How High Can Boston Beer Fly?

Shares of Boston Beer (NYS: SAM) hit a 52-week high yesterday. Let's look at how it got here and whether clear skies are ahead.

How it got here

The craft brewing business is firing on all cylinders and Boston Beer is capitalizing from the trend. The company is now hitting new highs on the back of three straight earnings reports that topped expectations, the most recent which blew it out of the park.

In the first quarter, revenue rose 11% to $113.3 million and net income more than doubled to $7.5 million, or $0.56 per share. That crushed estimates by 37% in Boston Beer's typically slow season.

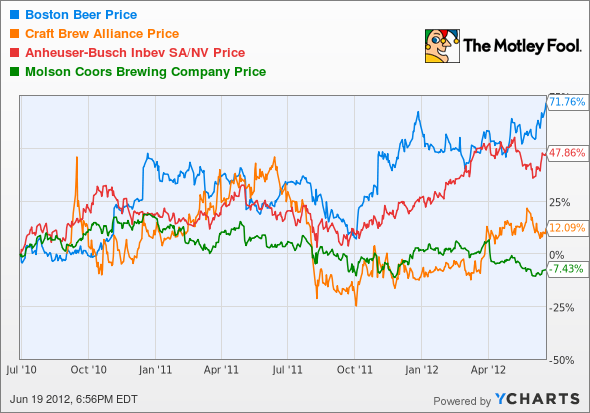

The trend toward craft beers has been going on for years and Boston Beer has been at the forefront. While Anheuser-Busch InBev (NYS: BUD) , Molson Coors (NYS: TAP) , and Craft Brew Alliance (NAS: BREW) have been acquiring and merging with brewers both large and small, Boston Beer has slowly been grabbing a share.

Boston Beer's stock definitely commands a premium over competitors. High return on assets, strong growth, and a solid profit margin show why this company can trade higher than peers and still outperform long term.

Price/Sales | Profit Margin | Return on Assets | Quarterly Revenue Growth | Forward P/E | |

|---|---|---|---|---|---|

Boston Beer | 2.8 | 13.3% | 20.6% | 10.9% | 24.1 |

Anheuser-Busch InBev | 2.9 | 16.7% | N/A | 3.7% | 14.1 |

Craft Brew Alliance | 0.9 | 6.7% | 2.7% | 19.2% | 22.4 |

Molson Coors | 2.0 | 19.1% | 2.2% | 0.1% | 10.4 |

Source: Yahoo! Finance.

What Boston Beer will need to do is continue the solid growth, something that won't be easy with local craft brewers popping up every day.

What's next?

I think Boston Beer's stock will continue to command a premium and will continue to move higher on the back of a general move toward craft beers. What concerns me is the amount of value that investors are currently getting from the stock. A 24.1 P/E ratio on 2013 earnings is very expensive, and it will require the company to continue to exceed expectations to make it worth it. I would prefer to buy on a pullback closer to $105 per share to give some room for error.

The CAPS community thinks this stock is a great buy, handing out the rare five-star rating. Of the players rating the stock, 1,490 call it as outperform versus just 59 underperform calls. I agree that the stock can outperform, I'd just like to buy a little lower than a new 52-week high in case the economy tanks again.

Interested in reading more about Boston Beer? Click here to add it to My Watchlist, and My Watchlist will find all of our Foolish analysis on this stock.

The article How High Can Boston Beer Fly? originally appeared on Fool.com.

Fool contributorTravis Hoiumloves beer but he doesn't have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.The Motley Fool owns shares of Boston Beer.Motley Fool newsletter serviceshave recommended buying shares of Molson Coors Brewing Company and Boston Beer. The Motley Fool has adisclosure policy.

We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.