How Low Can GameStop Go?

Shares of GameStop (NYS: GME) hit a 52-week low yesterday. Let's look at how it got here and whether dark clouds are ahead.

How it got here

Physical media has been on a decline for ages, and unfortunately for the video game retailer, that includes the bulk of its wares. NPD's latest figures showed new video game sales plunging by a gut-wrenching 42% in April, with hardware sales falling by a similarly depressing 32%.

On the bright side, GameStop is keenly aware that digital distribution is the future for the industry and is looking to embrace that. On the dark side, GameStop will likely never be a major leader in that arena. The clear powerhouse in digital game distribution is Steam, while Apple has conquered the casual and mobile gaming front by pure accident with its iOS platform.

Last quarter's earnings were disappointing, with same-store sales falling 12.5% and revenue also shrinking by 12%. New video game hardware and software combined dropped 20%. Higher-margin segments like used game products and GameStop's "other" category, which includes digital and mobile offerings, were nearly flat, only declining slightly, but the new stuff still comprises over half of sales.

How it stacks up

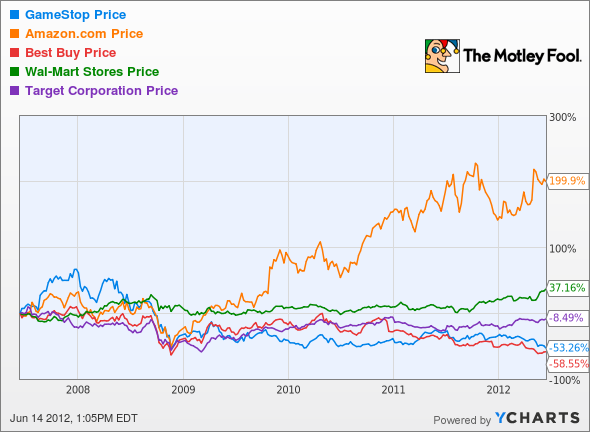

Let's see how GameStop stacks up with its e-tail and retail peers.

Let's compare some of their fundamentals too.

Company | P/E (TTM) | Sales growth (MRQ) | Net margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

GameStop | 7.5 | (12.2%) | 3.6% | 11.1% |

Amazon.com (NAS: AMZN) | 176.4 | 33.8% | 0.9% | 7.7% |

Best Buy (NYS: BBY) | NM | 6.1% | 0.7% | (20.7%) |

Wal-Mart (NYS: WMT) | 14.4 | 8.5% | 3.7% | 24% |

Target (NYS: TGT) | 13.4 | 5.9% | 4.2% | 18.9% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter. NM = not measurable.

Of course, Amazon hopes to disrupt every last brick-and-mortar on Earth as it sells just about everything. Best Buy and GameStop are more vulnerable, though, as electronics retailing is more competitive. Wal-Mart and Target are getting by better since they sell such a wide array of products that people don't mind picking up locally, like groceries and clothing.

What's next?

There's talk that the next generation of consoles from the big three (Nintendo, Microsoft, and Sony) might consider abandoning the disc drive, which would be the last nail in the retail coffin. At the E3 show earlier this month, Microsoft game exec Phil Spencer told IGN, "Retail distribution of games is going to be very important for years." Mr. Softy may not be ready to go all-digital quite yet, which should be music to GameStop's ears.

Still, the writing's on the wall, and I don't think GameStop will be able to navigate the transition to digital very well against its competition, so I'm also giving it an underperform CAPScall today.

Stay updated with these retailers by adding them to your Watchlist.

Add GameStop to My Watchlist.

Add Best Buy to My Watchlist.

Add Amazon.com to My Watchlist.

Add Wal-Mart Stores to My Watchlist.

Add Target to My Watchlist.

At the time thisarticle was published Fool contributorEvan Niuowns shares of Apple and Amazon.com, but he holds no other position in any company mentioned.Click hereto see his holdings and a short bio. The Motley Fool owns shares of Amazon.com, Best Buy, Microsoft, Apple, and GameStop. The Motley Fool has sold shares of Sony short.Motley Fool newsletter serviceshave recommended buying shares of Microsoft, Amazon.com, Nintendo, and Apple.Motley Fool newsletter serviceshave recommended creating bull call spread positions in Apple and Microsoft, creating a diagonal call position in Wal-Mart Stores, and writing covered calls on GameStop. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.