How High Can Lumber Liquidators Fly?

Shares of Lumber Liquidators (NYS: LL) hit a 52-week high on Tuesday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

You may have noticed that the stock market had a nearly 10% correction earlier in the month. Then again, if you own shares of Lumber Liquidators, you'd have no clue, as it's done nothing but go up for months.

The strength behind Lumber Liquidators' move higher is a broad one that we're witnessing across most of the home improvement sector. With many homeowners stuck in their homes due to tight credit markets and falling home prices, many have instead turned to remodeling their homes to give them a fresh look. That's great news for Lumber Liquidators, a provider of hardwood flooring; Beacon Roofing Supplies (NAS: BECN) , a supplier of roofing materials; Trex (NYS: TREX) , a manufacturer of deck products and coatings; and Lowe's (NYS: LOW) and Home Depot (NYS: HD) , the do-it-yourself centers that tie all of these interests together under one roof. With the exception of Trex, all five of these companies have remained profitable despite the worst housing downturn in 70 years (in Trex's defense, its latest profit crushed Wall Street's expectations).

Lumber Liquidators logged a 7.5% increase in comparable-store sales last quarter as customer invoices rose 8% and transportation and material costs actually dropped. How often do you hear a company mention that revenue rose while costs dropped? Not very! The company also took the time to raise both its full-year sales and EPS outlook in its latest quarterly report.

How it stacks up

Let's see how Lumber Liquidators stacks up next to its peers.

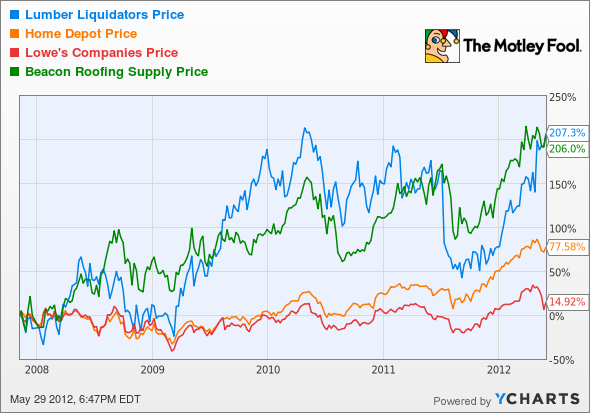

As you can see, the entire home improvement sector has been on a tear over the past five years, with specialized companies benefiting more than more-diversified do-it-yourself stores.

Company | Price/Book | Price/Cash Flow | Forward P/E | 5-Year Revenue CAGR |

|---|---|---|---|---|

Lumber Liquidators | 3.8 | 19.6 | 20.5 | 15.5% |

Home Depot | 4.3 | 11.0 | 15.2 | (5.0%) |

Lowe's | 2.0 | 8.0 | 12.0 | 1.6% |

Beacon Roofing Supply | 2.1 | 13.6 | 14.8 | 3.9% |

Sources: Morningstar and author's calculations. CAGR = compound annual growth rate.

Lumber Liquidators is the priciest of this group based on cash flow and forward P/E. However, it's also grown significantly faster than its peers, as consumers continue to reach for what they perceive as good deals in hardwood flooring.

Beacon Roofing Supply has really benefited of late from reroofing and remodeling activity that's been storm related. The one concern I have with its growth figures is what happens if tornado or hurricane activity is weaker than predicted?

You'd think Home Depot and Lowe's would both be reaping similar rewards, but that just hasn't been the case. Even though Home Depot's five-year growth rate is deceptively negative due to housing's amazing boom in the mid-2000s, Home Depot has been able to use technological advancements in its stores and strong advertising campaigns to continue to steal market share from rival Lowe's.

What's next

Now for the real question: What's next for Lumber Liquidators? The answer is going to depend on whether the market for remodeling remains strong and, most importantly, if it can keep its expenses from growing considerably larger. For Lumber Liquidators, so far, so good!

Our very own CAPS community gives the company a highly coveted five-star rating, with a whopping 95.6% of members expecting it to outperform. Consider me part of the majority, as I've also made a CAPScall of outperform on Lumber Liquidators, and find myself up a cool 87 points on that selection at the moment. But, is it time to lock in those gains? Almost...

Lumber Liquidators is growing significantly faster than its peers and has a lower-cost product than roofing supplier Beacon, which should create higher demand by default. The company is also on track to grow EPS by 31% this year and another 18% in fiscal 2013. I'm willing to hang around to see what develops of Lumber Liquidators' amazing growth spurt, but I also admit that I wouldn't hesitate to close my outperform call if it gets considerably pricier than its peers.

Lumber Liquidators may not be the perfect stock for you, but our team at Stock Advisor has a stock they feel could put some pep in your portfolio's step. See their top pick in our free special report by clicking here.

Craving more input on Lumber Liquidators? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Lumber Liquidators. Motley Fool newsletter services have recommended buying shares of Lumber Liquidators and Home Depot, as well as writing covered calls on Lowe's. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.