Skyworks Solutions Hits a 52-Week High: Can It Continue Skyward?

Shares of Skyworks Solutions (NAS: SWKS) hit a 52-week high recently. Let's look at how it got here and whether clear skies are ahead.

How it got here

Skyworks is one of many companies cashing in on the mobile revolution, as it provides crucial ingredients that facilitate today's smartphones and connected tablets. The company has enjoyed a spot providing power amplifier modules, or PAMs, for AppleiPhones for years, although players TriQuint Semiconductor (NAS: TQNT) and Avago Technologies (NAS: AVGO) also pitch in their own offerings there.

The company posted second-quarter earnings in April, with revenue rising 12% to $364.7 million and net income of $34 million, or $0.18 per share. Skyworks continues to gain momentum with its design wins and its power-efficient modules are capitalizing on the mobile boom and soaring demand for constant connectivity. Skyworks just released its family of LTE SkyHi modules for the next generation of data speeds.

How it stacks up

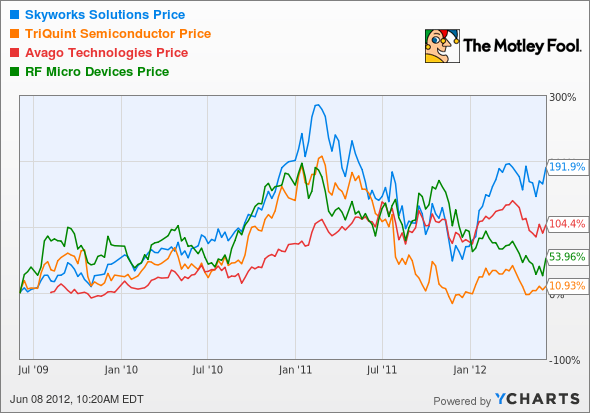

Let's see how Skyworks stacks up against some of its peers.

Let's add in some more fundamental metrics for additional insight.

Company | P/E (TTM) | Sales growth (MRQ) | Net margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

Skyworks Solutions | 26.2 | 12.1% | 13.6% | 13.0% |

TriQuint Semiconductor | 24.7 | (3.4%) | 4.2% | 4.2% |

Avago Technologies | 14.9 | 3.0% | 23.5% | 28.2% |

RF Micro Devices (NAS: RFMD) | NM | (11.9%) | 0.1% | 0.1% |

Source: Reuters. TTM = trailing 12 months, NM=not meaningful, MRQ = most recent quarter.

TriQuint has had some missteps recently and sits near the low end of its 52-week range, while larger Avago boasts higher profitability and a cheaper valuation. RF Micro Devices saw revenue fall by 17% last year, while higher costs barely allowed it to squeeze out a tiny net profit.

What's next?

I think Skyworks will continue to profit off the booming mobile revolution with its chips, so I'm also going to give it an outperform CAPScall today.

Stay up to date with the sector by adding these companies to your watchlist today.

Add Skyworks Solutions to My Watchlist.

Add RF Micro Devices to My Watchlist.

Add Avago Technologies to My Watchlist.

Add TriQuint Semiconductor to My Watchlist.

At the time thisarticle was published Fool contributorEvan Niuowns shares of Apple, but he holds no other position in any company mentioned.Click hereto see his holdings and a short bio. The Motley Fool owns shares of TriQuint Semiconductor and Apple.Motley Fool newsletter serviceshave recommended buying shares of Apple.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Apple. The Motley Fool has adisclosure policy.

We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.