Why NetSuite Could Go Even Higher

Shares of NetSuite (NYS: N) hit a 52-week high this week. Let's look at how it got here and see whether clear skies are ahead.

How it got here

NetSuite is a cloud enterprise software provider and has the backing of one the guys who knows enterprise software best: Oracle's (NAS: ORCL) Larry Ellison. The company was started by former Oracle execs, and Ellison has a big personal stake.

The past few quarters have received mixed reactions. Fourth-quarter results marched ahead of analyst estimates, with CEO Zach Nelson noting that the company's cloud-based offerings continue to grow share at the expense of traditional providers. First-quarter figures, meanwhile, may have rattled investors with decelerating billings growth, overshadowing the results that again came in on top of expectations.

NetSuite still isn't profitable yet, but it continues to put up strong top-line growth, and the gross margin ticked up by 2% last year to 70%. Heavy spending on sales and marketing is what's holding back the bottom line, but operating cash flow nearly doubled.

Investors have mostly shaken off the deceleration concerns, and shares have now climbed to new heights.

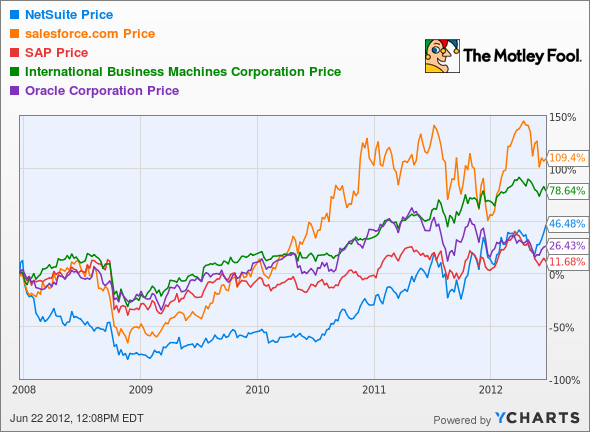

How it stacks up

Let's see how NetSuite stacks up with other enterprise-software companies.

And let's see how it compares on some fundamental metrics.

Company | P/S (TTM) | Sales Growth (MRQ) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

NetSuite | 14.3 | 29.7% | (12.7%) | (26.1%) |

salesforce.com (NYS: CRM) | 7.5 | 37.9% | (1.3%) | (2.1%) |

SAP (NYS: SAP) | 4 | 10.8 | 23.9% | 30.1% |

IBM (NYS: IBM) | 2.1 | 0.3% | 15% | 74% |

Oracle | 3.7 | 1.3% | 26.9% | 23.8% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

NetSuite is much smaller than these peers, and its growth prospects are fetching it a higher valuation. salesforce.com was also started by a former Oracle exec and similarly uses a cloud-based approach. Larger companies IBM and SAP are more mature and are solidly profitable.

What's next?

NetSuite's cloud-based approach appears set to continue disrupting the traditional enterprise-software scene. I think it will continue higher still, so I'm going to go ahead and also give it an outperform CAPScall today.

The next big thing in enterprise software will be all about tapping Big Data. Grab this special free report to learn about one company set to profit from the new technology revolution. It's totally free.

The article Why NetSuite Could Go Even Higher originally appeared on Fool.com.

Fool contributorEvan Niuholds no position in any company mentioned. Check out hisholdings and a short bio. The Motley Fool owns shares of IBM, Oracle, and salesforce.com.Motley Fool newsletter serviceshave recommended buying shares of Netsuite and salesforce.com, creating a synthetic long position in IBM, and creating a bear put spread position in salesforce.com. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.