How High Can Target Fly?

Shares of Target (NYS: TGT) hit a 52-week high yesterday. Let's look at how it got here and whether clear skies are ahead.

How it got here

The contrast between retailers has been dramatic recently as consumers change the way they shop. Online merchants are taking share, specialty retailers are taking it on the chin, and discount retailers like Target and Wal-Mart (NYS: WMT) are slowly expanding their empires to remain relevant.

Target has managed to survive the recession and emerge as one of the few retailers in a strong position as competition mounts. In the most recent quarter, sales rose 6.1% to $16.5 billion, and earnings per share increased 5% to $1.04 per diluted share. This continued a streak of four straight quarters that Target beat earnings estimates.

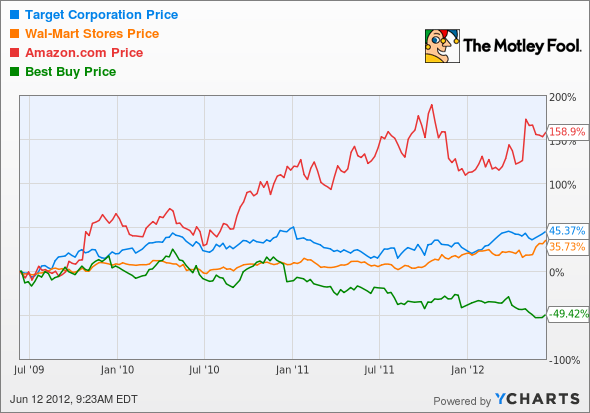

Over the past three years you can see the divergence of retailers in the chart below. Amazon.com (NAS: AMZN) has outpaced rivals by making it easier to shop online and Best Buy (NYS: BBY) has lost half of its market value because it is losing customers to rivals. Discounters like Target and Wal-Mart haven't suffered the same fate as Best Buy because they've filled a "one-stop shop" need in the market, offering everything from groceries to big-screen TVs. Their economies of scale have also helped them survive on lower margins.

From a valuation perspective, Target is also on par with Wal-Mart and looks a lot cheaper than Amazon. It doesn't have the same growth as its online competitor, but I'll take value over growth in retail right now, especially with the upside Target's online capabilities provide.

Target | 2.5 | 5.8% | 7.5% | 12.1 |

Wal-Mart | 3.3 | 8.5% | 8.8% | 12.7 |

Amazon | 13.4 | 33.8% | 2.5% | 83.9 |

Best Buy | 1.6 | 2.1% | 8.7% | 5.2 |

Source: Yahoo! Finance.

In this competitive marketplace I would rather be with a steadily growing retailer than a stock with growth already priced in or a retailer that may be on its last leg.

What's next?

So, where does Target's stock go from here? I think this is one of the few retailers worth buying right now. Target can offer many of the same products Best Buy does while providing a place to pick up milk and a loaf of bread as well. It's also a more upscale shopping experience than Wal-Mart, something I think will pay off in the long run.

Target is also a nice value, trading at 12.1 times forward earnings estimates and sporting a 2.1% dividend. I'll give my thumbs-up, and the CAPS community has given the stock four stars out of five, with 2,392 players making an outperform call. I think this is just the start of new highs and that Target will keep rising as the economy slowly recovers.

Interested in reading more about Target? Click here to add it to My Watchlist, which will find all of our Foolish analysis on this stock.

At the time thisarticle was published Fool contributorTravis Hoiumdoes not have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.The Motley Fool owns shares of Amazon.com and Best Buy.Motley Fool newsletter serviceshave recommended buying shares of Amazon.com.Motley Fool newsletter serviceshave recommended creating a diagonal call position in Wal-Mart Stores. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.