The 3-D Printing Battle Takes Shape

There's consolidation afoot in the 3-D printing industry. The biggest news this year was Stratasys' (NAS: SSYS) merger with Objet shortly before the latter could go public. Before that, competitor 3-D Systems (NYS: DDD) had gone on an acquisition binge, snapping up companies of various sizes, from small custom-robot maker My Robot Nation to its $137 million acquisition of Vidar Systems and Z Corporation late last year.

No one should be surprised at these moves. Although 3-D printing's ability to transform manufacturing has lately caught the attention of everyone from The Economist to your humble columnist, it's hardly a new phenomenon. But now that the technology has advanced far enough to take real root on shop floors and in futurists' minds, it's become somewhat more important to establish dominance before the platform becomes as popular as good old 2-D printing -- which is itself a more recent entrant to the mass market than many acknowledge.

Which company will come out on top? Can either become the dominant company in 3-D that Hewlett-Packard (NYS: HPQ) became in 2-D printing? The answer -- as is often the case -- seems complicated. Let's try to make it a little simpler.

Where we come from

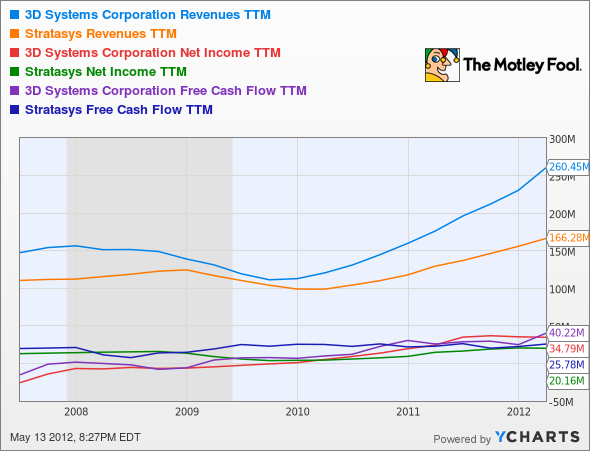

Both companies offered a wealth of data on their major moves, so we've got plenty to analyze. But it's also important to look at where the companies have been before we try to figure out where they're going. The current market size (in terms of total revenue) has been estimated in the range of $1 billion-$1.3 billion. By that measure, both 3-D Systems and Stratasys have a ways to go before they can claim the crown:

DDD Revenues TTM data by YCharts

Together, the two companies generated about a third of total industry revenue over the trailing-12-month period, if you want to use the higher estimate. But that was before the Stratasys merger. That move alone could push Stratasys back into the 3-D printing lead, as Objet brought in $121 million in revenue last year as a stand-alone company.

Where we're going

3-D Systems is proud of its health-care offerings, which Stratasys couldn't quite match. Objet, on the other hand, has a solid presence in health care, and the newly combined Stratasys will pose a formidable challenge to its chief rival. 3-D Systems doesn't gain health care presence for its printers through its acquisitions, but may gain mindshare through Vidar. That subsidiary offers scanners to turn medical film into digital format. That should help in the short term, but over the long term I'd expect medical readouts to be digital to begin with. Call this a big Stratasys advantage.

Stratasys has thus far ceded the personal printing space to 3-D Systems, which may be its greatest oversight. The company made some effort to launch an "affordable" printer with HP's backing, but we've heard little of that because the HP-branded devices are exclusive to Europe, and identical Stratasys-branded models are sold for the price (and the financing terms) of a small car. A recently revealed "cheaper" Stratasys desktop 3-D printer still costs nearly $10,000. Nothing in the Objet merger changes that picture.

3-D Systems, on the other hand, got a major PR boost at CES this year when it unveiled a printer for home users that will cost $1,299. I discussed the device's implications at length in the linked article, concluding that home printers aren't quite ready to take the world by storm. That doesn't mean it's not a step in the right direction, or that 3-D Systems is resting on its laurels. Small acquisitions, such as My Robot Nation, help spread the company's name, as do several on-demand 3-D printing companies scooped up in the past year.

These moves point in a clear direction -- 3-D Systems wants a place in your home, and if you can't afford its printer it'll be happy to print things you design with its own printers and ship them to your door. It's all about mindshare. Stratasys' on-demand offering caters to industrial clients, many of which might have otherwise just bought the company's high-end printers.

Two sides of the same coin

Stratasys' big move indicates, at least to me, more of an interest in claiming more corporate clients than in any sort of consumer presence. 3-D Systems seems interested in more of everything. Each strategy has its advantages, but the biggest barrier to home use -- as I've pointed out before -- is that you just can't create that many useful things for a single household. At least not yet.

3-D Systems is playing the long game. If and when 3-D printers can use multiple materials and approach the quality of factory-made items, 3-D Systems could come out ahead in a big way. But that time may be decades in the future. Stratasys can now claim toymakers Disney (NYS: DIS) and Mattel (NYS: MAT) as major customers thanks to its merger, as well as a number of luxury carmakers, consumer brands, and high-tech manufacturers. You might not ever buy a Stratasys printer, but it looks like you're a lot more likely to get your hands on a Stratasys-made product in the next few years than something made by a 3-D Systems machine.

Neither company is cheap. That doesn't make them bad investments. The market's given Stratasys a slight edge, and it's hard to disagree with that now. I wouldn't count 3-D Systems out either. We're still very early in the 3-D printing game, and there's lots of room for both companies to grow. Both companies have been among my best picks in The Motley Fool's CAPS, and I won't turn my back on them now. You shouldn't either -- add them both to your Watchlist to get all the Foolish updates you need.

Looking for more info on the future of 3-D printing? We've got a special free report just for you. Click here to find out why the future will be made in America.

At the time thisarticle was published Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights. The Motley Fool owns shares of Walt Disney. Motley Fool newsletter services have recommended buying shares of Stratasys, Walt Disney, Mattel, and 3-D Systems. Motley Fool newsletter services have recommended creating a bear put spread position in Mattel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.