Better Buy Now: Under Armour vs. lululemon athletica

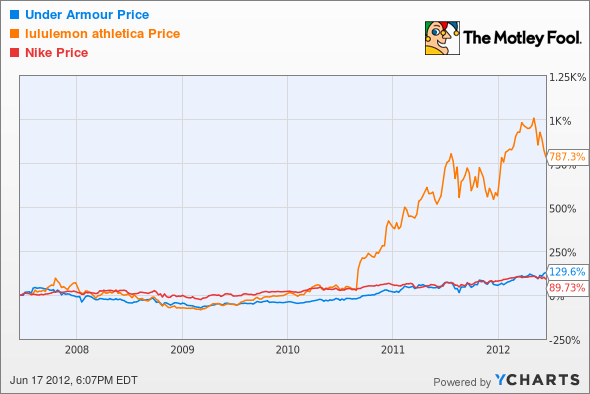

The healthy lifestyle is all the rage these days -- a trend that fitness apparel companies are taking to the bank. Two of the biggest winners in this space include Under Armour (NYS: UA) and lululemon athletica (NAS: LULU) . As the summer heats up, so do these sporty stocks. Let's take a look at which is a better buy today and what the future holds for these retail rivals.

Under Armour

This athletic gear company is off to a sprinting start this year. Last week the stock hit a 52-week high after its board approved a 2-for-1 stock split. For current shareholders, the news means they will have twice as many shares after the split, although the value of their stake will stay the same. Shares of Under Armour are up about 50% in 2012.

One reason for the stock's success is that the Baltimore-based company continues to pump out products that consumers love. In fact, Under Armour is aggressively pushing into the athletic footwear business in hopes of better competing with sports performance giant Nike (NYS: NKE) . However, the effort has been slow to gain traction despite the millions upon millions of dollars Under Armour spends for celebrity endorsements.

Meanwhile, Nike dominates the shoe segment with tech tie-ins like the company's recent Nike+ FuelBand. While it's important that Under Armour expand its product offerings to include new categories, I don't see it stealing significant market share from Nike in the sneaker arena anytime soon.

Product innovation remains at the core of Under Armour's success. However, that hasn't helped the company's inventory problems. Inventory growth has outpaced revenue growth in the most recent quarter.

Lululemon has also fought inventory issues in the past as well, although it had the opposite problem -- the retailer couldn't seem to make enough luxury yoga gear to meet demand fast enough. With inventory setbacks behind it now, let's see how the brand stacks up to Under Armour today.

Lululemon

The yoga-inspired apparel company has the most fashionable accessory in retail: a cult following. That's impressive for a company that relies on grassroots marketing. Lululemon focuses on local communities, unlike Under Armour and Nike, which fund their success with multimillion-dollar endorsement deals.

In fact, all of the company's 180 corporate-owned stores offer free yoga classes led by Lululemon "ambassadors," who, in exchange, get 15% off the merchandise. That's a great way to get customers through the doors and a strategy that's no doubt working for the retailer considering the stock is up more than 350% since its IPO in 2007, and I expect this trend to continue going forward.

The retailer remains focused on creating a positive customer experience in its stores. Additionally, by distributing through corporate-owned stores and its own website, Lululemon keeps more of the profit from sales than competitors like Under Armour and Nike, both of which sell their products through retailers like Dick's Sporting Goods (NYS: DKS) . While retailer relationships like those with Dick's may help them hit scale faster, the dollars they earn doing so are less valuable.

Last year, Lululemon passed $1 billion in sales. It's a fast-growing momentum stock, and management is finding new ways to expand the business. While Lululemon may have gotten its start by serving a niche market, a move into new product categories is fueling future growth for the retailer. The Canadian company is having tremendous success with its new men's clothing line, which now represents 15% of total sales.

In addition to active menswear, the retailer launched a dance-apparel line for teen girls called ivivva athletica. Growth in these new segments along with expansion overseas should move the stock higher in the quarters to come. Overall, I think Lululemon has more growth catalysts than Under Armour. But let's see how the stocks compare.

Lululemon's all-star run-up in price may give some investors pause. However, I think the stock is just getting started. That said, you're going to have to pay up for this growth because shares trade at over 45 times earnings. Still, that's better than shares of Under Armour, with a P/E of more than 55. That's why I'm sticking to my bullish CAPScall that Lululemon will dominate the market in the next three years.

And the winner is...

Both are high-quality stocks that command strong consumer demand. However, I think Lululemon is the best buy now. It isn't always easy to know which stocks will outperform and which will fizzle. Luckily, some of The Motley Fool's brightest analysts have done the hard work for you. Click here for instant access to a free report titled "The Stocks Only the Smartest Investors Are Buying" The report reveals why even Buffet is interested in these stocks, and how you can make money from them.

At the time thisarticle was published

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.