A Little Truth About Energy

I can't take it anymore. The political ads, the energy industry commercials, Rick Santelli's constant ranting on CNBC, and even our own David Lee Smith is pounding this notion of a war on energy in the U.S., perpetuating the idea that our energy picture is getting worse.

The problem with these rants is that the facts don't support them. Santelli says we could create 3 million jobs (a number I'll put into perspective later), David Lee Smith says the feds are "intent on fouling fracking," and political ads would make you think it's impossible to drill for anything in this country. But the facts don't support these positions, and our energy picture is actually looking very bright. Here are a few highlights from the past few years in energy.

U.S. energy production is up significantly under Obama

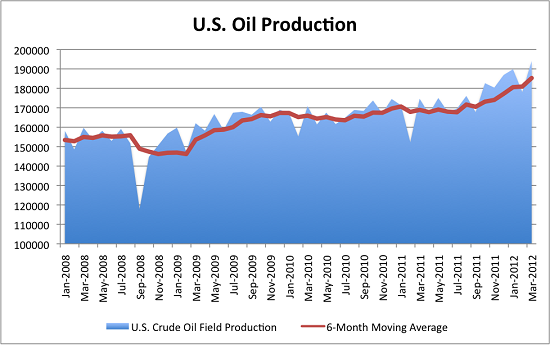

Listening to political ads, you may get the impression that our current administration has done a lot to hurt energy production in the United States. I keep a close eye on production numbers and import levels, and the numbers I see coming out of the Energy Information Administration tell a completely different story. In fact, there's been a boom in oil production over the past three years.

Source: Energy Information Administration.

The myth continues that environmental rules are making it harder to get a drilling permit and it's keeping oil drillers from producing more oil. I'm having a hard time seeing that trend in the past three years based on the number of oil drilling rigs in operation shown below. In fact, we're operating almost twice as many oil rigs as we were in 1987, the last peak and as far back as EIA data go.

Source: Energy Information Administration

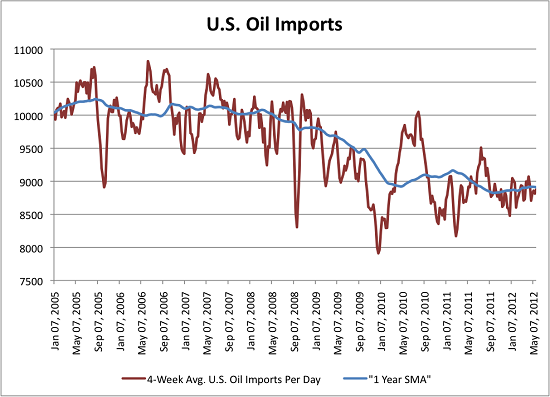

If there's some sort of war on energy, you would think that production would be down (which I've shown it's not) and imports would be up. But over the past five years our net crude oil imports have fallen dramatically. In 2005, we imported 60.3% of the petroleum products we used. In the past four months that number is down to 42.4% of our usage. Don't believe me? Check out the raw data here (link opens PDF file).

Source: Energy Information Administration

Maybe the rules are more stringent than they were from 2000 to 2008, maybe the industry is going to complain about having to tell us what (horrible) chemicals they're putting into the ground to break underground rock to extract oil and natural gas. But to say that the Obama administration has a war on energy or is somehow against U.S. energy just isn't supported by the facts.

We don't need more natural gas and coal production

The coal and natural gas industries would like you to believe that the government is somehow holding them back from unleashing even more energy in the U.S. -- rubbish!

The reason coal production is down is a decrease in demand from electricity generators. The reason electricity generators are demanding less coal is because natural gas is so cheap. The reason natural gas is so cheap is because we have more supply than we need.

Since natural gas isn't an energy source that's easy to export, like oil, it's more of a finite resource. If we don't use it here, it won't get used. As fracking production took off in the past five years, the industry produced more natural gas than we needed, causing prices to fall, losses to pile up, and recently had to cut back production.

Until an export facility from Cheniere Energy (ASE: LNG) comes on line in a few years, we won't have anywhere for excess natural gas to go. Clean Energy Fuels (NAS: CLNE) and Westport Innovations (NAS: WPRT) are trying to develop engines and infrastructure for natural gas fuel usage, but we're still years away from this being a meaningful demand source for the country.

The last thing we need is more natural gas production. Unless of course you think traders are at fault for keeping prices down.

Millions of fossil fuel jobs from thin air

It must be nice being able to flippantly throw around job numbers the way Rick Santelli does. On Friday, he said we could create 3 million jobs if the Obama administration stopped overregulating the energy industry. What exactly does 3 million jobs in energy mean? I'll put that number into perspective with three numbers of my own.

30.3 -- ExxonMobil (NYS: XOM) ended 2011 with 99,100 employees, including company-operated retail sites, so 3 million jobs would be equal to 30.3 ExxonMobils. The employees the company does have produced 1,629,000 barrels of oil per day in 2011, 8.8% of the U.S.' current consumption, so at that rate 3 million jobs would produce 49.4 million barrels per day, more than half of the world's needs. Oh, by the way, that doesn't include the natural gas and other products the company's employees produced.

656 -- Continental Resources, one of the largest companies in the Bakken shale, where much of the U.S. oil production growth has come from, has a whopping 656 employees, hardly a dent in the 3 million jobs we apparently could create.

4.6 employees per mile -- If you think building a pipeline or two would help, Kinder Morgan (NYS: KMI) , which owned 37,000 miles of pipeline at the end of 2011, had 8,120 employees to end the year.

Maybe we could create more jobs in energy. Maybe regulations are too harsh and too burdensome. But to throw around numbers like 3 million new jobs in energy needs some perspective. Maybe we could create 30 more ExxonMobils under a new administration, but my bet is that we won't.

Our energy picture looks strong

In light of everything that's happening globally, the progress we've made in expanding drilling and reducing our reliance on foreign oil in the past seven years is pretty remarkable. Momentum continues to be on our side as well, and with new fuel efficiency standards hitting automakers, we may continue to reduce usage just as we're increasing oil production.

As for natural gas and coal, we have more than we need as the prices for the two tell you. That's the wonderful thing about free markets: If you want to know if we need more of something, you can just look at the price. If it's hitting record lows, you know there's probably too much in the first place, just like there is right now in natural gas and coal.

Oil is down, but that doesn't mean there aren't opportunities to make money in energy. We've highlighted one stock that may be the only energy stock you'll even need. Find out what it is in our free report found here.

At the time thisarticle was published Fool contributor Travis Hoium manages an account that owns shares of Kinder Morgan. You can follow Travis on Twitter at @FlushDrawFool, check out his personal stock holdings or follow his CAPS picks at TMFFlushDraw.The Motley Fool owns shares of Westport Innovations. Motley Fool newsletter services have recommended buying shares of Westport Innovations and Clean Energy Fuels. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.