Is Freescale's 52-Week Low a Warning to Chip Makers?

Shares of Freescale Semiconductor (NYS: FSL) hit a 52-week low last Friday. Let's take a look at how the company got there to find out whether cloudy skies remain on the horizon.

How it got here

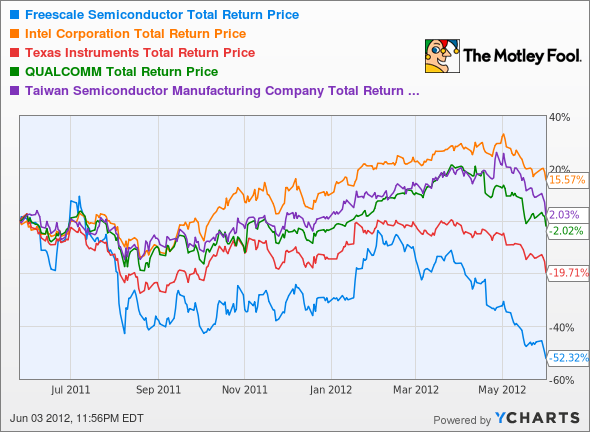

Freescale isn't the only chip maker feeling the heat. Since its IPO about a year ago, few of its competitors can even boast positive returns. That's not much comfort for Freescale, which has been one of the worst-performing chip makers in the industry:

FSL Total Return Price data by YCharts

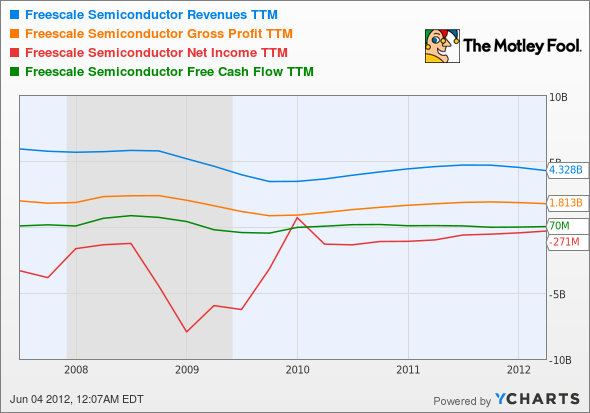

It certainly hasn't helped Freescale to have consistently negative earnings. Its free cash flow has barely nudged above zero in the past few years, either, which puts the company in dangerous waters, surrounded by extremely well-equipped companies like Intel (NAS: INTC) and Taiwan Semiconductor (NYS: TSM) , which also boast their own fabrication facilities.

FSL Revenues TTM data by YCharts

What you need to know

Most semiconductor companies don't burn money every year, they make it -- and many distribute some of it to shareholders each quarter. That goes a long way toward explaining why Freescale has free-fallen while its peers are increasingly seen as "buying opportunity," especially as their prices have declined.

Company | P/E Ratio | 3-Year Annualized Earnings Growth | Net Margin (TTM) |

|---|---|---|---|

Freescale Semiconductor | NM | NM | NM |

Intel | 10.6 | 40.9% | 23.2% |

Taiwan Semiconductor | 15.5 | 16.2% | 30.8% |

Texas Instruments (NYS: TXN) | 17.4 | 7.2% | 13.6% |

Qualcomm (NAS: QCOM) | 16.6 | 45.8% | 9.3% |

Source: Yahoo! Finance.

Investors seem to be spooked by mounting evidence of a global economic slowdown. Even in bad years, though, most of Freescale's competitors can at least maintain their operations without going belly up. There's no guarantee that Freescale can survive another grinding recession, as it has less than a half-year of operating expenses in currently available cash.

Freescale's focus on supplying automakers and industrial clients makes it particularly susceptible to downturns, since large-ticket items are likely to be forgone before a cell phone or laptop upgrade. That explains -- at least in part -- Texas Instruments' and Qualcomm's higher valuations relative to Intel, which hasn't quite cracked mobile yet. Still, a wide economic slump will swamp all boats. Freescale's just happens to be half-full of water already.

What's next?

Where does Freescale go from here? That will depend primarily on the economy's direction and to a lesser extent on Freescale's ability to diversify into stabler sectors. The Motley Fool's CAPS community doesn't think much of Freescale, with a small number of Fools giving the company a three-star rating. No Freescale bulls have earned any CAPS points for their pick yet, and they may wait a lot longer for that possibility.

Interested in tracking this stock as it continues on its path? Add Freescale to your Watchlist now for all the news we Fools can find, delivered to your inbox as it happens. Looking for a better investment? Discover the Fool's top stock for 2012 in our informative free report. Just click here to get the information you need for a better investment now.

At the time thisarticle was published Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights. The Motley Fool owns shares of QUALCOMM. Motley Fool newsletter services have recommended buying shares of Intel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.