Cirrus Logic Hits a 52-Week High: The Sweet Sound of Gains

Shares of Cirrus Logic (NAS: CRUS) hit a 52-week high on Monday. Let's look at how it got here and see whether clear skies are ahead.

How it got here

The audio codec specialist is perhaps best known for its lucrative relationship with Apple (NAS: AAPL) , and has thoroughly ridden Cupertino's coattails to riches. The company jumped to highs about two months ago following Apple's most recent blowout quarter and its own earnings release.

Shares saw some healthy upside on Monday, gaining 5.7%. There are a couple of possible reasons for the jump, including some reinvigorated analyst bullishness on the Mac maker, as Topeka Capital's Brian White was out touting Apple's prospects, saying the company should be measured in "trillions" instead of billions. If Apple crosses the trillion-dollar market-cap threshold, Cirrus would be a clear beneficiary as well.

The broader semiconductor market is also seeing some recovery, with the Semiconductor Industry Association, or SIA, recently saying that global semi sales in April rose 3.4% sequentially to $24.1 billion, the largest gain in the industry since May 2010 on a sequential basis. In dollar terms, the market remains lower than a year ago, but the growth figures are leading to an overall outlook of "cautious optimism," according to SIA CEO Brian Toohey.

How it stacks up

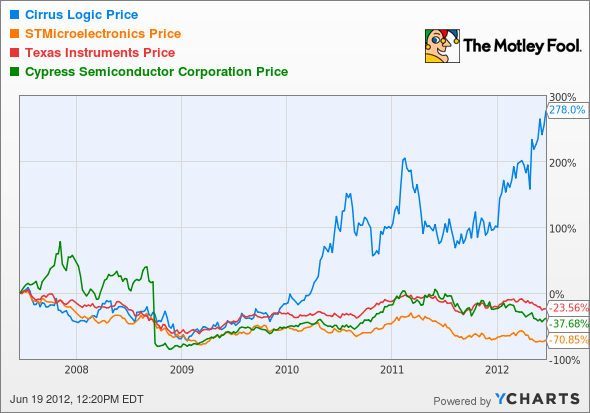

Let's see how Cirrus stacks up with some of its semiconductor peers.

We'll throw in some fundamentals metrics for comparison.

Company | P/E (TTM) | Sales Growth (MRQ) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

Cirrus Logic | 23.6 | 21% | 20.6% | 19.5% |

STMicroelectronics (NYS: STM) | 7.7 | (20.4%) | 0.6% | 8% |

Texas Instruments (NAS: TXN) | 18.1 | (8%) | 13.6% | 16.7% |

Cypress Semiconductor (NYS: CY) | 28.3 | (20.6%) | 9.8% | 21.2% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

All of these companies are actually Apple suppliers in some form or fashion. STMicroelectronics has long provided the gyroscope and three-axis accelerometer in iPhones, just as TI has always provided the touchscreen controller. Cypress Semiconductor's touchscreen controllers are found in some iPods and MacBook trackpads.

Obviously, some spots are ore lucrative than others, as Cirrus has vastly outperformed the others, thanks to its dedication to Cupertino and the expansion of its relationship.

What's next?

Cirrus should continue to ride Apple's success for the foreseeable future, as iPhone and iPad sales continue to take off.

Add these companies to your Watchlist to get the latest news and analysis.

Add Cirrus Logic to My Watchlist.

Add Apple to My Watchlist.

Add Texas Instruments to My Watchlist.

Add STMicroelectronics to My Watchlist.

Add Cypress Semiconductor to My Watchlist.

At the time thisarticle was published Fool contributorEvan Niuowns shares of Apple, but he holds no other position in any company mentioned. Check out hisholdings and a short bio. The Motley Fool owns shares of Cirrus Logic and Apple.Motley Fool newsletter serviceshave recommended buying shares of Cypress Semiconductor and Apple and creating a bull call spread position in Apple. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.