Stocks for the Long Run: Clorox vs. the S&P 500

A long history of returns.

Investing isn't easy. Even Warren Buffett counsels that most investors should invest in a low-cost index like the S&P 500. That way, "you'll be buying into a wonderful industry, which in effect is all of American industry," he says.

But there are, of course, companies whose long-term fortunes differ substantially from the index. In this series, we look at how members of the S&P 500 have performed compared with the index itself.

Step on up, Clorox (NYS: CLX) .

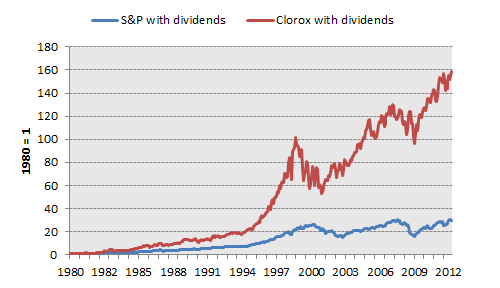

Clorox shares have simply crushed the S&P 500 over the last three decades:

Source: S&P Capital IQ.

Since 1980, shares returned an average of 17.1% a year, compared with 11.1% a year for the S&P (both include dividends). That difference adds up fast. One thousand dollars invested in the S&P in 1980 would be worth $29,400 today. In Clorox, it'd be worth $158,400.

Dividends accounted for a lot of those gains. Compounded since 1980, dividends have made up 64% of Clorox's total returns. For the S&P, dividends account for 41.5% of total returns.

And now have a look at how Clorox's earnings compare with S&P 500 earnings:

Source: S&P Capital IQ.

Again, significant outperformance. Since 1995, Clorox's earnings per share have grown by an average of 8.4% a year, compared with 6% a year for the broader index. That's testament to the power of the company's brand, where most of its value lies. It also says a lot about how simple businesses like bleach often trounce "breakthrough" companies that investors chase.

Interestingly, that earnings-growth dynamic hasn't led to superior valuations. Clorox has traded for an average of 21.4 times earnings since 1980, compared with 21.3 times for the S&P.

Still, the company without a doubt has been an above-average performer historically.

The question is whether that can continue. That's where you come in. Our CAPS community currently ranks Clorox with a five-star rating (out of five). Do you disagree? Leave your thoughts in the comment section below, or add Clorox to My Watchlist.

At the time thisarticle was published Fool contributorMorgan Houseldoesn't own shares in any of the companies mentioned in this article. Follow him on Twitter @TMFHousel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.