4 Indestructible Dividends You Can Buy Today

Take your pick of words that are scaring markets: Greece, Italy, Spain, Syriza, New Democracy, (no) QE3, Facebook, China. With fear meters buzzing, converting to cash seems like a good plan, but you may also be scared of having inflation eat away at your savings. Where to invest at a time like this? Let's look at some stocks that performed admirably in the last financial crisis, pay out a good dividend, and have positive future prospects.

A fear-proof portfolio

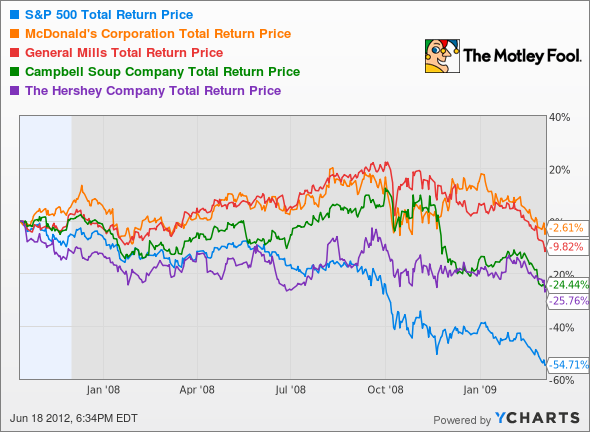

One thing you'll notice about this batch of companies is that they all provide food -- something that's needed no matter what governments, currency unions, central banks, or business cycles do. Whether you'll be sailing on your yacht enjoying the spoils of a new business deal and eating caviar, or hunkering down in your bunker eating soup and waiting until the zombies pass by, either way you'll still be eating. And as such, this set of stocks performed relatively admirably in the last recession:

From the high of the S&P 500 in October 2007 to its low in March 2009, the index lost more than half of its value. On the other hand, the worst loss among this basket of stocks was half that. Let's review each pick.

Heart healthy, portfolio healthy

Brand value? General Mills (NYS: GIS) has it, with Cheerios, Wheaties, Chex, Haagen-Dazs, and Green Giant just a sampling of its brands. The company has also moved into the lucrative organic and natural foods market, with the purchase of Food Should Taste Good earlier this year adding to its Muir Glen and Cascadian Farm brands that it purchased in 2000. This gives shareholders a piece of the market that Hain Celestial (NAS: HAIN) occupies, but it offers a much cheaper P/E ratio of 16.5, compared with Hain's 36. General Mills also brings in a higher profit margin, at 11% for 2011 compared with Hain's 5%.

General Mills continues to look abroad, hoping to add to the 20% of sales that come from outside the U.S. with a newly acquired Brazilian food maker. The company pays a dividend yielding 3.2%, and with a payout ratio of 51%, that dividend is easily sustainable.

Special sauce

McDonald's (NYS: MCD) continues to reinvent itself with a new menu items like an oatmeal breakfast, demonstrating it can satisfy its regular burger crowd and bring on healthy new options to take advantage of new consumer tastes. The company posted a same-store sales increase of 4.4% in the U.S., and almost 3% in Europe, while losing ground in Japan. It pays out a dividend yield of more than 3%, with a less than 50% payout ratio.

Andy Warhol, CFA

Campbell Soup (NYS: CPB) sells much more than chicken noodle in its iconic red and white cans, with brands including Pepperidge Farm, Prego, and V8 in its roster. In its most recent quarter, soup sales fell while bakery and beverage sales increased, and the company still posted a profit margin of almost 10%. The company has paid a dividend since 1980 and currently yields 3.6% with a payout ratio at 50%.

And for dessert

Any kid in America will tell you where to put your money: in candy! Hershey (NYS: HSY) offers a tempting, albeit a bit pricy, place to keep your cash safe while earning a 2.1% dividend yield (and only having a 46% payout ratio). The company is finishing its "Project Next Century," which includes adding 340,000 square feet to modernize a factory and is expected to save $65 million to $80 million total through 2014. While its stock price has run up more than 12% this year, it is definitely a stock to watch for any undeserved drop in value.

Preserving your capital

If a stock drops by 50%, it must gain 100%, not 50%, to come back to equal value. This makes defensive stocks like these food juggernauts attractive. Add in their dividends that are far away from any danger, and they become even more appealing.

Of course, you may not get multibagger gains with these defensive stocks, but you can rest easy knowing that if tomorrow brings zombies or some new currency backed by petrified wood, people will still need a lunch.

If you're looking for more quality companies, read our free report on "3 Stocks That Will Help You Retire Rich". This report gives you the habits you need to build long-term wealth, along with three stocks that can help you along your way -- and best of all, it's free.

At the time thisarticle was published Fool contributor and MichiganderDan Newmanalso has to mention Kellogg for being a Michigan company. He holds no position in any of the above companies. Follow him on Twitter,@TMFHelloNewman.

The Motley Fool owns shares of Facebook and Hain Celestial.Motley Fool newsletter serviceshave recommended buying shares of McDonald's and Hain Celestial. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.