I'm Buying This Safe Stock Now

Last week, I introduced readers to four different companies I was considering putting my Roth IRA money into. Today, I'm going to reveal which company I've picked, and why I'm picking it.

But first, I wanted to reflect on how my Roth picks have performed thus far. I started calling out one stock per month last August. Since then, my picks are slightly in the red and underperforming the S&P 500 by about 3.5 percentage points.

On one hand, I think it's too early to draw any conclusions about the performance of my picks thus far; long-term investors need to assume a time horizon of at least three years. On the other hand, after further inspection of my picks, I see that I've favored small, high-risk, high-reward companies.

There's nothing wrong with such an approach, as long as it's done intentionally. But in my case, I'd like to see a little more stability. Take a look at how I would generally classify my picks thus far and you'll see what I mean. Click on the individual company names to view my original write-up.

Small Cap, Somewhat Higher Risk | Large Cap, Somewhat Lower Risk |

|---|---|

And so it is with this in mind that I evaluated the four companies I was considered purchasing this month: National Oilwell Varco (NYS: NOV) , Heckmann (NYS: HEK) , Apple (NAS: AAPL) , and IPG Photonics (NAS: IPGP)

Before whittling it down, let's get one thing clear!

The three companies I'm going to eliminate are not unworthy of your investment dollars. As a matter of fact, I own shares of all four, and have maintained bullish CAPScalls on them in my All-Star Portfolio. Rather, I just want to guide you through how I went about making my decision of where to invest, based on the current makeup of my Roth IRA.

Given my parameters, both IPG Photonics and Heckmann were eliminated. I still think IPG is a screaming buy at today's prices and that its lasers are set to become an industry standard. But the company has a market cap of just over $2 billion, and there's always a chance that its fiber-optic lasers could be out-innovated -- the same way IPG's lasers are now taking market share from standard carbon-based lasers. That said, when all of my family's positions are included, IPG Photonics still represents 4.4% of our holdings.

And if IPG is small, then Heckmann is tiny. The water-solutions specialist with a focus on the energy industry has a market cap of just $500 million. Though it's a first mover in its niche, there's no guarantee that it will become the one-stop shop for energy companies as it envisions; it's simply too early in the game to tell for sure. Of course, I still think the odds are in the company's favor -- which is why it represents 1.2% of my family's overall holdings -- but I recognize that I'm looking for something steadier for my portfolio this month.

An apple a day keeps the doctor...

That leaves me with Apple and National Oilwell Varco. There's no doubt in my mind that Apple is the premier company of our generation; it has fundamentally changed the way we interact with technology, and with each other.

That said, the market is a forward-looking tool. I don't deny the unbelievable opportunity that exists in emerging markets for Apple, nor the ridiculously cheap price that it is trading for right now. As it stands, I'm a big believer in Apple, as it represents almost 9% of my family's total portfolio.

But when I look 10 years into the future, it's much easier for me to see National Oilwell Varco continuing to dominate than it is Apple. There's certainly a good chance that Apple will continue to rule, but in the field of technology, things can change fast. The company could have a product that flops, be usurped by the competition, or simply start resting on its laurels after the departure of Steve Jobs.

National Oilwell's future -- from my perspective -- is much easier to forecast. The company is a one-stop shop for virtually anything an energy extractor could need. As fellow Fool Aimee Duffy recently pointed out: "Ninety percent of the world's rigs have National Oilwell Varco equipment on them; if that's not market dominance, I don't know what is."

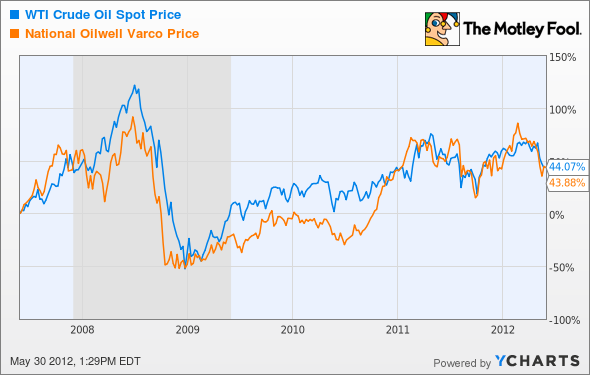

Because oil companies have more incentive to dig up the black gold when prices are high, National Oilwell's stock price has very closely mimicked the price of a barrel of oil over the past six years.

WTI Crude Oil Spot Price data by YCharts

With a rising global middle class, I don't see the price of oil going into a permanent free fall over the next 10 years. That means that National Oilwell's services should still very much be in demand, and that's why I'm adding the company -- for a second time -- to my Roth IRA portfolio.

Secure your retirement

One of the reasons I undertook this venture -- to publicly call out my Roth IRA trades -- was to raise awareness about how important it is to take advantage of this wealth-building tool.

But there are other can't-miss tricks that can help you too, and The Motley Fool has created a special free report detailing them. Click here and get your copy of the report today, absolutely free!

At the time thisarticle was published Fool contributorBrian Stoffelowns shares of all the companies mentioned in this piece. You can follow him on Twitter, where he goes byTMFStoffel.The Motley Fool owns shares of Google, IPG Photonics, Apple, Zipcar, Lumber Liquidators, Heckmann, and EnergySolutions.Motley Fool newsletter serviceshave recommended buying shares of LinkedIn, Google, Apple, Lumber Liquidators, Zipcar, MAKO Surgical, National Oilwell Varco, and IPG Photonics, as well as creating a bull call spread position in Apple. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.