Barrick Gold Grasps for a Convenient Scapegoat

The world's largest gold producer tried to offer up a human sacrifice to the market gods Wednesday by abruptly canning its CEO, Aaron Regent. I think Barrick Gold (NYS: ABX) has made a confounding and unwarranted move here, and I'm eager to tell you why.

I've been following Regent's career for nearly a decade, reaping profits along the way. I had the very good fortune to hold shares of base-metal miner Falconbridge (where Regent served as president and CEO from 2002 to 2005) before the merger with Noranda in 2005 and the subsequent C$27 billion acquisition by Swiss miner XSTRATA in 2006. Regent had served as CFO at Noranda years earlier, and in my view his connection with both companies played a key role in achieving that landmark pairing.

Regent then returned to his long-standing roots with Brookfield Asset Management (NYS: BAM) as a senior managing partner, and he served as co-CEO of Brookfield Infrastructure Partners (NYS: BIP) as that well-respected dividend payer branched out as a spin-off in early 2008. As a subscriber to The Motley Fool's Inside Value newsletter service, I found my way to those shares as well with yet another pleasant result.

Now, let's take a moment to consider what Regent inherited from Barrick's founder and then-acting-CEO Peter Munk when Regent took the reins as president and CEO in January 2009. Barrick Gold was suffocating beneath the weight of a disastrous and highly controversial portfolio of gold hedges that presented a monumental liability in the face of gold's secular bull market. Properly recognizing that gold would continue to run, Regent took decisive steps to clear that hedge book by taking a painful $5.6 billion writedown and raising $3 billion to cancel remaining hedges.

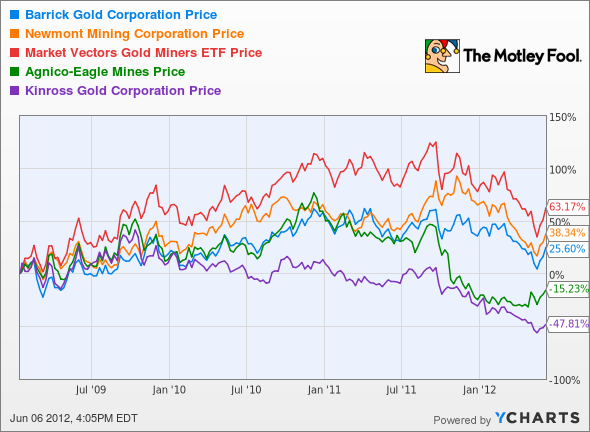

When I discovered this morning that Barrick had thrown Regent under the bus by ousting him from the top spot, I perceived a lame attempt by Barrick's board to offer the market a scapegoat for the less-than-stellar trailing price action in the stock. Reuters pointed out Wednesday morning that Barrick's stock on the Toronto exchange had risen only 3.8% since its close on the day before Regent began his stint as CEO. I'll admit that came as a surprise to me. I suppose perceptions of that trailing performance could vary based upon one's vantage point, since U.S. investors accessing Barrick on the NYSE have seen a 30% advance (adjusted for dividends) over the corresponding period from Jan. 15, 2009, through Tuesday's preannouncement close. As the following chart will show, Barrick's stock performance on the NYSE has indeed lagged that of the benchmark Market Vectors Gold Miners Index ETF (NYS: GDX) over the period in question. But over a period that has dealt the industry its share of hard knocks, it is hardly the standout underperformer. The chart depicts percentage advances and declines, since Jan. 15, 2009, for a relevant set of U.S.-listed gold securities (without adjusting for dividends).

As the world's largest producer, Barrick has suffered more than most the consequences of its own existing massive scale. Barrick-sized gold projects are increasingly hard to find, and Barrick has certainly been a poster child for victims of skyrocketing capital costs for mine construction. The company's $7.7 billion move into copper with last year's acquisition of Equinox Minerals has drawn vocal criticism, and perhaps this personnel change signals a dampening enthusiasm internally for that deal. Short of becoming a fly on the boardroom wall, we can only speculate as to the rationale.

I can say that Aaron Regent has distinguished himself with a golden record of effective management and meaningful value generation, and unless someone can convince me otherwise, I think Barrick just divested one of its more valuable assets. I continue to view Goldcorp (NYS: GG) as the superior choice among the major miners of gold, though I have also issued a bullish CAPScall for shares of Barrick Gold in anticipation of a convincing turnaround for the beleaguered miners of gold. Finally, I wish incoming Barrick CEO Jamie Sokalski a longer and more secure tenure than that of his ousted predecessor.

Looking for more ideas? Download The Motley Fool's special free report, "The Tiny Gold Stock Digging Up Massive Profits." Our analysts have uncovered a little-known gold miner that we believe is poised for greatness; find out which company it is and why we strongly believe in its future --for free!

Add Barrick Gold to My Watchlist.

Add Brookfield Infrastructure Partners to My Watchlist.

Add Goldcorp to My Watchlist.

At the time thisarticle was published Fool contributorChristopher Barkercan be foundblogging activelyand acting Foolishly within the CAPS community under the usernameTMFSinchiruna. Hetweets. He owns shares of Goldcorp. The Motley Fool owns shares of Brookfield Infrastructure Partners.Motley Fool newsletter serviceshave recommended buying shares of Brookfield Infrastructure Partners. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.