Is This the World That Microsoft Wants?

Microsoft's (NAS: MSFT) Surface tablet announcement earlier this week has got me thinking, despite my wife's warnings that I might hurt myself doing so. I called the move "one of the biggest strategic shifts for Microsoft since its inception nearly 40 years ago in 1975."

The magnitude of that shift remains to be seen, but let's play a game of pure speculation. Microsoft's jump into hardware warrants, at the very least, entertaining the idea of it shifting toward the integrated approach that Apple (NAS: AAPL) has ridden to success, despite the fact that it's not likely to ever go all the way with it.

In recent months, we've Foolishly pondered, "Where would we be without Apple?" and "Where would Apple be without the iPhone and iPad?" Here's another alternate reality to contemplate: What if Microsoft really does want to be the next Apple?

A galaxy far, far away

Let's say decades down the road, Microsoft has fully embraced a fully integrated approach, bundling its hardware, software, and service into one package. What would that world look like?

With Windows claiming nearly 90% operating system market share, according to StatCounter, that's a lot of devices to build for the world. In the most extreme scenario (remember, this is just a game), all of the Samsungs, Asuses, Acers, Dells (NAS: DELL) , and Hewlett-Packards (NYS: HPQ) of our fantasy world would lose out if Microsoft cut them out of the loop and transitioned to a fully integrated model and became the only company building Windows PCs.

Hardware OEMs would have nowhere left to go without the software to breathe life into their devices. These companies stand to lose the most if Microsoft goes all-out integrated.

Two can play

It's almost certain that Google (NAS: GOOG) is contemplating integrated Android devices. Let's say that Google similarly decides to make the plunge entirely into integrated devices and cuts out its hardware OEMs in favor of offering a complete package.

It could very well do better in the tablet market than it is right now, but then again that's not saying much considering its poor performance thus far.

It's nearly unfathomable to imagine a world where Microsoft, Google, and Apple all create entirely integrated devices, but with Microsoft and Google now looking to cross that bridge to an unknown extent, one can't help but wonder.

Wake up

Let's get back to reality. This scenario assuredly will never come to pass. Even logistically, the global PC market in the first quarter this year was nearly 89 million units. A 90% share is roughly 80 million PCs per quarter to make, an insurmountable task for one company.

Additionally, the whole reason why Android and Windows claim such huge market shares in the first place is because of their open nature and the wide array of choices it entails. That open approach leads to hardware commoditization, driving down prices, and boosting market share.

Open vs. integrated

It's also worth looking at the different incentive structures inherent with the different approaches.

Under the open model, the hardware maker looks to battle commoditization through perceived differentiation while relying on the initial sale to earn its slim margin. This creates motivation to cut corners and reduce costs in the name of margin expansion, resulting in poorer build quality, and is a detriment to the consumer. The software maker looks for scale so it can sell as many copies as possible, spreading out the development costs over a wider base, boosting margins. These players are incentivized to partner with as many hardware companies as possible, intensifying commoditization pressure and the trend toward lower quality hardware. Service and content providers look to sell high-margin content and add value to the device that's already been sold.

With an integrated model, one company tries to do all of these things. The software becomes a key differentiator for the hardware to fend off commoditization (great industrial design doesn't hurt either). Charging next to nothing extra for the software allows it to be scalable since everyone will use it, and content and services boost the value of the end product.

In this case, the single company's profits may be more than the sum of the parts of its open rivals. Apple has always grabbed much more profit share than it does market share. The net result is that Apple is able to charge premiums for its overall package, while only incurring various corporate operating expenses like sales, marketing, and R&D, among others, just once; these costs are incurred numerous times in the value chain under the open model.

A tale of three charts

Apple's gross margin is squarely in the middle of software companies like Microsoft and hardware companies like HP and Dell, while below services providers like Google.

AAPL Gross Profit Margin data by YCharts

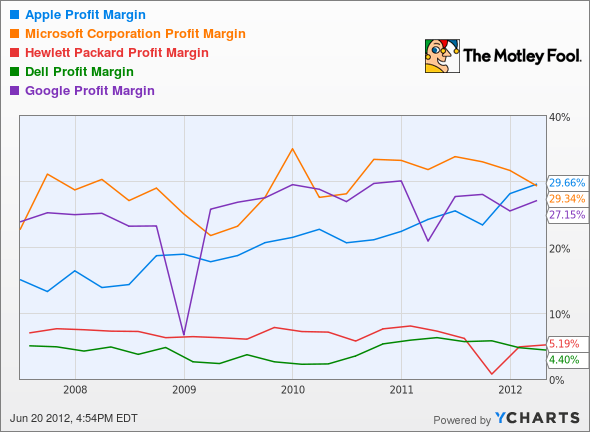

However, by the time you get to the bottom line, Apple's net margin has recently squeezed ahead of Microsoft and now tops all of these players.

AAPL Profit Margin data by YCharts

This is how it looks in dollar terms.

AAPL Net Income data by YCharts

The father of disruption theory and author of The Innovator's Dilemma, Clayton Christensen, recently expressed his concerns about Apple: "The transition from proprietary architecture to open, modular architecture just happens over and over again." There's absolutely historical precedent and reason to question Apple's integrated approach. Although one might argue that no one has ever built as large of a proprietary ecosystem as Apple has successfully done, so it could be different this time around.

If you ask Microsoft and Google, it looks like they're starting to recognize the advantages of integration.

Apple's success with integration has made it the biggest tech company in the world, so does that mean you should buy or sell Apple today? We've laid it all out for you in a brand new report that has the answer to that $500 billion question. Or to learn about another tech revolution, you can check out our research report detailing another technology revolution you might not even know about.

The article Is This the World That Microsoft Wants? originally appeared on Fool.com.

Fool contributorEvan Niuowns shares of Apple, but he holds no other position in any company mentioned.Click hereto see his holdings and a short bio. The Motley Fool owns shares of Microsoft. The Fool owns shares of Apple. The Fool owns shares of Google.Motley Fool newsletter serviceshave recommended buying shares of Microsoft, Apple, and Google. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.