Motley Fool Congressional Testimony on IPOs

This week, Senate Banking Subcommittee on Securities, Insurance, and Investment Chairman Jack Reed (D-R.I.) held a hearing called "Examining the IPO Process: Is it Working for Ordinary Investors" to raise questions about Facebook's controversial IPO and the JOBS Act's changes to the IPO process. What follows is the official written testimony The Motley Fool submitted to the subcommittee. You can view the full hearing on C-SPAN here. Post a comment in the comments section below to let us hear your thoughts on this issue.

Testimony from Ilan Moscovitz, senior analyst, The Motley Fool. Before the U.S. Senate Banking Subcommittee on Securities, Insurance, and Investment, June 20, 2012

Mr. Chairman and members of the Committee:

I want to thank you for the opportunity to offer testimony and recommendations today.

My name is Ilan Moscovitz, senior analyst for The Motley Fool.

Founded in 1993, The Motley Fool's purpose is to help the world invest better. To that end, we have created the world's largest investment community for individual investors to learn, share, and grow together.

Millions of investors rely on The Motley Fool not only for guidance on how to manage their money, but also as an advocate for their rights as shareholders. For years we have worked to create a level playing field in the market. It's for this reason that we are eager and grateful to discuss whether the IPO process is working for ordinary investors.

* * * * * * * * * *

It goes without saying that IPOs are critical to both developing public markets and helping businesses raise the capital they need to grow and hire.

Public markets give ordinary investors the opportunity to participate in the growth and success of companies. They also increase transparency and accountability, making our economy more efficient and competitive.

However, in a world of finite capital, we need to recognize that there are good IPOs, and there are bad IPOs. On the one hand you have Apple, Microsoft, and Starbucks, all of which went on to successfully innovate their industries as public companies. And on the other, you have Pets.com, a retailer with an unproven business model that was losing money on every sale, and which filed for bankruptcy less than a year after going public, taking with it the $82 million that it raised from public investors. Needless to say, a properly functioning market gives capital to good companies and not bad ones.

The quality of IPOs is just as important as their quantity.

* * * * * * * * * *

From our vantage point as retail investors, the overarching problem with IPOs is that there is an imbalance of both information and access. Although issuers and venture capitalists ultimately depend on us for capital and liquidity, the deck is stacked against us in at least two major ways.

First, insiders, underwriters, and their favored clients have access to more and better information than do ordinary investors. This gives them an unfair advantage over us in estimating a company's fair value. Reports of Facebook's (NAS: FB) recent IPO provide a prominent example of this, and improved efficiency in IPO pricing when information is freely available provides a statistical illustration of the problem.

Second, there's unequal access to shares. The initial offering is traditionally limited to preferred clients of underwriters. By the time we can buy shares, there's already been a significant markup. It's estimated that from 1990 to 2009, that markup averaged 22%, totaling $124 billion.

In addition to these two problems, the fact that IPOs are weighted against individual investors needlessly diminishes confidence in our markets.

Consider the chart below. After a period of artificially inflated volume of IPOs in the mid-to-late 1990s, filings dropped by 75% from 2000-2001 once retail investors lost confidence in the quality of companies coming public.

Fast-forward to today, and we're on track to have the fewest number of June IPO filings since 2003 (excluding the financial crisis) in the aftermath of Groupon's (NAS: GRPN) questionable accounting and reports that Facebook's underwriters disclosed material information to favored clients and not to the rest of us.

As a side note, it's worth pointing out that the number of IPO filings had doubled after the global settlement and passage of Sarbanes-Oxley addressed some of the worst abuses of the dot-com bubble and ensuing years.

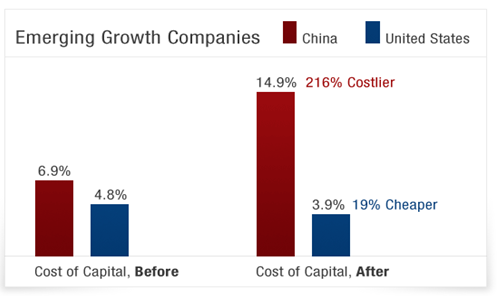

Unfortunately, the recently passed JOBS Act undoes many of these reforms for most companies coming public, and provisions that weaken reporting requirements will result in less information reaching investors. The dramatic collapse of confidence in Chinese emerging-growth companies in 2010 that followed reports of accounting problems is another recent example of how reducing the quality of reporting can ruin investors' faith in all emerging growth companies. In just one year, shares of 93% of Chinese emerging-growth companies fell, cutting the average market value of Chinese emerging-growth companies in half, costing public investors $11 billion, and harming the ability of any good emerging-growth companies to raise capital.

This isn't to suggest that weakening the quality of American accounting to be more closely aligned with China's will necessarily cause an equivalent increase in the cost of capital for American EGCs, but it's not the direction we want to move in.

* * * * * * * * * *

To remedy these problems, our objective should be to level the playing field and preempt such crises of legitimacy by maximizing transparency and useful disclosure in the marketplace.

Here are three recommendations:

Extend the application and enforcement of Regulation Fair Disclosure to the beginning of the IPO process. This will help to improve the flow of information to all investors and reduce one of the most preventable information asymmetries -- between underwriters and their favored clients, and ordinary investors.

Second, require that companies and underwriters allocate shares in the initial offering in a more inclusive and efficient manner. Over the past decade, companies like Google (NAS: GOOG) , Morningstar, and Interactive Brokers have successfully employed a Dutch auction process, which gives all investors the opportunity to buy shares at the same price, under an equitable plan of distribution. An ancillary benefit is to lower the cost of going public for companies by more than half.

Finally, fix the most troubling portions of the JOBS Act from the retail investor's perspective. While there are a number of improvements that could be made, if you're looking for the most straightforward remedies, one would be to decrease the size threshold in the emerging-growth company definition, as the chairman has previously recommended, to increase the amount of information available to investors. After all, the current definition encompasses virtually all IPOs, and companies larger than, say, $350 million in gross revenues really are large enough to provide three years of audited financial statements.

A second remedy would be to implement a lockup period covering pre-IPO insiders in emerging-growth companies. The period should include the offering and extend for at least 180 days after an issuer is subject to normal reporting requirements, which has been common practice prior to passage of the JOBS Act. This will better align the incentives of insiders and ordinary investors. It will also help to ensure that any capital raised via the emerging-growth-company exemption serves its intended purpose by flowing to the company and not to insiders exiting on the IPO onramp.

* * * * * * * * * *

As the IPO process currently stands, ordinary investors have unequal access to information and unequal access to the market. We are asking for a level playing field, disclosure, and transparency. We believe the lack of these qualities is what's most troubling about the IPO process right now.

I appreciate the opportunity to submit testimony on how IPOs affect ordinary investors and would be happy to answer any questions.

Signed,

Ilan Moscovitz

The article Motley Fool Congressional Testimony on IPOs originally appeared on Fool.com.

Ilan Moscovitzowns shares of Apple and Google. The Motley Fool owns shares of Facebook, Starbucks, Google, and Apple. Motley Fool newsletter services have recommended buying shares of Google, Interactive Brokers Group, Starbucks, Morningstar, and Apple. Motley Fool newsletter services have recommended writing covered calls on Starbucks. Motley Fool newsletter services have recommended creating a bull call spread position in Apple. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.