Is It Time to Buy These 3 Stocks?

"To everything there is a season and a time to every purpose under the Sun," begins a song made famous in 1965 by The Byrds and entitled "Turn, Turn, Turn." And so it is with investing.

We recently learned that the U.S. economy is slowing again, GDP growth was revised downward from 2.2% to 1.9% in late May, and the U.S. Department of Labor reported a third straight month of dismal jobs growth. Europe is in the midst of a recession brought on by sovereign debt crisis, and China's economic growth is also slowing, further heightening the possibility of trouble ahead for U.S. markets.

It is now more important than ever before to weigh your investment decisions against several factors, including (but not limited to) the type of company; the products or services it makes or sells; the sector; the timing of the investment; and the company's earnings quality.

The world's economic slump has caused commodity prices to abate, including that of oil. Patient investors should consider adding energy sector companies to their portfolios, because they will be able to pick up some quality stocks at hefty discounts. As we all know, oil makes the world "turn, turn, turn."

Murphy Oil (NYS: MUR) is an oil and natural gas exploration and production company that drills crude oil and refines it into petroleum products such as gasoline and distillates. It then markets and transports these products worldwide.

Murphy is ranked an "A" for earnings quality in The Motley Fool's EQ Score database and has been atop the charts since the first of the year. Murphy's income statement shows revenue for that last quarter rising 11.57% year over year. Net income and earnings per share for the past quarter are almost double what they were two years ago at $290 million and $1.49, respectively.

Murphy's cost of goods sold is understandably high at 86% of revenue. However, inventory (oil and natural gas) value as a percentage of revenue has fallen from 14% to 9% since 2010, due to the rise in the price per barrel of oil. Also, the company has seen a steady decline in its inventory ratio of finished goods to raw materials, and the inventory is moving to consumers faster. Days in inventory dropped from 15 days to 10 days over the last two years. Strong operating and free cash flows have helped Murphy reduce its long-term debt considerably over the last two years.

Murphy's stock price has fallen from $58.11 to $45 most recently. This is less than its tangible book value per share of $46.74. With a P/E of less than 10 and a dividend yield of 2.4% ($1.10 per share), this stock is a compelling long-term buy -- even if the price of oil continues to decline.

Source: YCharts.

San Antonio-based Valero Energy (NYS: VLO) is another highly ranked energy company (EQ Score of "A"), with a tangible book value of $28.45 -- $6.30 higher than its recent stock price. This means you are buying Valero's assets at a discount. Revenue has nearly doubled since 2010 to $34.933 billion, though much of this goes back into the business of refining oil for consumption. Cash flows are positive, but cash margins are not as strong as with Murphy, so debt is not being paid down as quickly. Inventories are rising, but inventory is turned every 16 days, down from 24 days two years ago. Accounts receivable has doubled to nearly $8 billion, but collections -- days sales outstanding -- are only 14 days.

Source: YCharts.

Since January, Valero's stock has risen from $20.96 to $22.15, but it has been as high as $28.56. As with Murphy, Valero's P/E is a low 7.83, and the company pays a $0.60 dividend (2.9%).

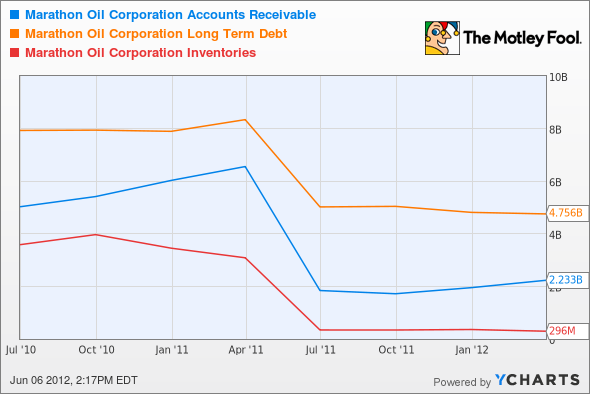

Another "A"-rated, Texas-based energy company is Marathon Oil (NYS: MRO) , and again the tangible book value is $24.07 a share, or slightly below its current price of $24.70. Marathon is a play on North American oil and natural gas production due to the location of a majority of its reserves and growth assets. Marathon is extracting oil from oil sands deposits in Alberta, Canada. Marathon has much lower cost of sales than either Murphy or Valero, which creates higher operating and profit margins. Notably, it had an average operating cash-flow margin of 36% during the year. Accounts receivable, long-term debt, and inventories are all way down from prior years' levels. In addition, inventory is moving much faster at 18 days.

Source: YCharts.

Marathon's stock has fallen since January from $30.96 to $24.70 currently. The P/E is a low 7.46, and Marathon pays a $0.68 dividend (2.8%).

Foolish Takeaway

Oil prices have fallen significantly during the last six months, and they may fall further in the short term. However, the time to add quality energy stocks could be now. Foolish readers should always make their investment decisions based on earnings quality.

To stay current on whether Murphy Oil's earnings meet or beat expectations, be sure to add it, or any of the other companies mentioned here, to My Watchlist -- a totally free service offered by The Fool that keeps you current on your favorite stocks. Get started with the links below.

Add Murphy Oil to My Watchlist

Add Valero Energy to My Watch List

Add Marathon Oil to My Watch List

At the time thisarticle was published Fool contributorJohn Del Vecchiois Co-Advisor to Motley Fool Alpha and co-manager of the Active Bear ETF (HDGE). You may follow him on Twitter @johnfdelvecchio. He does not own any shares in the companies mentioned in this article. The Motley Fool The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.