How Low Will Quality Systems Go?

Shares of Quality Systems (NAS: QSII) hit a 52-week low on Wednesday. Let's take a look at how it got there and see whether cloudy skies are still in the forecast.

How it got here

You'd think that both technological advancements and a growing population should increase the demand for better medical care and boost health-care information service companies like Quality Systems higher, but that just hasn't been the case.

The threat that the U.S. government may cut some funding to Medicare to reduce its budget has investors in the health-care sector and the companies themselves worried. This is one reason that Medicare-dependent nursing facility stocks like Gentiva Health Services (NAS: GTIV) took a swan dive off a tall building shortly after the U.S. debt mceiling was raised in August. Although Quality Systems isn't reliant on Medicare, it is reliant on hospitals to purchase its software. If hospital funding gets reduced, many may choose to delay implemented Quality Systems' software to a later date.

That worry appears to have materialized in the company's latest quarterly report, which demonstrated 12% sales growth but a $3.5 million decline in net income, which it attributed to "delays in the closing of several fourth quarter opportunities." Still, Quality Systems is forecasting that its fiscal 2013 sales will rise by 20% to 24% with EPS growth of 20% to 25%. Something has to give here: Either Quality Systems' growth estimates are too high, or Wall Street is vastly underestimating the company's potential.

How it stacks up

Let's see how Quality Systems stacks up next to its peers.

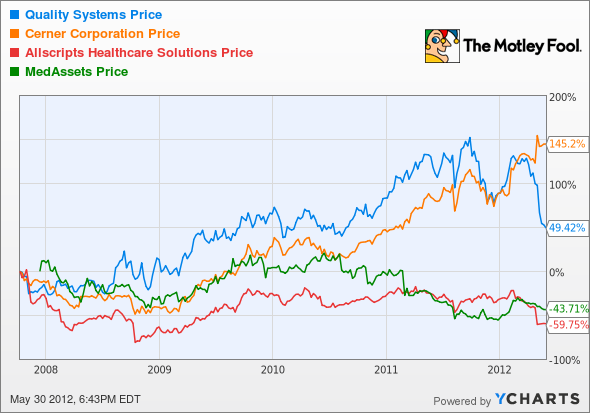

Despite some noticeable hiccups from every company, this is one of those rare instances where the largest company in the group, Cerner (NAS: CERN) , ran away from its peers.

Company | Price/ Book | Price/ Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Quality Systems | 5.8 | 22.1 | 15.6 | 22.3% |

Cerner | 5.6 | 23.9 | 28.7 | 9.8% |

Allscripts Healthcare Solutions (NAS: MDRX) | 1.4 | 7.6 | 12.1 | 44.7%* |

MedAssets (NAS: MDAS) | 1.6 | 5.3 | 9.6 | 31.7% |

Sources: Morningstar, author's calcuations.

*Allscripts-Misys merger heavily increased overall revenue figures.

CAGR = compound annual growth rate.

It might look from those figures that you could throw a dart and nail a winner, but it's just not that easy.

Take Allscripts Healthcare Solutions, for example. Shares of the company imploded five weeks ago, when it badly missed Wall Street's earnings expectations as sales growth slowed, development costs rose, and it lost three long-serving members on its board of directors. It may appear cheap now, but it's a downright scary stock to own at the moment.

Cerner has been a consistent growth stock, as evidenced by its triple-digit gain over the past couple of years -- but does it really deserve to be trading at nearly 29 times forward earnings? I'm not quite sure of that. MedAssets has struggled to stay profitable, but it boasts a much stronger growth rate and much lower forward earnings multiples than Cerner. Even Quality Systems, which isn't what I'd call "cheap" in the normal sense of the term, is valued at just under 16 times forward earnings in relation to Cerner's 29. Based on this, I'd say MedAssets looks the most attractive, but I'd give Quality Systems the nod as well.

What's next

Now for the real question: What's next for Quality Systems? That question is going to depend on whether hospitals do indeed delay their orders for the company's software and whether it can keep its expenses under control.

Our very own CAPS community gives the company a four-star rating (out of five), with an overwhelming 97.1% of members expecting it to outperform. For once you can count me among the majority, as I've made a CAPScall of outperform on Quality Systems that currently has me down 31 points. I don't, however, have any intention of closing that pick.

Quality Systems, as I've alluded, is in the very high-growth field of hospital information technology, and unless hospital funding gets cut off at the knees, it should remain a long-term winner in my eyes, as well as a reasonable buyout candidate. The company has $139.4 million in cash and no debt, and it has forecasted earnings growth to continue at 20% to 25%. That's not a company I'd dare bet against!

Quality Systems clearly has a product pipeline that's helping to change lives. If you'd like the inside scoop on a stock our Motley Fool Rule Breakers team feels could offer the next revolutionary product, get free access to our latest report.

Craving more input on Quality Systems? Start by adding it to your free and personalized Watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributorSean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.Motley Fool newsletter serviceshave recommended buying shares of Quality Systems. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.