When Earnings Estimates Are Useless

Earnings estimates are one of the most important factors in determining a company's stock price. Valuations, after all, are based on primarily on future cash flows, which come from earnings projections, and Wall Street analysts tend to adjust their earnings forecasts based on macroeconomic news, quarterly reports, or other company or industry-specific information.

This model can work well for some industries. Retailers or restaurants, for example, have two principal ways of increasing sales: opening new stores, or increasing sales within already existing stores. Since these companies tell analysts how many new locations they plan to open and project same-store sales growth, near-term earnings are fairly easy to predict.

Other industries, however, are much more complex and nearly impossible to accurately project.

The legislation problem

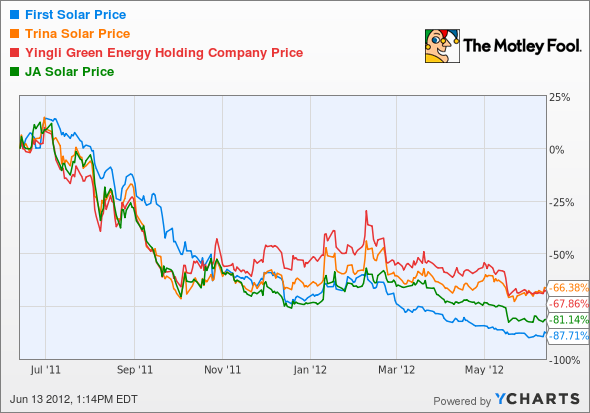

Take the solar industry, for example. Solar stocks have collapsed over the past year, as subsidies have dried up and investors have come to realize that industry fragmentation will mean that many of the companies around today may not survive the next 10 years. Just look at the collapse of some of the better-known companies in this industry.

No question, it's been a terrible year for solar shareholders, but Wall Street analysts might bear some of the blame as well. First Solar (NAS: FSLR) , for example, posted EPS at least 15% less than analyst estimates in each of its past four quarters. The most recent quarter was particularly egregious. Wall Street was looking for a $0.59-per-share profit, but the maker of thin-film panels lost $0.08 a share. Looking forward, it seems analyst projections are a veritable Tower of Babel. Estimates for the company's next quarter range from a paltry $0.03 a share all the way up to $3.03. Wall Street may use the average of $1.02 as a gauge next time First Solar reports earnings, but with such a wide range, the idea of an average loses its meaning. Estimates for 2013 look just as ridiculous, with a low at $0.99 per share and a high of $5.90.

The solar industry is subject to a number of unique legislative circumstances that don't affect most industries -- after all, these businesses need government help to compete -- but we can see this pattern in other commodity industries as well.

Like solar panels, the market for rare-earth metals is heavily influenced by Chinese policy and subject to a number of other rapidly changing economic factors. Molycorp (NYS: MCP) , the strongest of the U.S. rare-earth producers, has taken a tumble over the past year as speculation in rare-earth elements has cooled off. Since commodity prices are volatile, analysts again can't seem to agree on what to expect from the miner. Estimates for the coming quarter range between a $0.15-per-share loss and a $0.20 gain, while for the year analysts are looking for profits anywhere between $0.38 and $2.30 per share.

Turnaround plays

Perhaps the best-known collapse in the past year was Netflix (NAS: NFLX) . The onetime highflier crumbled when investors sensed that its business model was no longer the cash cow it used to be. Issues with contract negotiations and an aborted plan to spin off the mail-order business didn't help. Analysts still don't know what to make of the streaming video distributor. Netflix has beaten expectations in its past four quarters, and estimates for 2013 range from $0.16 a share to $3.93. If you're a shareholder, you need to look beyond the financial data and find qualitative reasons to believe in the company, such as a strong management team or a well-known brand.

Finally, bank earnings can also be exceedingly difficult to predict. In two of the past four quarters, analyst projections for Bank of America (NYS: BAC) earnings have diverged from estimates by more than 75%. JPMorgan Chase's (NYS: JPM) $2 billion trading loss has led analysts to estimate earnings as low as $0.19 per share this quarter, with the average at $0.86. The inconsistent and risky nature of the business means unseen problems or windfalls can creep up at any time.

Foolish takeaway

The estimates mystery is perhaps one of the best reminders to have a well-articulated investing thesis. When numbers aren't predictable, the model can't be trusted, so you're better off looking for qualitative evidence. JPMorgan Chase might have been a favorite of investors because of the way the bank successfully steered through the financial crisis or because of CEO Jamie Dimon's sterling reputation, though that may have changed with the recent $2 billion loss. Netflix is competing in an ever-changing industry, so a bet on the red-envelope mailer seems to be more of a bet on management or that its brand strength will hold up, rather than on anything strictly financial.

Similarly, commodities are subject to an array of market forces that could push the stock one way or another. An investment in a solar or rare-earth stock is in many ways a bullish bet on the industry or commodity itself. Whatever stock you're invested in, ask yourself whether it makes sense to trust the analyst estimates. If not, don't be fooled by the numbers; you can see for yourself that several of those Wall Street analysts are getting paid to be dead wrong.

If you're looking for a stock that's still flying under Wall Street's radar, check out a pick straight from our chief investment officer. It's a retailer in an emerging market, using a proven business model and growing fast. Revenue is improving at solid clip, and same-store sales grew by an impressive 13% last month. Best of all, this company has plenty of room to expand as it takes advantage of a burgeoning middle class in Latin America. Find out the name of this hot stock and all the other details you need to know in our special free report: "The Motley Fool's Top Stock for 2012." You can get your copy right now.

At the time thisarticle was published Fool contributorJeremy Bowmanowns shares of Molycorp. The Motley Fool owns shares of Bank of America, Netflix, and JPMorgan Chase. Motley Fool newsletter services have recommended buying shares of First Solar and Netflix. The Motley Fool has a disclosure policy. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.