Is Yahoo! Finally a Buy?

While I'm not yet convinced that Yahoo! (NAS: YHOO) shares are worth buying, for the first time in years, I'm intrigued by one of the company's products. The new Axis browser shows uncommon promise.

On the surface, the hype -- that it "redefines" what it means to search and browse the Web -- doesn't match the reality. Axis is a browser within a browser, plugging into Chrome, Firefox, Safari, and Internet Explorer. Yahoo! has also created stand-alone versions for the iPhone and iPad.

Three features make Axis interesting:

Images. Click in a search box and enter a term and Axis instantly presents a horizontal bar of results with image previews for the pages where you'll find more information. Swiping left to right reveals more results. Not a breakthrough, I realize, but an interesting addition. At the very least, it makes hunting for information more aesthetically pleasing.

Trending searches. Much like Twitter or Google's (NAS: GOOG) Trends, Axis shows the most popular searches. Think of it as a portal without the news, organized by what's most popular at that moment.

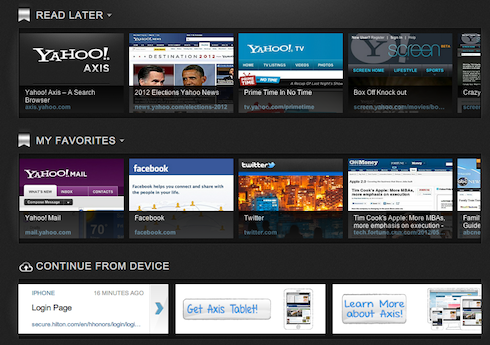

Cross-device synchronicity. A "home" button in Axis takes you to a screen where you'll find designated favorites and pages marked for later reading. Most interesting, though, is a section marked "Continue From Device." Login using a Yahoo!, Google, or a Facebook (NYS: FB) ID, and your browsing history will follow you from desktop to iPhone to iPad and back again.

Source: Yahoo!

How does Yahoo! monetize any of this? Through data would be my guess. Get enough users onto Axis, aggregate the results, and then sell ads against it a la Google, Facebook, and Apple's (NAS: AAPL) apparently ailing iAd platform. (Neither of the Mac maker's prior two quarterly reports nor last year's 10-K annual report mentions the system.)

Same as it ever was, in other words. Which is why I don't see Axis adding much to Yahoo!'s prospects in the near term. But it's also early enough that I'm willing to suspend final judgment. Good work producing something worth caring about, Yahoo!. Now let's see what you do with it.

Interestingly, Facebook has a similar problem. For as many users that engage with it daily -- more than 900 million at last count -- the company generates precious little in the way of profit. And yet, as troubling as that truth may be, it shouldn't scare you out of investing in the social media sector entirely. We've created a new report, "Forget Facebook -- Here's the Tech IPO You Should Be Buying" that details a much better social media stock that has a longer runway for growth than Facebook. The report won't be available forever, so click here to get access today -- it's totally free.

At the time thisarticle was published Fool contributorTim Beyersis a member of theMotley Fool Rule Breakersstock-picking team and the Motley Fool Supernova Odyssey I mission. He owned shares of Apple and Google at the time of publication. Check out Tim'sweb home,portfolio holdingsandFoolish writings, or connect with him onGoogle+or Twitter, where he goes by@milehighfool. You can also get his insightsdelivered directly to your RSS reader.The Motley Fool owns shares of Facebook and Google. The Fool owns shares of Apple.Motley Fool newsletter serviceshave recommended buying shares of Apple and Google.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Apple. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.