Is This Industry Losing Steam?

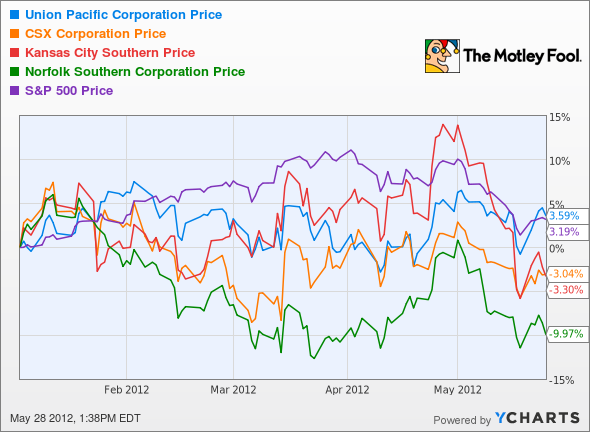

Between the end of the recession and the beginning of 2012, the major railroad operators were chugging ahead at full speed, collectively returning more than 150% in share-price appreciation, while the S&P 500 (INDEX: ^GSPC) gained only 38%. Since then, the sector's been derailed, if you will, and only Union Pacific (NYS: UNP) has outperformed the broader market, by a mere 0.3%.

For an industry that seemed to be on the rebound, the falloff in 2012 has taken many investors by surprise. These are highly cyclical companies that tend to track the American economy, yet their returns have been widely divergent. Sure, oil prices have slipped in recent months, but have the economic advantages afforded by railroads truly started to erode? Let's look at the driving force behind this industry trend and shed some light on the path ahead.

The coal collapse

The railroads were riding high for several years as oil prices eclipsed $100 per barrel, and other cargo companies struggled to compete, especially when it came to long-haul trips. As I pointed out previously, fuel prices accounted for only 14% of rail revenues in 2010, but they absorbed 21% and 35% of revenues for the trucking and air cargo industries, respectively.

On top of the fuel cost advantages, railroads trimmed down operating expenditures and invested in infrastructure to make their network more nimble, most notably through the use of intermodal containers. An industry once viewed as outdated suddenly became more attractive for transporting a variety of goods beyond heavy commodities and industrial goods.

Still, the significance of transporting commodities, in particular coal, cannot be overlooked. Railroads deliver around 70% of coal shipments to their final destination, mainly coal-fired power plants. When demand for coal tapers off, so, too, does carload traffic for most of the major carriers.

The most recent data from May 19 highlights this ongoing shift in products delivered. Traffic declined 5% for U.S. railroads from the same week last year, despite the fact that 12 of 20 product groups gained substantially. While petroleum products, motor vehicles and equipment, and lumber products were up 49%, 23%, and 18%, respectively, coal traffic declined 16% and carloads of coke, a coal derivative, decreased 9%.

Rather than an isolated event, this represents a clear secular trend. Overall traffic is down 1.8% in North America through 20 weeks of 2012, primarily as a result of the rising popularity of natural gas. Demand for coal and coke suffered slightly because of the warmer winter weather, but plummeting prices in natural gas have struck a serious blow to coal demand.

Within the electricity markets, coal's dominant position as a source of energy decreased from more than 50% in 2008 to only 36% of U.S. electricity in the first quarter of 2012. On the flip side, natural gas as a source of electricity surged from 8% in the first quarter of 2011 to more than 25% today.

So the ramifications of U.S. adoption of cleaner energy sources are obvious when it comes to railroad coal traffic, but should investors shy away from the industry altogether?

Light at the end of the tunnel?

While recent trends seem to cast a shadow over rail stocks, coal's decline will not spell doom and gloom for this industry. For starters, many of the operators still maintain a healthy balance when you look at the cargo breakout.

Company | Coal as Percent of 2011 Revenue |

|---|---|

Union Pacific | 22% |

CSX (NYS: CSX) | 32% |

Norfolk Southern (NYS: NSC) | 31% |

Kansas City Southern (NYS: KSU) | 13% |

Even for Norfolk Southern and CSX, both of which relied on coal for nearly a third of revenue, the threat of declining demand in America could be overblown. Beyond our borders, developing countries find coal an attractive source for power, and America's coal reserves are greater than any other nation's. China, for example, generates 80% of its electricity from coal, and almost 15% of globally traded coal ends up in China. The rise of urbanization places pressure on these countries to provide power for growing populations, and the U.S. railroads will support the coal export business even if U.S. coal consumption declines.

Further, demand for automobiles, drilling equipment, and other energy resources can fill in the void left by declining coal transport. Studies have shown that railroads continue to be the most attractive means of transportation when crude oil trades above $70 per barrel, and the current spot price is still 30% above this tipping point. When the economy grows, albeit at a tepid pace, the need for transport follows suit, and the railroads will continue on a steady trajectory.

Finally, investors can feel bullish about a return in manufacturing to North America that could bolster the outlook for railroads even further. According to a recent survey by Accenture, two-thirds of big U.S. manufacturers have moved factories within the past two years, and the U.S. and Mexico ranked No. 1 and No. 3 as top destinations. No doubt, transportation costs are a significant factor in this emerging trend, and the shift bodes well for the rail operators.

Should investors hop on for the ride?

When surveying the railroad industry, take into account the individual operator's reliance on coal, its ability to shed operating costs, and the opportunities in play for a potential manufacturing renaissance both in America and Mexico.

The natural gas revolution will play a role in the future of rail transport, but there's a more interesting development under way that I think many investors might take for granted. You might think the digital age transformed America, but the technology behind this revolution could have even greater implications on our local and global economies. Read on in our special report, "3 Stocks to Own for the New Industrial Revolution" and learn about a company that I believe is poised for tremendous growth. Uncover the reasons I decided to invest in one of these companies by one of these companies.

At the time thisarticle was published Isaac Pino owns shares of CSX. The Motley Fool has adisclosure policy. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.