At a New High, Does Hawaiian Electric Still Have the Power to Head Higher?

Shares of Hawaiian Electric Industries (NYS: HE) hit a 52-week high on Friday. Let's take a look at how the company got there and see if clear skies are still in the forecast.

How it got here

Hawaiian Electric Industries isn't a household name, but with the stock hitting new highs it's bound to turn some heads.

The company itself is actually made up of three electric utilities and a bank. This dual business approach leads to both good and bad consequences. On the plus side, electric utilities supply a necessity product that has little price elasticity (unless it's heading higher) and the company's banking investment portfolio yields semi-consistent cash flow. On the other hand, the bank, and to some extent the utilities, are at the mercy of the Hawaiian economy. If Hawaii's economy dips into recession, chances are Hawaiian Electric Industries isn't going to fare well, either.

The good news for the company is that Hawaii's economic figures have improved for 23 straight months, and both its utilities and bank saw marked improvement in their bottom lines. The utilities benefited from tax breaks because of green energy investments made by the company over the past few months. Hawaiian Electric's bank, American Savings Bank, benefited from lower loan loss reserves.

The big news that's literally fueling the stock higher is the cost savings being noted from readying its electric facilities to run on more renewable fuels. The company is trying to gain approval to generate 50 megawatts of electricity using geothermal energy, and it's already working on running its Oahu facility off biofuels. While this might be chickenfeed compared with the 1,630 MW that Duke Energy (NYS: DUK) is generating from wind farms, it's nonetheless one of very few utilities harnessing energy from biofuels.

How it stacks up

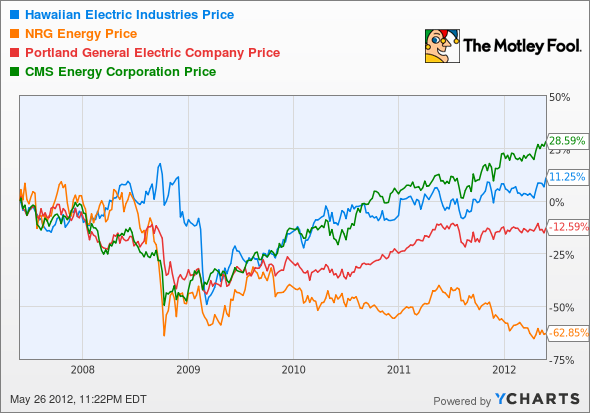

Let's see how Hawaiian Electric Industries stacks up next to its peers.

Because Hawaiian Electric is a virtual electric monopoly (serving 95% of all Hawaiian residents), we'll compare it against utilities that encompass similar geographical areas or are close to each other in market value.

Company | Price/Book | Price/Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

Hawaiian Electric Industries | 1.7 | 10.6 | 15.5 | 4.6% |

NRG Energy (NYS: NRG) | 0.5 | 4.2 | 212.1 | 0% |

CMS Energy (NYS: CMS) | 2 | 6.4 | 14.1 | 4.2% |

Portland General Electric (NYS: POR) | 1.1 | 4.6 | 13.3 | 4.3% |

Source: Morningstar. Yields are projected.

You might have expected more parity among utility stocks, but the above figures suggest otherwise.

NRG Energy, for example, is generating positive cash flow but has been losing money over the trailing 12-month period because of the milder winter and extra conversion costs to change some of its generation facilities over to natural gas from coal.

CMS Energy boasts considerably more debt-to-equity than the others in this grouping, which is especially concerning when you consider that it's trading at two times book value and, like NRG, had its earnings affected by the warmer winter.

Portland General Electric is the tried-and-true turtle of this group; make no mistake about it -- there's nothing wrong with that. Although sales volume and retail prices were down 1% in its latest quarter, the company reaffirmed its guidance and pays out a healthy dividend.

Hawaiian Electric appears a bit pricey based on the metrics above, but remember that it's only now just starting to see the benefits of its green energy initiatives.

What's next

Now for the real question: What's next for Hawaiian Electric Industries? That question is going to depend on what type of cost-savings the company can achieve through its biofuels and geothermal initiatives, and if the Hawaiian economy continues to move in the right direction.

Our very own CAPS community gives the company a four-star rating (out of five), with 86.4% of members expecting it to outperform. Even though I have yet to make a CAPScall on Hawaiian Electric, I am ready now to enter a CAPS limit order to make it an outperform call at $22.50.

"Why not buy it right now?" The answer to that question has a lot to do with the still-shaky Hawaiian economy and less to do with what the company is doing wrong. I admit to still having doubts that the transition to renewable energy sources will go smoothly, but I do expect it to save Hawaiian Electric a lot of money over the long run. At $22.50, the company would be valued around 12-13 times forward earnings and boast a yield north of 5% -- that would be a nice value indeed!

If you love high dividend yields and are excited by the idea of building your nest egg by reinvesting your returns, then you'd like the inside scoop on three more companies that could help you retire rich through healthy dividends and future growth alike, then click here for access to our latest free special report.

Craving more input on Hawaiian Electric Industries? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

At the time thisarticle was published Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.