How Low Can Rovi Go?

Shares of Rovi Corporation (NAS: ROVI) hit a 52-week low recently. Let's look at how it got here and whether dark clouds are ahead.

How it got here

Rovi's software solutions help consumers discover various types of content, including music and movies, which is an increasingly important segment. The company competes with a slew of rivals, some of which specialize in certain types of content. Pandora Media (NYS: P) comes to mind in the music-discovery arena, although it's not without its own intense competition.

Shares had popped in January on upbeat 2012 guidance and the announcement that it was selling off its Roxio product line, which included digital media apps like Creator, Toast, and Popcorn. The company was running hot at the beginning of the year due to all the hopes surrounding connected TVs, boosting various home entertainment names. Turns out Rovi was due for a crash, as shares now sit at lows.

More recently, Rovi sank on its first-quarter earnings release when revenue fell shy of consensus estimates.

How it stacks up

Let's see how Rovi stacks up with some of its content-discovery peers and competitors.

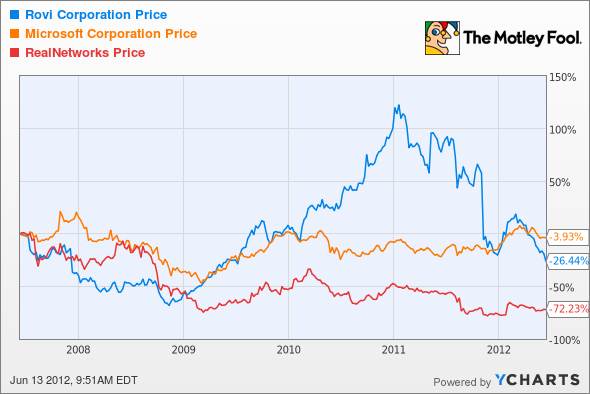

Source: YCharts.

We'll add in some more fundamental figures for a deeper read.

Company | Price-to-Sales Ratio (TTM) | Sales Growth (MRQ) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

Rovi | 3.8 | 14.6% | (1%) | (0.4%) |

Microsoft (NAS: MSFT) | 3.4 | 6% | 32% | 38.2% |

RealNetworks (NAS: RNWK) | 1 | (23.3%) | (10%) | (9.6%) |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

Rovi's sales grew last quarter, but its bottom line turned into a light shade of red due to higher research and development costs and expenses related to debt modifications. Microsoft continues to beef up the capabilities of its Xbox 360, focusing on making the console a hub for home entertainment. RealNetworks has seen its top line dry up and has lost nearly three-quarters of its value over the past five years.

What's next?

Rovi got ahead of itself earlier this year, so the subsequent pullback is unsurprising. Its licensing revenue may benefit as connected-TV adoption rises, but it will face intense competition from heavyweights.

Add these content-discovery companies to your watchlist to get the latest news.

Add Rovi to My Watchlist.

Add RealNetworks to My Watchlist.

Add Pandora Media to My Watchlist.

Add Microsoft to My Watchlist.

At the time thisarticle was published Fool contributorEvan Niuholds no position in any company mentioned.Click hereto see his holdings and a short bio. The Motley Fool owns shares of Microsoft.Motley Fool newsletter serviceshave recommended buying shares of Microsoft.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Microsoft. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.