Can Tiffany Sparkle Again After a 52-Week Low?

Shares of Tiffany (NYS: TIF) hit a 52-week low yesterday. Let's take a look at how the company got there to find out whether cloudy skies remain on the horizon.

How it got here

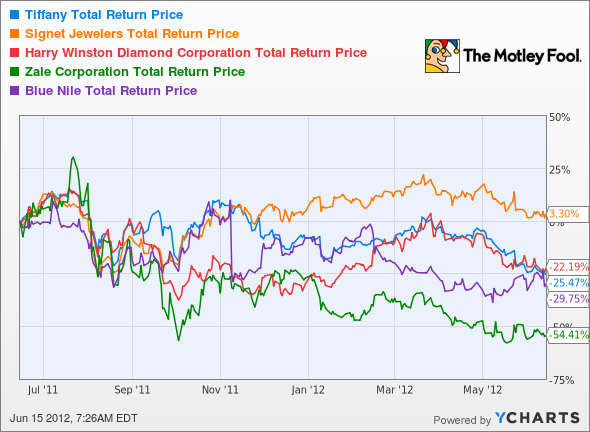

Jewelers have definitely lost their luster this year. My fellow fool Sean Williams thinks there are some flaws in the sector, and judging by their performance, it's hard to disagree. The best-performing jeweler of the past 52 weeks is Signet Jewelers (NYS: SIG) , and it's barely clinging to a positive return for the prior year:

TIF Total Return Price data by YCharts

Tiffany, as Sean pointed out, has underperformed expectations for two straight quarters, which would put downward pressure on just about any stock. The decline kicked in around the beginning of the year when management cut 2012 guidance and has been rather steady since. Despite its sparkling brand name, Tiffany's been little more than a bellwether for troubled luxury stocks. Commodity costs -- that's diamonds, silver, and gold -- have put the squeeze on jeweler margins. That's hit Internet vendor Blue Nile (NAS: NILE) harder than most, but hardly spared Tiffany.

What you need to know

Thanks to its decline, Tiffany is now one of the cheapest jewelers you can buy, and it maintains the highest profit margin as well:

Company | P/E Ratio | 3-Year Annualized Earnings Growth | Net Margin (TTM) |

|---|---|---|---|

Tiffany | 15.7 | 18.4% | 11.9% |

Signet Jewelers | 11.3 | 28.3% | 8.8% |

Blue Nile | 49.9 | (10.8%) | 2.6% |

Harry Winston Diamond (NYS: HWD) | 29.9 | NM | 4.5% |

Zale (NYS: ZLC) | NM | NM | (2.2%) |

Source: Yahoo! Finance. TTM = trailing 12 months. NM = not material, due to negative earnings.

Out of all the companies on this list, Tiffany has suffered the steepest decline in its P/E over the past year. That could make it an attractive value, especially when you consider that it also has the highest dividend yield of the bunch.

TIF P/E Ratio data by YCharts

Investors also have to be aware of looming economic crises that could send well-heeled investors scurrying for safe havens (and far away from ostentatious luxury purchases). But it's Tiffany's high-end focus that could keep it afloat, unlike Zale and Signet, which lack the polish of their elite rival. I'm not sure that's a bet worth making. Weak guidance has plagued all levels of the sector, including Harry Winston, which ominously predicted a slowdown in Chinese sales just as global fears have reached a boiling point. If the Chinese elite won't open their pocketbooks, Tiffany and its competitors probably can't count on other emerging or developed markets to make up the slack.

What's next?

Where does Tiffany go from here? That will depend, as it did during the last economic shock, on how rich the rich actually feel. If 2008's crash is any indication, Tiffany shareholders might be in for a bumpy ride. The Motley Fool's CAPS community has given Tiffany a middling two-star rating (out of five), with 22% of CAPS players expecting the stock to continue its 52-week trend of underperformance. Fool Analyst Austin Smith agrees with their bearish assessment -- he cautioned investors to avoid Tiffany earlier this week.

Interested in tracking this stock as it continues on its path? Add Tiffany to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens. If you're still looking for defensive dividend stocks to withstand a downturn, The Motley Fool's just released a new report: "The 3 Dow Stocks Dividend Investors Need." Find out which stocks you should add to your portfolio -- click here to get free information on these dividend dynamos now.

At the time thisarticle was published Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights. Motley Fool newsletter services have recommended buying shares of Blue Nile. Motley Fool newsletter services have recommended creating a position in Blue Nile. Motley Fool newsletter services have recommended shorting Tiffany. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.