similar land auction. This time, more than twice as many acres were up for sale. The result? The state brought in a paltry $9.7 million.

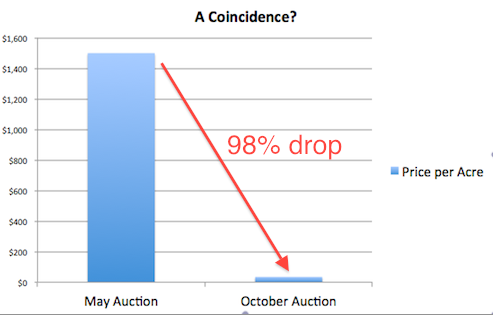

Whereas land went for about $1,500 per acre in May, it sold for just $35 per acre in October. It probably didn't help that natural gas prices had fallen 20% in the interim, but that hardly explains the full extent of a 98% drop in land price.

Source: Reuters.

Even before the October auction, a contractor hired by Chesapeake to bid for land noted that both companies had cut their maximum per acre bids by 50%. This led the contractor to question the company if this was just a "coincidence."

A smoking peace pipe

Though the contractor never got an official answer to his question, emails reveal that it may not have been a coincidence at all. As Reuters reported, Chesapeake CEO Aubrey McClendon sent a number of potentially damning emails after the expensive May auction:

In one email, dated June 16, 2010, McClendon told a Chesapeake deputy that it was time "to smoke a peace pipe" with Encana "if we are bidding each other up." The Chesapeake vice president responded that he had contacted Encana "to discuss how they want to handle the entities we are both working to avoid us bidding each other up in the interim." McClendon replied: "Thanks."

Colluding with a competitor to hold prices down for land would be in direct violation of the Sherman Antitrust Act and carry stiff penalties. Companies could be fined up to $100 million -- and individuals $1 million -- for each offense. Additionally, victims of the rigging can receive up to triple what they missed out on.

Though it is common practice to have joint ventures and area-of-mutual interest agreements between competing companies, it does not appear that either one of these mechanisms was in place during the October bidding.

Instead, it seems that the companies divvied up counties to lower competition. Emails reveal that the two companies evenly divided bidding in certain counties. In the end, neither company abided by the agreement 100%, but neither company bought land in the same county as the other.

What this means for investors

It could take months or years for this to play out in court, but the markets need not wait to factor in such risks. Chesapeake has already been plagued by bad behavior from McClendon, ranging from leveraged bets that exposed him to conflicts of interest to running a secret hedge fund with current SandRidge Energy (NYS: SD) CEO Tom Ward.

I wouldn't be surprised to see McClendon shown the door soon at Chesapeake. For Encana, one of Canada's largest natural gas companies, it's more difficult to see how things will play out. The stocks of both companies are down significantly on the news this morning.

If you're looking for a way to gain safe exposure to the energy industry without all the drama, our analyst have found the only energy stock you'll ever need. Inside this special free report, you'll get the name and ticker behind this under appreciated and cheap stock that has exposure to both oil and natural gas. Get the report today, absolutely free!

The article Chesapeake: From Bad to Worse to Potentially Criminal originally appeared on Fool.com.

Fool contributor Brian Stoffel does not own shares in any of the companies mentioned. You can follow him on Twitter, where he goes by TMFStoffel.The Motley Fool owns shares of Chesapeake Energy. Motley Fool newsletter services have recommended buying shares of Chesapeake Energy. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.