Can This Driller Be a Thriller for Your Portfolio?

Ensco (NYS: ESV) has undergone a major transformation over the past year thanks to the $7.3 billion purchase of Pride International. Ensco is now the second-largest deepwater driller, behind only Transocean (NYS: RIG) .

As you can expect, the Pride purchase fueled results in the latest quarter -- but there was more to its results than just what was reported on the surface.

Aside from a 184% increase in revenue and a 127% spike in EPS, the big news in Ensco's first-quarter report was that rig utilization rose 10% to 87% from the year-ago period. After a deepwater moratorium related to the tragic accident at the BP (NYS: BP) leased Deepwater Horizon rig in the Gulf of Mexico in 2010 that released nearly 5 million barrels of oil into the ocean, it's important to know that Ensco is nearly fully operational in the Gulf again. Also making waves was the deepwater day rate that jumped 25.8% to $382,618 when compared to last year. That is a huge jump.

Ensco is also experiencing decent cost savings from the merger as was noted by its debt-to-capitalization ratio, which remained largely unchanged year over year (30.7% versus 31.1%). This comes in stark contrast to deepwater driller in the Gulf ATP Oil & Gas (NAS: ATPG) , a company I've been critical about in the past, that has $2 billion worth of crushing debt to deal with, and is paying in excess of $300 million per year just in interest.

How it stacks up

Let's see how Ensco stacks up next to its peers.

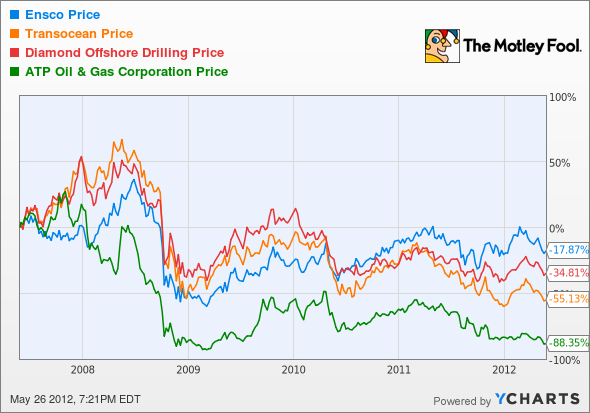

Between this group's reliance on high oil prices and the brief deepwater drilling ban, it hasn't been a great five years to be a shareholder of offshore drilling stocks.

Company | Price/Book | Price/Cash Flow | Forward P/E | Debt/Equity |

|---|---|---|---|---|

Ensco | 1.0 | 9 | 7.1 | 46% |

Transocean | 1 | 7.4 | 8.6 | 85% |

Diamond Offshore (NYS: DO) | 1.9 | 6.2 | 11.9 | 34% |

ATP Oil & Gas | N/M | 1.2 | N/M | 1,411% |

Source: Morningstar, Yahoo! Finance, N/M = not meaningful.

As you can see from these metrics, many of these companies -- with the exception of the ticking time bomb of debt ATP Oil & Gas -- are trading at inexpensive valuations.

Transocean remains one of my favorite ways to play the sector, but even I must admit its share issuances and legal issues are getting the company in hot water with its shareholders. It remains well capitalized but has a lot to prove with Ensco nipping at its heels.

If you can look past Diamond Offshore's 5% drop-off in revenue, you'd see it's putting together results that are getting decisively rosier. It's ultra-deepwater and deepwater rig utilization rates rose to 85% and 88%, respectively, but did see a noticeable drop-off in day rates sequentially from the fourth quarter.

What's next

Now for the real question: What's next for Ensco? That question is going to depend on what happens with global oil demand and if the company can continue to efficiently manage its new and improved deepwater and jack-up rigs while also maintaining decent pricing power to negotiate higher day rates for its rigs.

Our very own CAPS community gives the company a highly coveted five-star rating, with just 17 of 1,095 members expecting it to underperform. Although I have yet to make a CAPScall in either direction on Ensco, I'm ready to join 1,078 other community CAPSters and anoint Ensco with a call of outperform.

Ensco remains an incredibly attractive company to own over the long run. It's not unreasonable to assume that Ensco could outperform Transocean over the next few quarters given Transocean's legal problems stemming from the Deepwater Horizon accident. I also feel the company's rig utilization and day rates speak for themselves. Even Ensco's jack-up rig day rates were up 3% in the first quarter, which is nothing to sneeze at. At just seven times forward earnings, I'm willing to deal with the occasional hiccup in the oil market for a chance at long-term appreciation and a 3% dividend yield.

Even if Ensco isn't the right stock for you, perhaps one of the three stocks chosen by our analysts at Stock Advisor that'll benefit most when oil crests $100 a barrel could be? Transocean is one of them; find out the remaining two by clicking here to get your copy of this latest free special report.

Craving more input on Ensco? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of Ensco and Transocean. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.